Despite significant dollar weakness in 2025 and its slide toward nearly four-year lows in 2026, the US dollar index remains at historically high levels. Since the 1970s, it has reached two comparable peaks — and both times, it collapsed quickly. There are a number of parallels between the current situation and those earlier episodes.

In the 1980s, the White House was unhappy with a strong dollar, arguing it undermined the competitiveness of US manufacturers. Sound familiar? Donald Trump is using rhetoric similar to that of four decades ago. It is therefore unsurprising that as soon as the president praised a weaker greenback, investors recalled the Plaza Accord — the coordinated intervention by the United States and other countries that sent the USD index down by more than 40% over two years.

USD index dynamics

The second episode occurred around the turn of the millennium. Between 1995 and 2000, the US dollar strengthened amid the dot-com boom as capital flowed into the United States via Internet companies. Once that bubble burst, the US dollar index plunged in a broad wave of sell-offs.

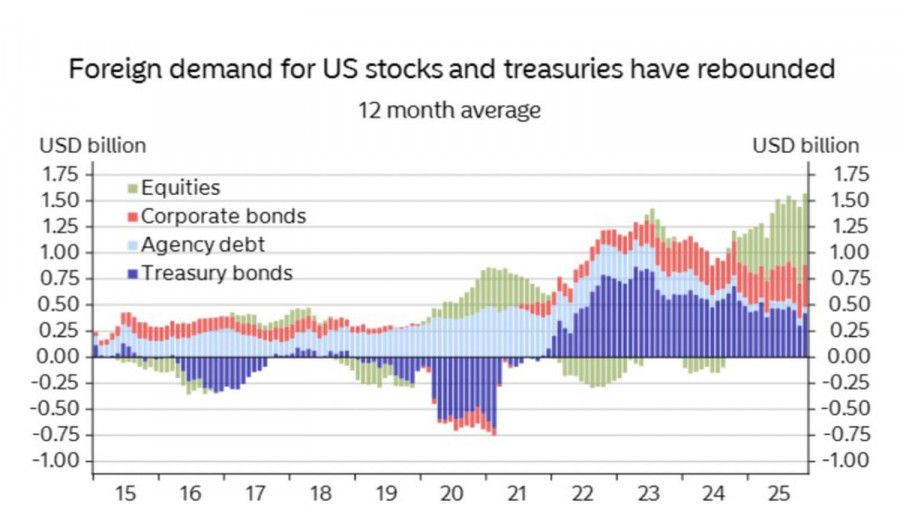

History partly repeated in 2023–2025, but the focal point was not dot-coms but tech giants. For a long time, the Magnificent Seven dominated, and foreign investors delivered capital to the United States on a silver platter. The process almost reversed in April amid White House tariffs, but a quick rebound in the S&P 500 restored non-residents' interest in US equities. They hedged currency risk on those investments by selling the greenback.

Capital flows into US securities

Today, the broad index is within arm's reach of record highs, while talk of Big Tech's inefficiency has triggered rotation into small-cap stocks. Again, this recalls the dot-com bust that preceded the USD plunge.

Thus, the long-term outlook for the US dollar looks bleak. However, Credit Agricole argues it is too early to throw in the towel on the greenback. The bank cites three reasons. First, the "sell America" trade began to reverse in 2025. Second, the risk of a prolonged US government shutdown is low, and any shutdown in 2026 is unlikely to last long. Third, geopolitical tension in the Middle East will support the dollar as a safe-haven asset.

Technically, the daily chart shows that EUR/USD has played out an inside bar and seen a confident bear attack. Short positions opened on a break of the 1.1905 support level can be scaled on a successful test of the pivot at 1.1835. In that case, the risk of a further decline toward 1.1760 and 1.1690 would increase.

RÁPIDOS ENLACES