On Thursday, February 5, not only will the European Central Bank hold its meeting, but the Bank of England will also convene. It's difficult for me to say which of these meetings will be more significant. In my opinion, both will have a neutral tone. The BoE is not planning to cut interest rates at its first meeting in 2026, as the latest inflation report indicated an acceleration. Therefore, it will take time for the disinflation process to recover. Only then would there be a rationale for easing the new policy.

Market participants may react not to the BoE's "neutral" stance, but to the inconsequential outcome of the MPC's voting. I want to remind you that in most cases, analysts' and traders' expectations regarding the voting do not align with reality. However, forecasts for changes in the rate itself almost always match. Any (even small) discrepancy between forecasts and the actual voting results can elicit a reaction. At first glance, this all seems logical. If more officials vote in favor of a rate cut, the Bank's position can be considered more "dovish," and the pound can be sold. However, in practice, this logical chain holds little value, as the interest rate will not be cut regardless. Further reductions will depend solely on UK inflation, with nothing else.

The consumer price index in the UK remains elevated; the December report showed a year-on-year rate of 3.4%. In the US, a much lower inflation rate prevents the Fed from continuing its easing cycle. Therefore, without inflation dropping below 3%, I would not expect a new round of rate cuts. The conclusions summarized in the last two reviews suggest that both meetings tomorrow are largely formalities.

Earlier this week, I stated that the employment and unemployment reports from the US now hold much more significance for both instruments. On Wednesday, the ADP report has already disappointed and cast doubt on the "recovery of the labor market." However, we won't find out the actual state of the US labor market this week. The "shutdown" may end tomorrow, but the Bureau of Labor Statistics has been on holiday for several days, meaning the reports cannot be published on time, specifically on Friday. Therefore, market movement may remain rather weak until the end of the week.

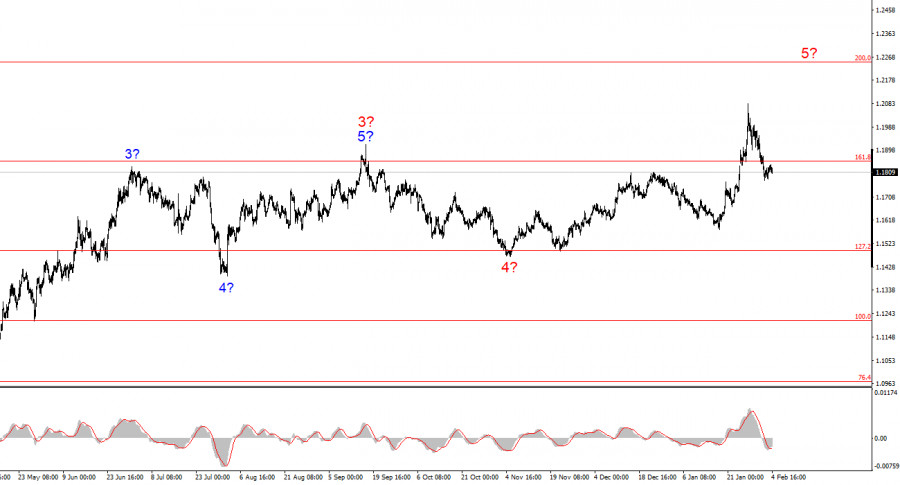

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend. Donald Trump's policies and the Fed's monetary policy remain significant factors contributing to the long-term decline of the American currency. The targets for the current segment of the trend may reach the 25 figure. At present, I believe that global wave 4 has completed its formation, so I expect further increases in quotes. However, I also anticipate a downward wave in the near term, as the a-b-c-d-e wave sequence appears complete. My readers may want to search for benchmarks for new purchases in the near future.

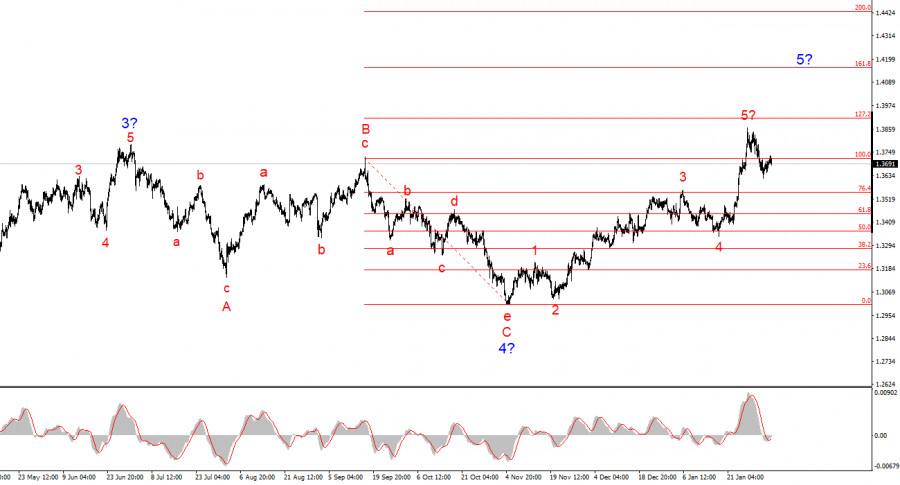

The wave picture for the GBP/USD instrument is quite clear. The five-wave upward structure has completed its formation, but global wave 5 may take on much more extended forms. I believe that in the near future, a corrective wave set may be observed, after which the upward trend construction will resume. Therefore, in the coming weeks, I recommend looking for opportunities for new purchases. Under Donald Trump, the British pound has a good chance of trading at 1.45-1.50 USD. Trump himself welcomes the decline of the dollar. All of his actions have a double positive effect: the decrease of the dollar and the resolution of internal, external, trade, and geopolitical issues.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2026-02-28 06:42:55 IP: 172.18.0.1