Tensions are running high. Donald Trump's patience is wearing thin, and President Emmanuel Macron's authority is beginning to waver. Conflicting comments from the U.S. President have raised doubts about the end of the government shutdown, while the escalating political crisis in France continues to weigh heavily on the EUR/USD exchange rate.

Mistakes shouldn't just be acknowledged — they're expected to be corrected, at any cost. Just over a year ago, Macron dissolved the National Assembly and called for snap parliamentary elections. At that time, the spread between French and German bond yields was just over 40 basis points. By October, it had surged to 86 basis points. Since then, France has seen four prime ministers come and go — and appointing a fifth won't fix things.

The National Rally (Rassemblement National) party openly claims that current budget negotiations aren't aimed at helping the French people — their goal is to politically bury the President. In their view, dialogue is pointless.

Both the left and the right are calling for Emmanuel Macron's resignation. They say they'll agree to sign off on a budget — but only if new presidential elections are announced afterward. Parliamentary elections are likely to be won by the National Rally, which would then form a government and further disregard EU fiscal rules. Frexit isn't imminent, but investors are already fleeing France.

This is reflected not only in the widening bond spreads but also in the sell-off of the CAC-40 stock index and continued pressure on the EUR/USD currency pair.

A glimmer of hope was offered to euro bulls by a recent statement from Donald Trump. The U.S. President said he is open to negotiations with Democrats on healthcare policy. However, he later added that they must first allow the government to reopen. This kind of rhetoric signals growing internal tension within the Republican team. The ongoing shutdown is slowing GDP growth, leading to layoffs and missed payrolls. Public dissatisfaction is on the rise, and Trump's approval ratings are declining.

For EUR/USD, the shutdown is currently more of a bearish factor than a bullish one. The longer the U.S. federal government remains closed, the less likely the Fed will feel justified in cutting interest rates. Not only does political uncertainty force the central bank to tread carefully, but key economic data are no longer being released, making decision-making even harder.

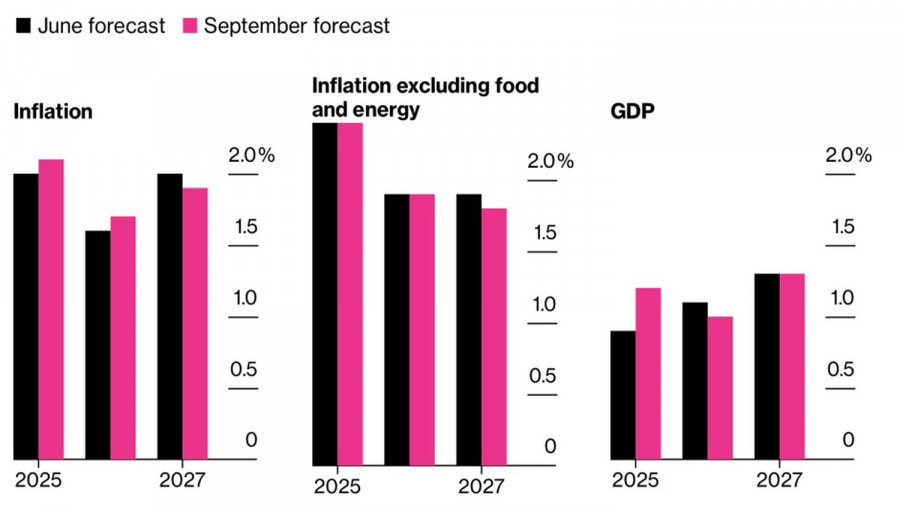

Unless the Fed takes action, the ECB's monetary expansion alone won't help EUR/USD recover. According to Christine Lagarde and other ECB officials, inflation in the eurozone remains "anchored," while tariffs are still hindering the economy, as are rising global competition and a strong euro. However, they expect these negative influences to ease in 2026, allowing GDP growth to pick up again.

Technically, the EUR/USD daily chart had formed a pin bar pattern. However, the pair didn't respond to this classic bullish reversal signal and instead moved in the direction of the long lower shadow — a sign of bearish strength. This validates the decision to stay in short positions initiated from the 1.171 level.

ĐƯỜNG DẪN NHANH