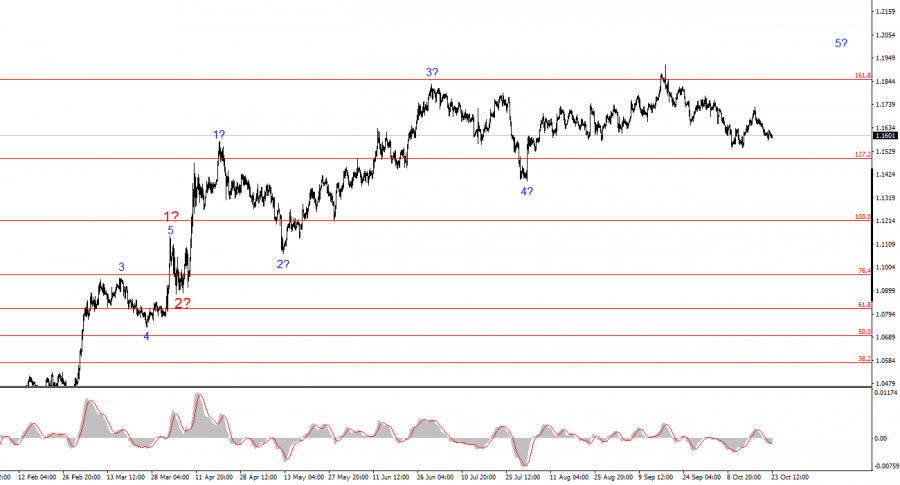

The wave pattern on the 4-hour chart for EUR/USD has transformed — and unfortunately, not for the better. It's still too early to conclude that the upward trend section has been canceled, but the recent decline in the European currency has made it necessary to refine the wave count. We now see a series of three-wave structures (a-b-c). It can be assumed that they are part of the larger wave 4 of the overall upward trend. In this case, wave 4 has taken on an unnaturally extended form, but overall, the wave pattern remains coherent.

The formation of the upward trend continues, and the news background continues to mostly not favor the dollar. The trade war launched by Donald Trump continues. The confrontation with the Federal Reserve persists. The market's dovish expectations regarding the Fed's interest rate policy are growing. The U.S. government shutdown continues. The market holds a rather low opinion of Donald Trump's performance over the first nine months of his term, even though economic growth in the second quarter reached nearly 4%.

In my view, the upward trend structure is not yet complete, with potential targets reaching up to the 1.25 level. Based on this, the euro may still decline for some time — even without fundamental reasons for doing so (as has been the case for the past three weeks) — but the wave pattern will nonetheless remain intact.

The EUR/USD pair barely moved on Thursday, and overall this week (like several before it) is one we'd all like to forget. A few weeks ago, the wave pattern clearly pointed to the formation of a new upward set of waves, suggesting further growth in quotations. Moreover, throughout 2025, the news background has remained such that nearly all market participants are eagerly awaiting a new decline in the U.S. dollar. Large institutional players continue to hold long positions on the euro, indicating their expectations for further growth.

However, about a month ago, something in the market "broke." The dollar — which had neither reason nor justification to attract demand — began to strengthen, disrupting the existing wave structure. If not breaking it entirely, then certainly making it more complicated. Had the news background during this period supported dollar buyers, such complications would be understandable. But EUR/USD has been falling against all logic and background fundamentals.

The most notable event this week was the cancellation of the summit between Vladimir Putin and Donald Trump in Hungary. Once again, negotiations on the Ukrainian issue have been postponed, while the war continues. Kyiv has repeatedly stated its readiness to stop the conflict, but Moscow insists on resolving the issues that led to it — specifically, Ukraine's refusal to join NATO. At this point, the full lists of demands from Kyiv and Moscow remain unknown, but the latest publicly available versions stand on opposite sides of the planet.

Based on the analysis of EUR/USD, I conclude that the pair continues to form an upward segment of the trend. The wave pattern still largely depends on the news background related to Trump's decisions, as well as the foreign and domestic policy of the new White House administration. The targets for the current upward trend could extend up to the 1.25 level. At present, we are likely observing the completion of corrective wave 4, which is nearing its end but has taken on a complex and extended form. Therefore, in the near term, I continue to consider only buying positions. By the end of the year, I expect the euro to rise toward 1.2245, which corresponds to the 200.0% Fibonacci level.

At a smaller scale, the entire upward segment of the trend is visible. The wave count is somewhat non-standard, as the corrective waves differ in size. For instance, the larger wave 2 is smaller than the internal wave 2 within wave 3 — but such situations do occur. Let me remind you that it's best to identify clear and readable structures on the chart, rather than trying to account for every minor wave. Currently, the upward structure raises almost no questions.

Key Principles of My Analysis:

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-10-24 02:02:14 IP: 216.73.216.154