The GBP/USD currency pair has experienced less-than-favorable moments this week. In our view, the market reacted too strongly to the British central bank's meeting results. In previous articles, we noted that it is not particularly important how many members of the Monetary Policy Committee vote for a rate cut if the rate ultimately remains unchanged. However, traders believed that four "dovish" votes represented an almost agreed-upon decision to lower the key rate, leading them to assume that if the Monetary Policy Committee had nearly made this decision in February, they would do so with certainty at the next meeting. We do not share that belief, but the market reacted as if it did.

Overall, the British pound shows a similar dynamic to the euro. Following a strong rise that confirmed the end of the correction and the resumption of the upward trend for 2025, there has been a correspondingly strong pullback. We consider any drop in the pair as a correction, so we still expect movement to the north. In the article on EUR/USD, we already mentioned that there will be three important events next week, all of which will impact the dollar. However, it is precisely the dollar that continues to dominate the currency market for over a year. Therefore, it is not surprising that U.S. reports may have the strongest impact on trader sentiment.

As we mentioned, it is extremely difficult to expect strong values from the NonFarm Payrolls and unemployment reports. Of course, the market could react similarly to last week's Bank of England meeting, seizing on a formal reason for sales. If the actual NonFarm number exceeds forecasts, it will still be weak and insufficient. Nevertheless, the market could respond with GBP/USD sales.

The third test for the dollar is inflation. The report will be published on Friday, and forecasts suggest that the consumer price index may slow down to 2.4-2.5%. If inflation continues to decline, the Fed will have even fewer reasons to keep the key rate at its current level, especially given the dismal state of the U.S. labor market. Consequently, a decrease in inflation to 2.4-2.5% could place significant pressure on the American currency amid rising expectations of the Fed easing monetary policy.

In summary, it is impossible to predict the actual values of the "big statistical trio" in advance, especially for ordinary traders without insider information. As of today, it can be said that the probability of receiving weak data from the U.S. is much higher than that of receiving strong data. We have seen a technical pullback, so the resumption of growth for EUR/USD and GBP/USD would be quite logical. However, it is still important not to assume that American reports will fail with a 100% chance. Actions should be taken based on the situation, while keeping in mind the most likely scenario of a declining U.S. currency.

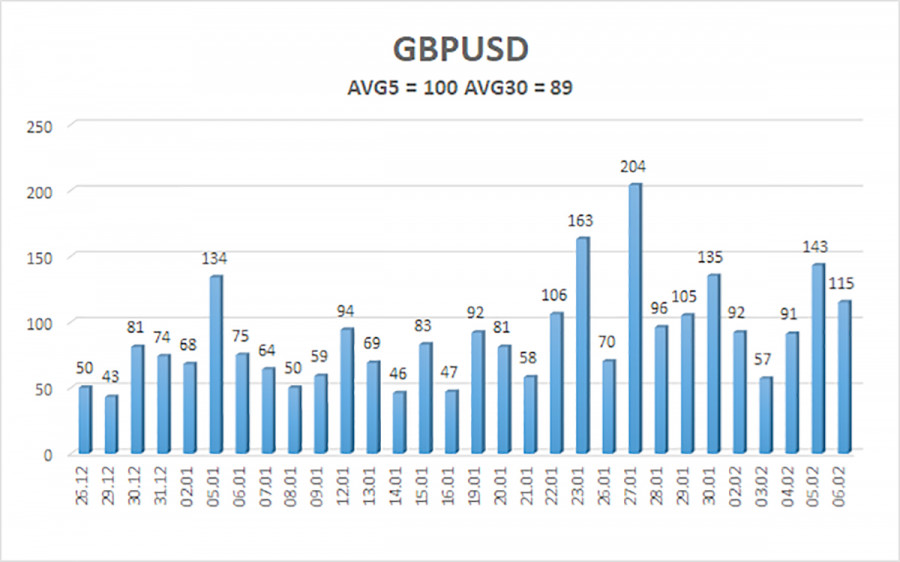

The average volatility of the GBP/USD pair over the last 5 trading days as of February 8 is 100 pips, which is classified as "average." On Monday, February 9, we expect movement within the range of 1.3508 to 1.3708. The upper linear regression channel is oriented upwards, indicating a trend recovery. The CCI indicator has entered overbought territory six times in recent months and has formed numerous "bullish" divergences, consistently signaling the impending resumption of the upward trend. The entrance into overbought territory has warned of the beginning of a correction.

The GBP/USD currency pair is set to continue the upward trend of 2025, and its long-term prospects have not changed. Donald Trump's policies will continue to exert pressure on the U.S. economy, so we do not expect the U.S. currency to grow in 2026. Even its status as a "reserve currency" is no longer meaningful for traders. Therefore, long positions with targets of 1.3916 and above remain relevant for the near future as long as the price is above the moving average. If the price is below the moving average line, small shorts can be considered with a target of 1.3508 on technical (correction) grounds. From time to time, the American currency shows corrections (on a global scale), but for a trend to grow, it needs global positive factors.

RÁPIDOS ENLACES