Skupina UnitedHealth Group utratila v roce 2024 téměř 1,7 milionu dolarů za bezpečnost svých vrcholových manažerů, jak zdravotnický konglomerát zveřejnil v pondělí, několik měsíců po prosincovém smrtelném postřelení vysoce postaveného manažera Briana Thompsona před hotelem na Manhattanu.

Společnost rovněž zaplatila 207 931 USD jménem některých rodinných příslušníků vedoucích pracovníků za poskytování osobních a domácích bezpečnostních služeb, uvedla.

Zveřejnění výdajů na bezpečnost, které v předchozích výročních zprávách UnitedHealth chybělo, podtrhuje, že prosincová střelba přiměla společnosti přehodnotit riziko cíleného násilí vůči vrcholovému managementu.

Americké farmaceutické společnosti Johnson & Johnson (NYSE:JNJ) a Eli Lilly (NYSE:LLY) rovněž zvýšily výdaje na bezpečnost svých vrcholových manažerů v roce 2024, jak ukázala regulatorní hlášení z minulého měsíce.

„Jsme přesvědčeni, že tyto bezpečnostní služby jsou vhodné a nezbytné vzhledem k rizikům spojeným s pozicemi vedoucích pracovníků ve společnosti,“ uvedla společnost UnitedHealth v podání.

Brian Thompson, bývalý generální ředitel pojišťovací jednotky UnitedHealth Group (NYSE:UNH) UnitedHealthcare, byl zastřelen 4. prosince před hotelem v centru Manhattanu, kde společnost pořádala konferenci pro investory.

Z podání rovněž vyplynulo, že celková odměna generálního ředitele UnitedHealth Andrewa Wittyho za rok 2024 činila 26,3 milionu USD, zatímco před rokem to bylo 23,5 milionu USD.

Konglomerát vynaložil 150 951 dolarů na Wittyho ochranku, zatímco 926 989 dolarů bylo vyplaceno za Heather Cianfrocco, generální ředitelku zdravotnické jednotky společnosti Optum.

Trade Review and Tips for the Japanese Yen

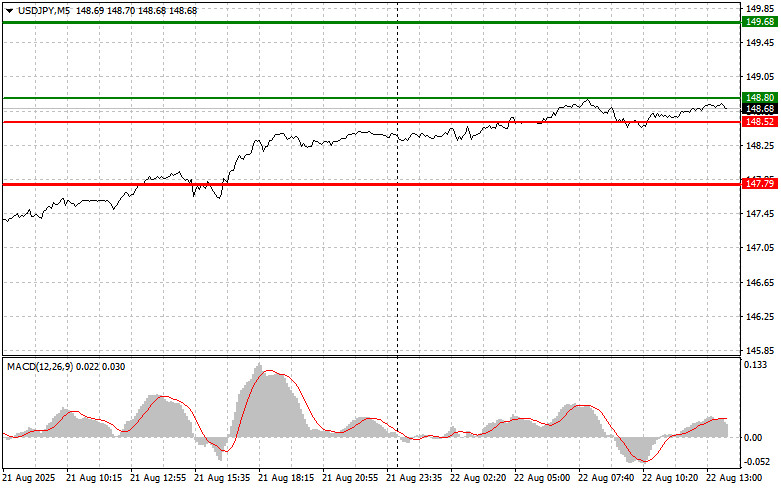

The first price test at 148.52 occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downward potential. For this reason, I did not sell the dollar. The second test of this level happened when MACD was in the oversold area, which allowed Scenario #2 (buy) to play out. As a result, the pair gained 20 points.

It is clear that everyone is waiting for the speech of Federal Reserve Chair Jerome Powell, and this has affected the upward potential in the first half of the day. Maintaining a wait-and-see stance is unlikely to provide strong support for the dollar's growth, while hints of a September rate cut will almost certainly strengthen the yen. Indeed, Powell's rhetoric will be decisive for the dollar's short-term dynamics. Markets are pricing in different scenarios, and any deviation from expectations could trigger sharp fluctuations. Signals of readiness to maintain high interest rates, though unlikely under current conditions, would support the U.S. currency. On the other hand, the hypothetical September rate cut that everyone is talking about would be a strong signal of a Fed policy shift. This would not only weaken the dollar but also impact other assets. In such a scenario, yen appreciation would be quite logical.

As for intraday strategy, I will mainly rely on Scenarios #1 and #2.

Buy Signal

Scenario #1: Today I plan to buy USD/JPY at the entry point around 148.80 (green line on the chart), targeting a rise toward 149.68 (thicker green line on the chart). Around 149.68, I will exit long positions and open shorts in the opposite direction (expecting a 30–35-point reversal from that level). Growth in the pair will be possible after a hawkish stance from Powell. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of 148.52 while the MACD indicator is in the oversold zone. This would limit the downward potential of the pair and trigger a reversal upward. Growth toward the opposite levels of 148.80 and 149.68 can then be expected.

Sell Signal

Scenario #1: Today I plan to sell USD/JPY after a breakout of 148.52 (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be 147.79, where I will exit short positions and immediately open longs in the opposite direction (expecting a 20–25-point rebound from that level). Pressure on the pair will return if Powell takes a very dovish stance. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of 148.80 while the MACD indicator is in the overbought zone. This would limit the upward potential of the pair and lead to a reversal downward. A decline toward the opposite levels of 148.52 and 147.79 may then be expected.

Chart Notes:

Important: Beginner Forex traders must be very cautious when deciding on market entries. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp volatility. If you do trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember: for successful trading you need a clear plan, like the one presented above. Spontaneous trading decisions based solely on the current market situation are an inherently losing strategy for an intraday trader.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-08-25 03:13:58 IP: 216.73.216.167