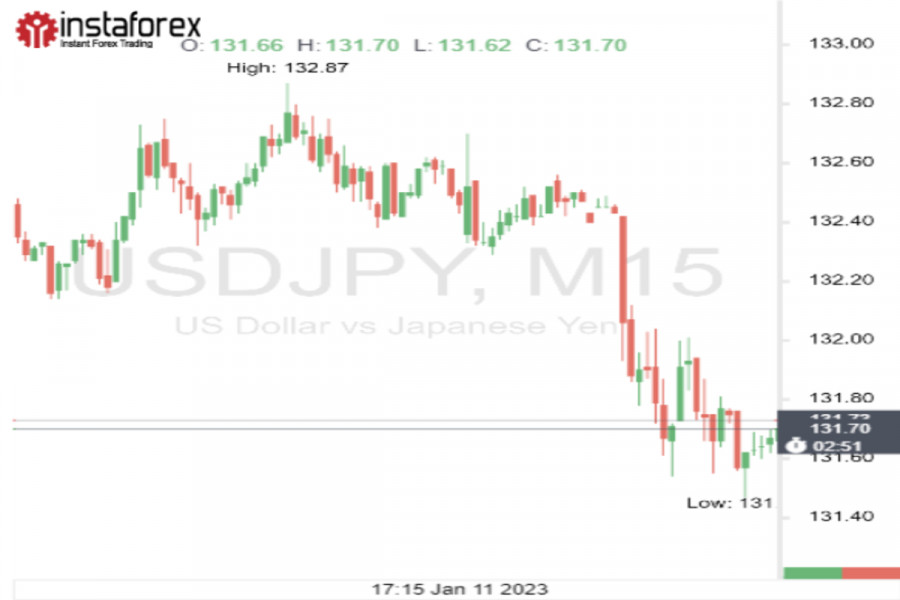

The dollar/yen pair has been rising steadily for some time. However, on Thursday night, the pair dropped sharply due to news from Japan.

Today, traders are anticipating US CPI data for December. For this reason, they did not expect sharp moves in currencies. Yet, the dollar/yen pair surprised investors with sharp price swigs.

At the opening of the trading session in Tokyo, the pair fell drastically by 0.7%, reaching 131.58. The reason for such a rapid decline was another wave of speculation about a possible policy reversal by the BoJ.

Apart from that, markets got excited about the news published by the Japanese media agency -Yomiuri. It reported that the BoJ intends to assess the negative consequences of its ultra-soft monetary policy at the January meeting.

The media did not cite any source. It stated that the central bank may again revise its bond purchase program and, if necessary, make additional adjustments.

As a reminder, last month, the regulator allowed the Japanese 10-year bond yield to reach 0.50% from the previous cap of 0.25% for the first time in many years. This move was aimed at stimulating the bond market. However, traders interpreted it as a shift to a hawkish stance.

The Japanese currency was able to recoup a significant part of its losses incurred against the US dollar over the past year.

In 2022, the yen plunged to a 32-year low at 151.90 due to the divergence in monetary policies between Japan and the United States. It is currently trading 15% above this critical threshold.

Currently, the yen is climbing amid expectations of a policy reversal by the BoJ and a slowdown in the pace of monetary tightening by the Fed.

Soaring inflation, which forced the Fed to raise interest rates to a range of 4.25-4.5% from 0% last year, is gradually starting to decline.

Investors assume that a further drop in consumer prices may allow the central bank to undertake a smaller rate hike as it happened in December.

At its last meeting, the Fed raised the interest rate by only 50 basis points after four consecutive rate hikes by 75 basis points.

Now, market participants are anticipating an even smaller rate hike by 25 basis points.

If the inflation report for December turns out to be weak, which is quite likely, speculators will be more sure of this outcome.

Economists assume that in annual terms, the Consumer Price Index rose by 6.5% last month. This is lower than the 7.1% logged in November.

If the reading is in line with forecasts, traders are sure to expect the Fed to end its tightening cycle. In this case, the US dollar will inevitably drop across the board. The yen will not miss the opportunity to take advantage of the situation. So, the greenback is likely to fall the most against the yen.

Given the market speculation ahead of the Bank of Japan meeting next week, the USD/JPY pair is highly likely to dip lower, TD Securities analysts said. One cannot, of course, rule out alternative scenarios. Now dollar bulls are betting on a rise in inflation. If this scenario comes true, the US dollar may jump markedly.

Some analysts are confident that next week we will see a steady recovery of the USD/JPY pair. If the scenario unveiled by Yomiuri turns out to be false and the BoJ does not make any hawkish moves, the yen will fall dramatically.

These are just predictions. Traders are largely focused on today's US inflation report.

One should keep in mind that any inflation figures will trigger volatility. Now, the expected weekly volatility for the USD/JPY pair is at the highest level since October.