Speculation about a possible nomination by U.S. President Donald Trump for the position of Chair of the Federal Reserve is gaining momentum, as an announcement could be made as early as Wednesday—right when the Federal Open Market Committee (FOMC) is holding its monetary policy meeting.

According to several media reports, Trump has said that he has already decided on a successor to Jerome Powell, whose term expires in May. This sequence of events increases market uncertainty, given that the Fed is likely to leave interest rates unchanged, shifting the focus toward the central bank's statements and the outlook for leadership succession.

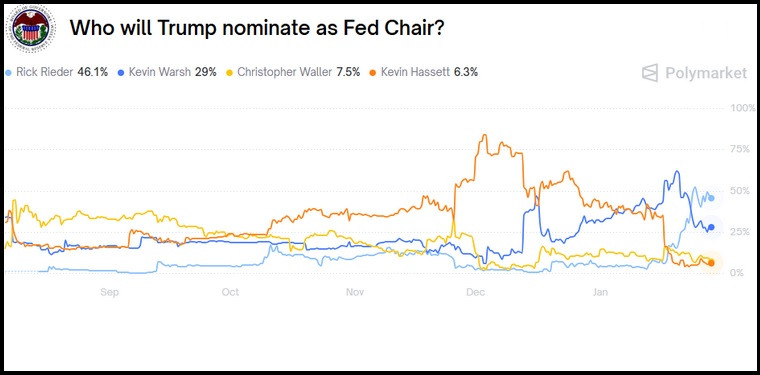

The current front-runner to replace Jerome Powell is Rick Rieder, BlackRock's Chief Investment Officer for Fixed Income. He is widely viewed as supportive of interest rate cuts, although a number of investors do not see him as a threat to the Fed's independence. At present, he leads prediction markets with 46.1%, ahead of former Fed Governor Kevin Warsh at 29%. Christopher Waller, a current member of the Federal Reserve Board of Governors, has 7.5%, while Kevin Hassett, Director of the National Economic Council (NEC), stands at 6.3%. The choice involves both political and macroeconomic considerations. Trump has repeatedly advocated for looser monetary policy, prompting markets to weigh the risks: a candidate perceived as too close to the White House could undermine confidence in the Fed's independence. On the other hand, a figure with a more institutional outlook could restrain aggressive rate cuts, especially since policy decisions are made collectively by the FOMC.

The choice involves both political and macroeconomic considerations. Trump has repeatedly advocated for looser monetary policy, prompting markets to weigh the risks: a candidate perceived as too close to the White House could undermine confidence in the Fed's independence. On the other hand, a figure with a more institutional outlook could restrain aggressive rate cuts, especially since policy decisions are made collectively by the FOMC.

This day could prove pivotal for market expectations: appointing someone who supports rate cuts could accelerate that process, while a choice perceived as more independent would shift attention back to economic data.

RÁPIDOS ENLACES