The British pound received an unexpected blow from the Bank of England, with more "dovish" voting on interest rates. However, the market's reaction in the form of selling the British currency did not spoil the current wave structure. I want to remind you that before the BoE meeting, I also predicted a decline within a corrective wave or set of waves. At this point, it can be said that the first wave (which may be the only one) is nearing completion or has already completed. If this is indeed the case, a new upward section of the trend may begin from the current position. Additionally, market participants may have many reasons to sell the dollar next week. But let's not get ahead of ourselves.

Next week in the UK, the only important reports worth noting are the fourth-quarter GDP data and the industrial production report. The British economy has been stagnating for a long time, despite Andrew Bailey's confidence in its faster growth at the beginning of 2026. Year-on-year growth in the third quarter was 1.3%. Judge for yourself how significant that is. It is certainly not stagnation or recession, but the growth rates are weak. For the fourth quarter, even weaker growth is expected—only 1.2%.

The situation with industrial production in the UK is also poor. The indicator rises in some months and falls in others, averaging up in one month and down in the next. There's no reason to expect support for the pound from these two reports. Furthermore, I want to emphasize that the American news backdrop next week will be of paramount importance to markets. Demand for the U.S. currency has been increasing over the last two weeks, and the reports on inflation, unemployment, and labor market conditions will show whether this has been justified.

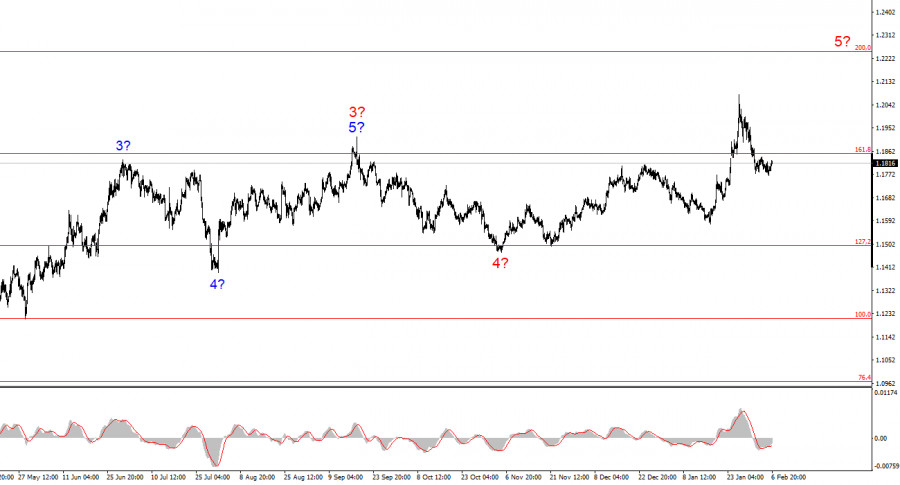

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend. Donald Trump's policies and the Federal Reserve's monetary policy remain significant factors affecting the long-term decline of the U.S. dollar. The targets for the current trend section could extend to the 25th figure. At this moment, I believe global wave 5 has begun and is continuing, so I expect prices to rise in the first half of 2026. However, in the near term, I anticipate a downward wave (or series of waves), as the structure a-b-c-d-e appears complete. My readers can soon look for areas and levels for new long positions.

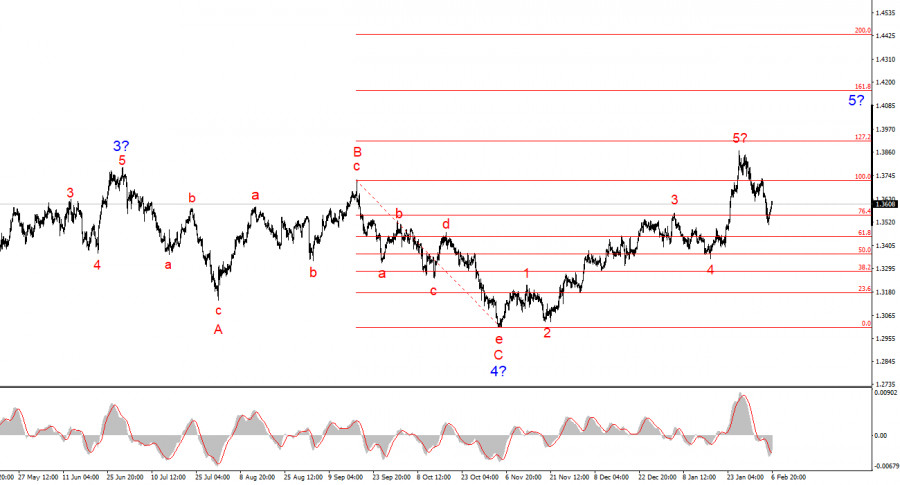

The wave pattern for GBP/USD appears quite clear. The five-wave upward structure has completed its formation, but global wave 5 may appear much more extended. I believe that a corrective set of waves may be formed in the near future, after which the upward trend will resume. Therefore, in the coming weeks, I can advise seeking opportunities for new longs. In my opinion, under Donald Trump, the British pound has a good chance of trading at $1.45-$1.50. Trump himself welcomes the decline in the dollar's exchange rate. All his actions have a dual effect: a weaker dollar and the resolution of internal, external, trade, and geopolitical issues.

RÁPIDOS ENLACES