AI rules the day! No matter how grim Donald Trump's threats of mass layoffs, warnings from Scott Bessent about a U.S. economic slowdown, or even the ADP private sector jobs report may seem, the S&P 500 still managed to notch its 30th record high of the year. Leading the northbound herd are the tech giants. Deals between OpenAI and Samsung Electronics, as well as SK Hynix, sparked a swift rebound in the broad equity index after a dip early in the session.

A 45% rally in tech stocks since the April low doesn't look like a bubble — at least according to Bank of America. The bank recommends that its clients continue to buy U.S. stocks through futures contracts. The average daily derivatives volume over the last 20 trading days has hit 40 million — a record since Goldman Sachs began tracking this data in 2010, with 65% of the trades involving net buying positions.

The upward trend in the S&P 500 is so strong that even the slightest dips are immediately bought. Whether it's Jerome Powell's comments on inflated stock valuations or Tesla's record sales report, investors are on edge. The concern now is that the removal of government subsidies may have a significant impact on Elon Musk's company, whose shares tumbled 5% in response.

That concern, combined with the Congressional Budget Office's forecast that a government shutdown could result in the layoff of 750,000 workers, pulled down the S&P 500 early in the October 2 session. Still, the index quickly recovered thanks to positive developments from OpenAI.

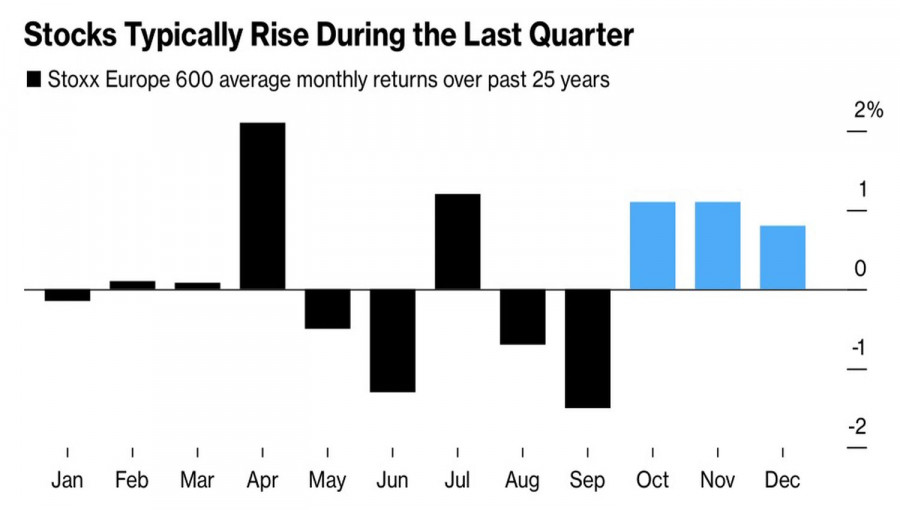

Currently, U.S. equity markets face virtually no significant competition. Europe, which started the year strong and initially outpaced the S&P 500, has lost its edge due to the explosive impact of artificial intelligence developments.

Even though the EuroStoxx 600 is setting fresh highs — with a 12% gain year-to-date — the S&P 500 is up 14%, pulling further ahead. Capital continues to flow out of the EU to the U.S., though often through currency-hedged strategies. Not surprisingly, the negative correlation between the U.S. dollar and U.S. stocks has intensified.

Greed continues to dominate sentiment in U.S. equity markets. The fear of missing out — FOMO — is propelling the S&P 500 to new highs. Investors remain relatively unconcerned about the government shutdown, instead paying close attention to the Federal Open Market Committee (FOMC) officials' remarks and anticipating the kickoff of the Q3 earnings season.

Technically, the S&P 500 continues its upward trend on the daily chart. Bulls managed to hold ground above a cluster of critical pivot levels at 6688 — a strong signal of market strength. In this environment, buying on dips remains a relevant strategy. Price targets for long positions stay at 6800 and 6920.

RÁPIDOS ENLACES