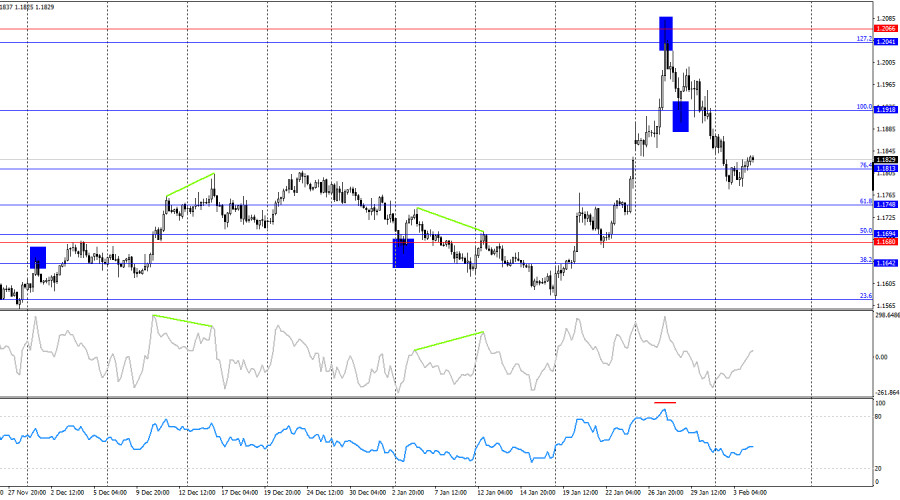

The EUR/USD pair continued its weak growth throughout Tuesday, which does not allow for any clear technical conclusions. Yesterday, I said that buy trades and expectations of euro growth would be better considered after consolidation above the 50.0% corrective level at 1.1829. Today, the bulls managed to achieve such consolidation with great difficulty, but it strongly raises doubts about the European currency's ability to continue rising in the near future. Perhaps today the news background will help the bulls.

The wave picture on the hourly chart remains simple. The latest downward wave did not break the low of the previous wave, while the latest upward wave broke the previous high. Thus, the trend remains bullish. The bulls have taken a short pause within a large-scale offensive that might not have happened without Donald Trump. Trump has heated up the situation in the world and within the United States to the extreme, and markets continue to react by fleeing from the risky U.S. currency with uncertain economic prospects.

On Tuesday, the news background was virtually absent, which explains the relatively low trader activity. Since the FOMC meeting last week, the U.S. dollar has risen by 250 points, but most likely this was not due to the meeting itself. Last week, the market learned the name of the new FOMC chairman—Kevin Warsh. At the moment, very little can be said about Warsh, as traders are interested in what views he will hold regarding monetary policy. Previously, Warsh was a supporter of higher interest rates and did not support various economic stimulus programs. But that was before, and now there is President Donald Trump, who demands maximum interest rate cuts. So what should the market expect from Warsh, who is not yet the Fed chair? Theoretically, Warsh may adhere to a relatively hawkish policy—but compared to whom? Jerome Powell also adheres to a fairly hawkish stance, and until the end of his term, the regulator is unlikely to implement even a single easing. The factor of dollar support in the person of Warsh is highly questionable.

On the 4-hour chart, the pair consolidated below the 100.0% corrective level at 1.1918 and fell to the 76.4% level at 1.1813. A rebound of quotes from the 1.1813 level will allow traders to expect a reversal in favor of the euro and a return to the 1.1918 level. A consolidation below 1.1813 will make it possible to expect a continuation of the decline toward the 1.1748 and 1.1694 levels. No emerging divergences are observed today on any indicator.

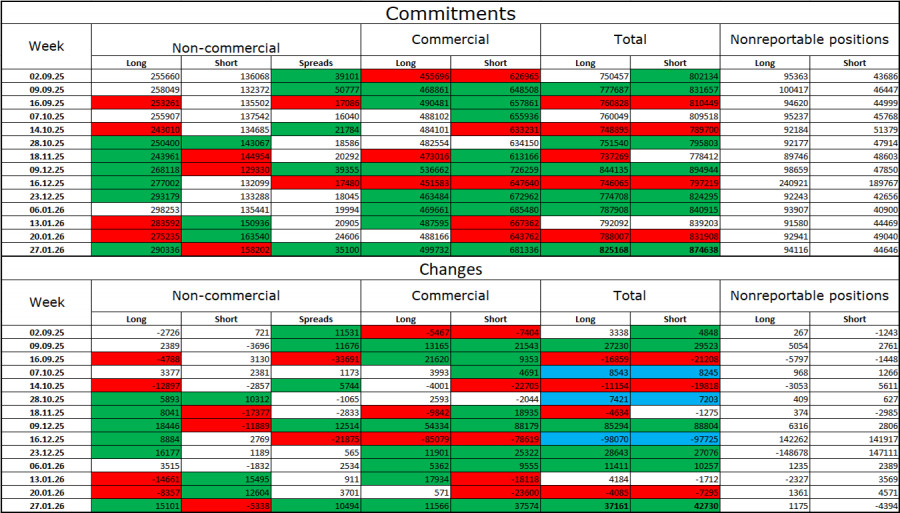

Commitments of Traders (COT) Report:

During the last reporting week, professional players opened 15,101 long positions and closed 5,338 short positions. The sentiment of the "Non-commercial" group remains bullish thanks to Donald Trump and his policies, and it continues to strengthen over time. The total number of long positions held by speculators now stands at 290,000, while short positions amount to 158,000. This represents almost a twofold advantage for the bulls.

For thirty-three consecutive weeks, large players reduced short positions and increased long ones. Then the government shutdown began, and now we are observing the same picture again: professional traders continue to build up long positions. Donald Trump's policies remain the most significant factor for traders, as they create numerous problems that will have long-term and structural consequences for the United States—for example, deterioration of the labor market and a decline in global reputation. Traders also fear a loss of Fed independence in 2026 and Donald Trump's geopolitical ambitions.

Economic Calendar for the U.S. and the Eurozone:

On February 4, the economic calendar contains five events, three of which (the latter ones) can be considered important. The impact of the news background on market sentiment on Wednesday may be present in the second half of the day.

EUR/USD Forecast and Trading Advice:

Selling the pair was possible after a close below the 1.1945 level on the hourly chart, with targets at 1.1867 and 1.1805. Both targets were reached. I doubt the further decline of the euro. Buy positions will become possible after a close above the 1.1829 level on the hourly chart, with targets at 1.1888 and 1.1963.

Fibonacci grids are drawn from 1.1805–1.1578 on the hourly chart and from 1.1918–1.1471 on the 4-hour chart.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2026-02-04 04:37:11 IP: 172.18.0.1