Trouble never comes alone. European industry is beginning to lose steam after rapid growth driven by a front-loaded surge in U.S. imports. The euro area is a net oil importer, so the Brent rally triggered by the Middle East conflict casts a shadow over the eurozone's outlook. Meanwhile, German bonds have failed to act as a safe haven, and their sell-off triggered a decline in the EUR/USD.

In June, business activity in the currency bloc barely grew—rising to just 50.2, falling short of Bloomberg analysts' expectations. The manufacturing PMI has failed to rise above the critical 50 mark for 36 consecutive months, while the services sector is barely expanding. These figures point to stagnation in Q2, following growth in Q1 driven by a rush in U.S. imports.

At first glance, the situation may not seem alarming, as inflation appears to be under control. Yes, the European Central Bank's 2025 GDP growth forecast of +0.9% looks overly optimistic, but the EU's trade agreement with the U.S. could reduce uncertainty, and Germany's fiscal stimulus might boost the economy. Unfortunately, the Israel-Iran conflict has delivered a blow to both the eurozone and the euro.

The eurozone is a net oil importer. The higher Brent climbs, the more costs rise for businesses. This is bad news for European stock indices, which had recently become a key driver of the EUR/USD rally in 2025. It's also becoming harder to argue that inflation is "anchored." The oil rally raises the risk of accelerating consumer prices and ties the ECB's hands. Christine Lagarde and her colleagues might welcome the idea of throwing the economy a lifeline by cutting the deposit rate again, but they can't. There is a significant risk that the CPI will again exceed the inflation target, and the ECB has limited remaining tools.

It seemed the U.S. dollar had long lost its status as the ultimate safe haven. Donald Trump's policies pushed investors from a belief in American exceptionalism toward strategies of "selling America." However, the Middle East conflict has revived demand for the greenback as a haven. In contrast, German bonds—once seen as an alternative—are being dumped quickly. The dollar may have lost some trust, but the euro isn't ready to take its place.

As a result, the eurozone economy is showing signs of weakness, and rising oil prices may worsen the situation. European stocks and bonds are being sold off, depriving EUR/USD bulls of their key advantages. Only a de-escalation of the Middle East conflict or the revival of trade wars could reverse this trend.

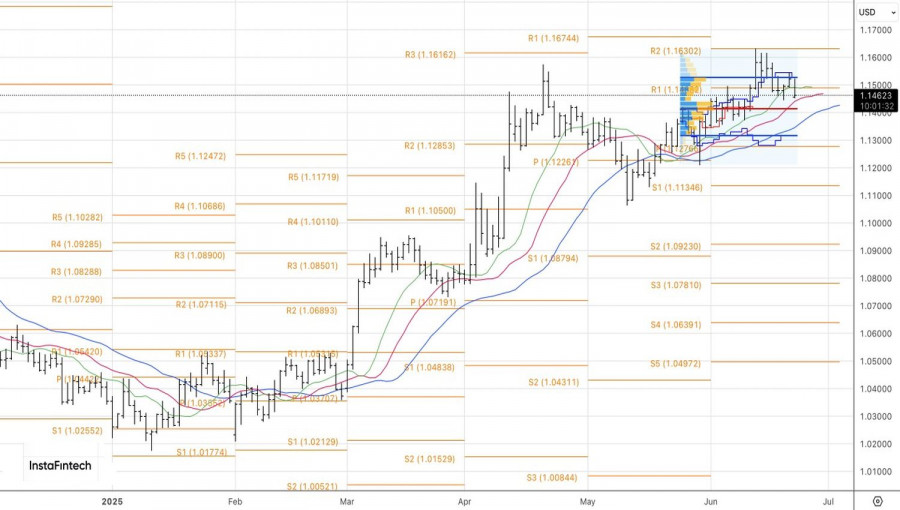

From a technical standpoint, the daily EUR/USD chart shows that the bulls' failure to push prices outside the fair value range of 1.131–1.153 indicates weakness and creates a selling opportunity. However, a rebound from 1.141 or 1.131 would justify a reversal and the opening of long positions.

QUICK LINKS