Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

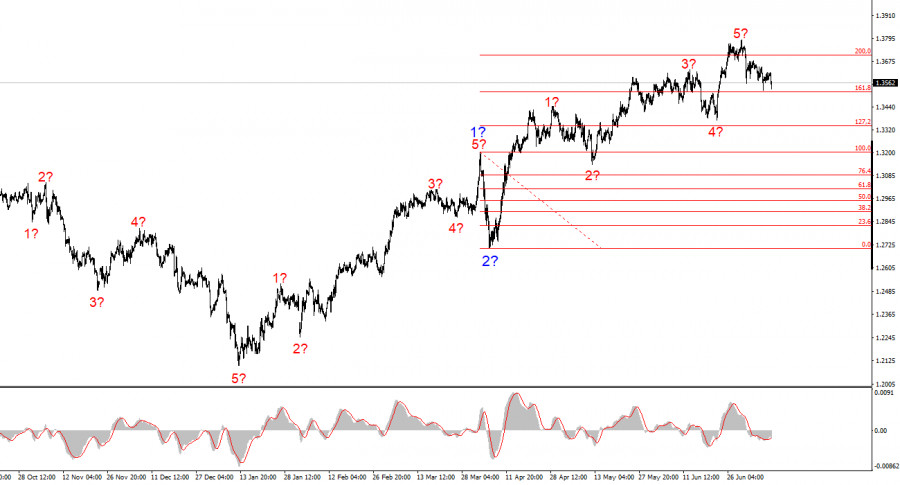

The wave pattern for GBP/USD continues to indicate the formation of a bullish impulse structure. The wave picture closely resembles that of EUR/USD because the dollar remains the main driver of movement across the board. Demand for the U.S. currency is weakening across the entire market spectrum, resulting in similar dynamics across many instruments. Wave 2 of the upward trend took the form of a single wave. Within the presumed wave 3, sub-waves 1, 2, 3, 4, and presumably 5 have been formed. This means the current wave sequence appears to be complete, and the pair is now transitioning into a corrective phase.

It is important to remember that much of the current movement in the currency market is being driven by Donald Trump's policies—trade-related and otherwise. While some positive news occasionally comes from the U.S., the market remains wary due to economic uncertainty, contradictory decisions and statements from Trump, and a hostile, protectionist stance from the White House. As a result, the dollar has to work hard to convert even favorable data into market demand.

The GBP/USD pair has dropped about 170 basis points over the last 8 trading sessions, and the market appears to be ignoring the new tariff announcements from Donald Trump. Why is it ignoring them? That's perhaps the most interesting and important question right now. The situation for the pound (and not only the pound) has become complex and uncertain precisely because of how the market is interpreting recent news. Let me remind you that last week's reports on employment, unemployment, business activity, and job openings in the U.S. showed rather strong figures, which could have supported demand for the U.S. dollar. Yet most of that data only led to minor buying of the currency.

This week, the situation appears to be quite the opposite. Despite the absence of major economic data and daily announcements of new tariffs by Trump, the U.S. dollar has been appreciating. Why is this happening? Has the market already priced in the most pessimistic scenario of the trade war and sees no further justification to sell the dollar? Or is this simply a temporary pause—a calm before the next round of volatility? I tend to favor the latter explanation. The wave pattern still points to an upward trend that is, to say the least, far from complete. The persistent flow of negative news from the U.S. has weighed on the dollar for nearly six months. Naturally, the instrument cannot rise indefinitely without corrective movements. With the five-wave structure now complete, a corrective phase is likely to follow.

Based on this, I believe that the decline in the U.S. dollar is not over. In fact, it may continue through the end of 2025 (as there are no signs of the trade war ending), and even into 2026 (since Jerome Powell will step down next year, and Trump is likely to appoint a new Fed Chair expected to follow his policy direction). Therefore, I still see no strong prospects for the dollar.

The wave pattern for GBP/USD remains intact. We are still in an upward impulse segment of the trend. Under Donald Trump, markets may face many more shocks and reversals, which could significantly impact the wave structure. However, for now, the current scenario remains valid. The target for the upward trend is now around the 1.4017 level, corresponding to the 261.8% Fibonacci extension from the presumed global wave 2. At present, a corrective sequence is likely forming. Classically, this would consist of three waves, though in reality it may turn out much shorter.

Key principles of my analysis:

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

RYCHLÉ ODKAZY