Yesterday, equity indices closed sharply lower. The S&P 500 fell by 0.51%, while the Nasdaq 100 plunged by 1.59%. The Dow Jones Industrial Average also slipped, down 1.20%.

Global equity markets extended declines as a three-day sell-off in US tech stocks dented risk appetite. Silver and Bitcoin recovered amid volatile trading.

Futures on US and European equity indices tumbled after Wall Street's Thursday losses, with the Nasdaq 100 logging its steepest three-day drop since the April rout. Since Fed officials signalled last week they were reluctant to cut interest rates soon, the tech-heavy index has lost more than $1 trillion — a colossal sum that highlights how sensitive the technology sector is to changes in monetary policy. Expectations of imminent rate cuts that had been supporting risk assets proved misplaced, triggering large capital outflows from equities.

On Friday morning, Nasdaq 100 futures continued to move lower, down about 0.7%. S&P 500 futures fell by roughly 0.4%. The numbers indicate investors remain pessimistic, with no clear signs of an imminent trend reversal. The lack of definitive guidance from the Fed on the path for interest rates is creating uncertainty, hitting markets that are most sensitive to borrowing costs.

Although Asian equity markets stabilized somewhat after initial Friday losses, investors remain wary of the tech sector: Amazon.com Inc. shares lost about 11% in premarket trading. The company plans to spend $200 billion on AI this year, stoking concerns that its outsized bet on AI may not pay off over the long term.

Volatility was evident across asset classes. Silver jumped by 4.1% after a 20% drop on Thursday. Bitcoin showed a similar rebound, rising by more than 3% after earlier falling toward $60,000 — roughly 50% below its October 2025 peak.

Widespread volatility continues to weigh on sentiment. Given the observed volatility and prevailing pessimism, there remains potential for further aggressive selling.

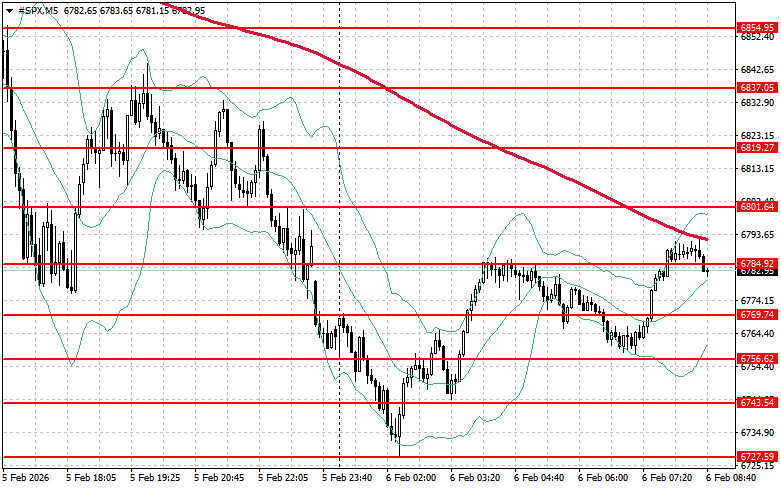

Regarding the technical outlook for the S&P 500, the immediate task for buyers today is to overcome the nearest resistance level of $6,784. Breaking above that level would signal upside and open the path to $6,801. An additional priority for bulls is to secure control above the $6,819 mark, which would strengthen buyers' positions. In case a downside move amid falling risk appetite, buyers must defend around $6,769. A break below that level could quickly push the instrument back to $6,756 and open the way to $6,743.

RÁPIDOS ENLACES