Should we expect radical actions or statements from the ECB? This question is on the minds of market participants ahead of the European Central Bank's first meeting in 2026. I may disappoint some, but I do not anticipate anything significant. First, the probability of changing monetary policy parameters is virtually zero. The ECB has no reason to continue cutting interest rates right now, and there are even fewer reasons to increase them. Therefore, on Thursday, we are likely to see rates maintained at current levels.

Now, turning to the second point—important statements. Many analysts, upon seeing the EU's January inflation report, immediately reported that the likelihood of Lagarde shifting to a more "dovish" tone on February 5 is quite high. Inflation has dropped to its lowest level since December 2020, but is it worth panicking about this? The consumer price index has been steadily decreasing in recent years, and the ECB has always indicated that its target is 2%. However, my readers likely understand that inflation cannot equal 2% every month. In some months, it may be higher, and in others, lower. Even Lagarde has emphasized the importance of inflation remaining around 2% in the long term. Right now, it still hovers around that level.

Therefore, in my opinion, we will not hear any important statements on Thursday either. If I am wrong and Lagarde hints at future monetary policy easing, it will not be a "death sentence" for the euro. The US dollar's position remains much weaker than the euro's. The upward trend in the EUR/USD instrument continues. Few believe in the dollar (as well as in the lofty goals of Donald Trump) now. Hence, while local demand for the euro may decrease, it is not likely to drop significantly.

The market is seeking alternatives to the US dollar. It recognizes that the "time of the dollar" has passed and that transferring assets into other currencies is now necessary. Of course, the entire world cannot abandon the dollar overnight, but the process has already begun, so demand for US currency will decrease in the long term. It's also worth noting that the attractiveness of investments in the US economy, given Trump's policies, is slightly above zero for foreign investors. Therefore, investments are also steering clear of the US. I believe that the dollar's decline is inevitable in 2026. Now, we need to wait for the corrective wave or wave structure to complete.

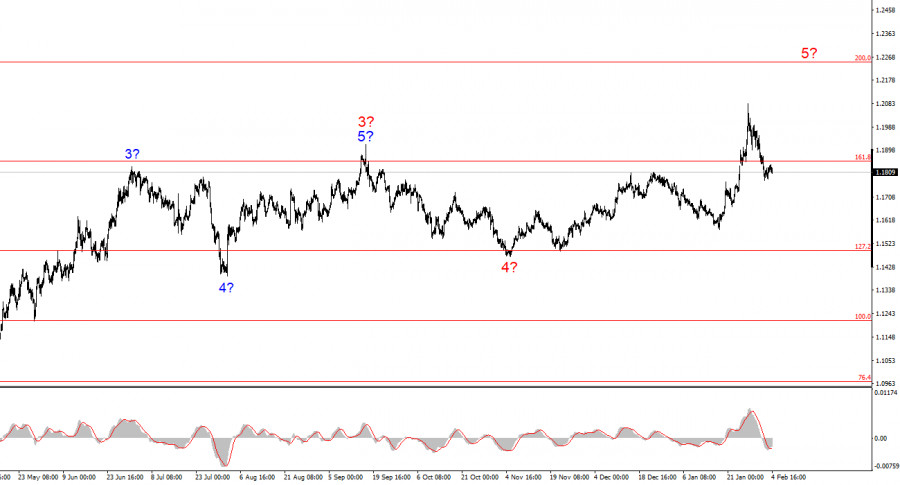

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend. Trump's policies and the Fed's monetary policy remain significant factors in the long-term decline of the American currency. The targets for the current trend segment may reach the 25 figure. At the moment, I believe global wave 4 has completed its formation, so I expect further increases in prices. However, I anticipate a downward wave in the near term, as the series of waves a-b-c-d-e also appears to be complete. My readers may want to search for benchmarks for upcoming purchases.

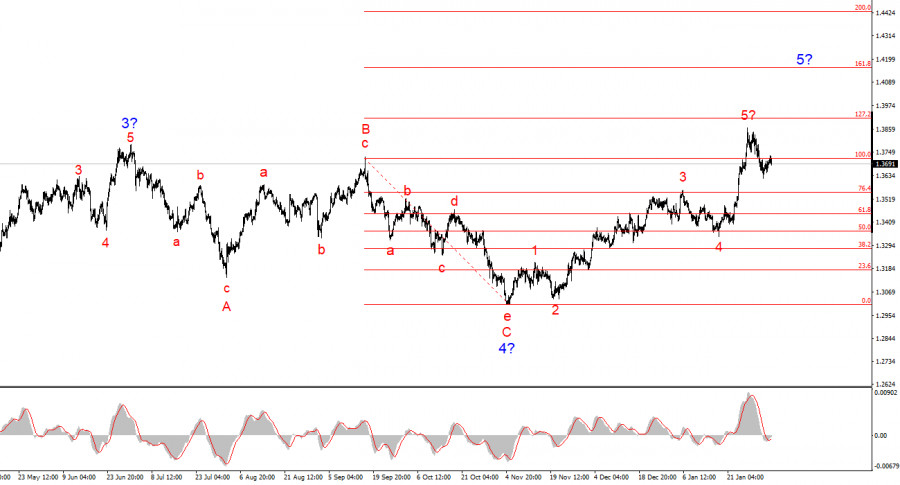

The wave picture for the GBP/USD instrument is quite clear. The five-wave upward structure has completed its formation, but the global wave 5 may take on much more extended forms. I believe that a corrective set of waves may be observed in the near future, after which the upward trend construction will resume. Therefore, in the coming weeks, I recommend looking for opportunities for new purchases. In my opinion, under Trump, the British pound has a good chance of trading at 1.45-1.50 USD. Trump himself supports the decline of the dollar. All of his actions have a double positive effect: the decrease of the dollar and the resolution of internal, external, trade, and geopolitical issues.

RÁPIDOS ENLACES