Trade Review and Tips for Trading the European Currency

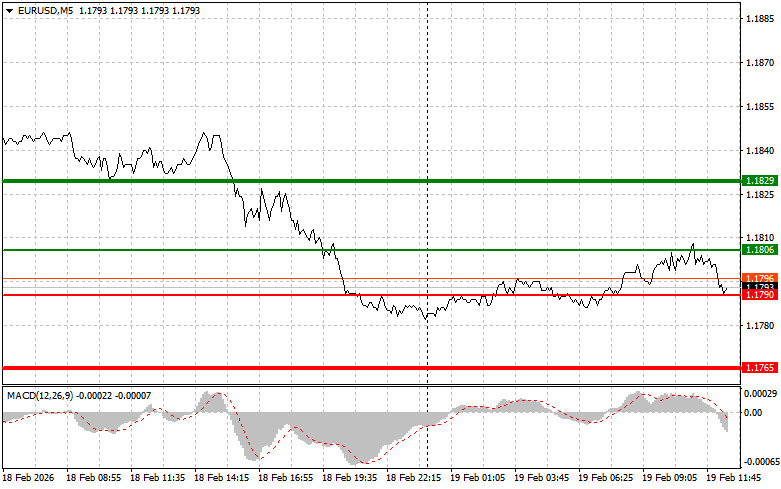

The test of the 1.1806 price level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential. For this reason, I did not buy the euro against the trend.

The lack of significant statistical data from the eurozone negatively affected EUR/USD growth in the first half of the day. Going forward, everything will depend on key statistics that have the potential to significantly adjust the pair's trajectory. Among the key data are the weekly U.S. jobless claims reports. This indicator is known for its high sensitivity to economic fluctuations, accurately reflecting the state of the labor market. The Philadelphia Fed Manufacturing Index and foreign trade balance data will also carry weight. Given that the dollar has recently reacted with gains to strong U.S. data, a positive deviation from economists' forecasts would support the U.S. currency.

In addition, investors' attention will be focused on statements by Federal Reserve Board members Raphael Bostic and Neel Kashkari. Their assessments of the economic situation, labor market conditions, and inflation processes may trigger an immediate market reaction. Any signals of upcoming interest rate cuts would weigh on the dollar.

As for the intraday strategy, I will rely more on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: Today, you can buy the euro when the price reaches around 1.1806 (green line on the chart), with a target of growth to 1.1829. At 1.1829, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. A strong rise in the euro can only be expected after weak statistics.Important! Before buying, make sure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today in the case of two consecutive tests of the 1.1790 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Growth toward the opposite levels of 1.1806 and 1.1829 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after it reaches the 1.1790 level (red line on the chart). The target will be 1.1765, where I intend to exit the market and immediately buy in the opposite direction (aiming for a 20–25 point move from the level). Pressure on the pair will return in the case of strong statistics.Important! Before selling, make sure that the MACD indicator is below the zero line and just beginning its decline from it.

Scenario No. 2: I also plan to sell the euro today in the case of two consecutive tests of the 1.1806 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal. A decline toward the opposite levels of 1.1790 and 1.1765 can be expected.

What's on the Chart:

Important: Beginner Forex traders must be very cautious when making market entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use proper money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based solely on the current market situation are inherently a losing strategy for an intraday trader.

RÁPIDOS ENLACES