Trade Review and Trading Tips for the British Pound

The test of the 1.3660 price level occurred at a moment when the MACD indicator had already moved significantly downward from the zero line, which limited the pair's downward potential. A second test of this price led to the implementation of Buy Scenario No. 2, resulting in the pair rising by more than 25 points.

News that another U.S. government shutdown had been avoided brought demand back to the British pound. However, this euphoria is likely to be short-lived. The fundamental factors determining the long-term dynamics of the pound remain unchanged. Above all, this is the state of the UK economy. Despite some improvement in indicators, growth prospects remain rather modest. Inflation, although declining, is still significantly above the Bank of England's target level, which limits the regulator's ability to ease monetary policy.

Today, in the first half of the day, data is expected on the UK services sector business activity index and the composite PMI. Special attention will be paid to the services sector PMI, as this sector is dominant in the British economy. It includes a wide range of activities, from financial services to tourism and retail trade. Strong performance in the services sector can offset weakness in manufacturing, and vice versa. The composite PMI combines data from the services and manufacturing sectors, offering a comprehensive view of the country's economic situation. Sustained growth in the composite index will also support the British pound.

As for the intraday strategy, I will rely more on the implementation of Scenarios No. 1 and No. 2.

Buy Scenarios

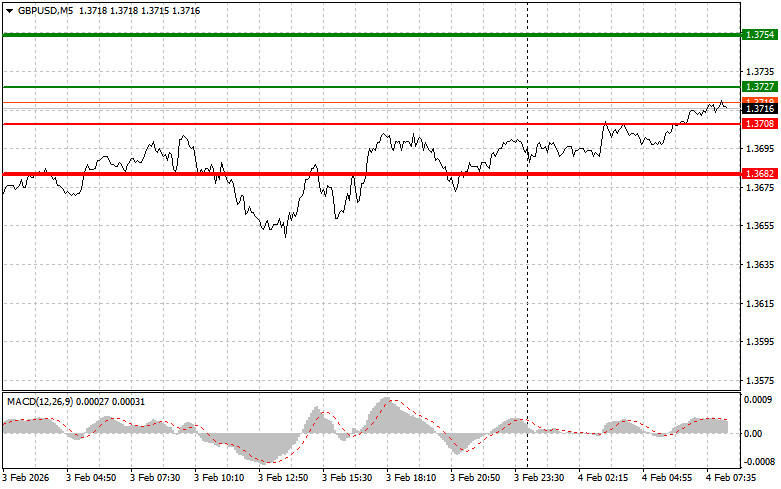

Scenario No. 1: Today, I plan to buy the pound upon reaching the entry point around 1.3727 (green line on the chart), with a growth target at 1.3754 (the thicker green line on the chart). Around 1.3754, I plan to exit long positions and open sell positions in the opposite direction (aiming for a move of 30–35 points in the opposite direction from this level). Pound growth today can be expected only after strong data.Important! Before buying, make sure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3708 price level while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal of the market upward. Growth toward the opposite levels of 1.3727 and 1.3754 can be expected.

Sell Scenarios

Scenario No. 1: I plan to sell the pound today after the 1.3708 level is updated (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 1.3682 level, where I plan to exit sell positions and immediately open buy positions in the opposite direction (aiming for a move of 20–25 points in the opposite direction from this level). Pound sellers will become active in the event of a strong recovery of the pair toward major resistance areas.Important! Before selling, make sure that the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3727 price level while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal of the market downward. A decline toward the opposite levels of 1.3708 and 1.3682 can be expected.

What's on the Chart

Important. Beginner traders in the Forex market need to be very cautious when making decisions about entering the market. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that successful trading requires a clear trading plan, like the one presented by me above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.

RÁPIDOS ENLACES