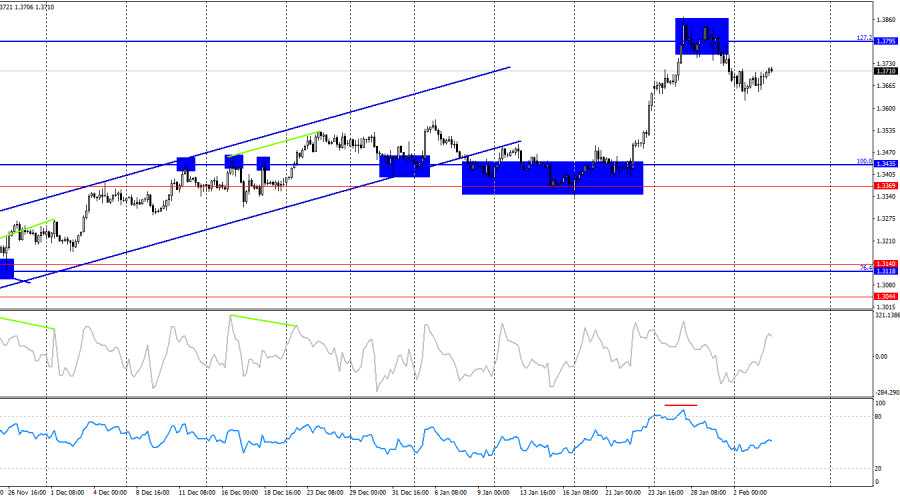

On the hourly chart, the GBP/USD pair continued its upward movement on Tuesday after rebounding from the support level of 1.3611–1.3620 toward the corrective level of 161.8% at 1.3755. A rebound of the pair from this level would favor the U.S. dollar and lead to a moderate decline toward the 1.3611–1.3620 level. A consolidation of prices above the 1.3755 level would increase the probability of further growth toward the 1.3845 level.

The wave structure remains "bullish." The most recent completed upward wave broke the previous high, while the new downward wave has not yet even approached the last low. The news background for the pound has been weak in recent months, but the news background in the United States is even worse. Bulls are regularly supported by Donald Trump, which ensures growth in the British currency. A break of the current trend can be identified only by two consecutive "bearish" waves.

There was no news background on Tuesday, and now traders may face a very limited agenda for the rest of the week. Initially, ADP, JOLTS, Nonfarm Payrolls, and the unemployment rate (all related to the U.S. labor market) were scheduled for release this week. However, JOLTS was not released on time, and Nonfarm Payrolls and unemployment data are in question due to the ongoing government shutdown. As a result, the Bank of England meeting, which will take place tomorrow, has unexpectedly become the key event of the week. I remind you that the ECB will also hold a meeting on Thursday, but traders are currently not expecting monetary policy decisions from the European regulator. The Bank of England will most likely also leave interest rates unchanged, but the tone of the MPC committee will be important, as traders will be able to assess the voting results. If the outcome is more "dovish" (more than two votes in favor of a rate cut), bears may launch a new attack. And vice versa. Thus, in order not to lose the trend, the pound needs "hawkish" results from the Bank of England meeting.

On the 4-hour chart, the pair rose to the Fibonacci level of 127.2% at 1.3795 and rebounded from it. As a result, a reversal in favor of the U.S. dollar followed, and a decline toward the support level of 1.3369–1.3435 began. A consolidation of the pair above the 1.3795 level would allow expectations of a continuation of the bullish trend toward the 1.4020 level. No emerging divergences are observed today.

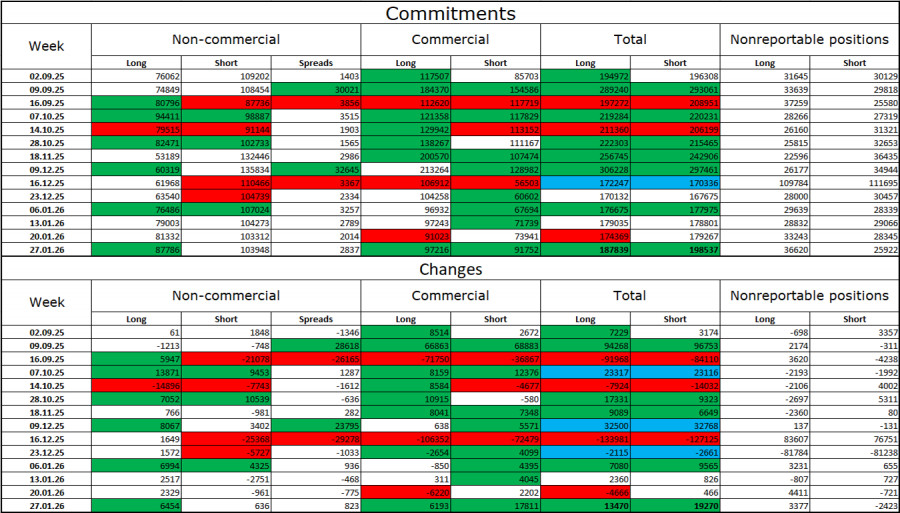

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became more bullish over the last reporting week. The number of long positions held by speculators increased by 6,454, while the number of short positions increased by only 636. The gap between the number of long and short positions is now effectively as follows: 87,000 versus 104,000, and it is rapidly narrowing. Bears have dominated in recent months, but it seems they have exhausted their potential. At the same time, the situation with euro currency contracts is the exact opposite. I still do not believe in a bearish trend for the pound.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency may occasionally enjoy demand in the market, but not in the long term. Donald Trump's policies have led to a sharp deterioration in the labor market, and the Fed is forced to ease monetary policy to stop the rise in unemployment and stimulate job creation. U.S. military aggression also does not add optimism for dollar bulls.

Economic Calendar for the U.S. and the UK:

On February 4, the economic calendar contains three events, but only the U.S. releases may attract traders' interest. The impact of the news background on market sentiment on Wednesday may be present, but only in the second half of the day.

GBP/USD Forecast and Trading Advice:

Selling the pair was possible after a rebound from the 1.3845 level on the hourly chart, with targets at 1.3755 and 1.3620. All targets were reached. I would not rush into new sell positions at the moment. Buy positions could be opened after a rebound from the 1.3611–1.3620 level on the hourly chart with a target of 1.3755. Today, these trades can be kept open.

Fibonacci grids are drawn from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

RÁPIDOS ENLACES