Several macroeconomic reports are scheduled for Wednesday, specifically two. Reports on October inflation will be published in the UK and the Eurozone, but while the British report is significant, the European one is not. European inflation is published in two estimates, and markets generally pay little attention to the second estimate, which rarely differs from the first. In contrast, British inflation is published in a single variation, has a strong influence (currently) on the Bank of England's monetary policy, and may slow down for the first time in five months by 0.1-0.2% year-on-year. A decline in October inflation could lead to a December cut in the BoE's key rate, creating additional challenges for the pound if the market shifts to focusing on fundamentals and macroeconomic factors.

A few fundamental events are scheduled for Wednesday. The only noteworthy event is the minutes from the last Federal Reserve meeting, but this is a rather formal document. The document typically contains information that has already been available to the market for three weeks. It is important to remember that immediately after the central bank meeting, the results are announced, and all the most crucial information is made available to the market right away. The minutes usually discuss the sentiment of individual FOMC members, their views on inflation, the economy, and the labor market. Therefore, we do not expect any reaction to this event, and the future of the Fed's monetary policy in December will depend on the next reports on the labor market, unemployment, and inflation.

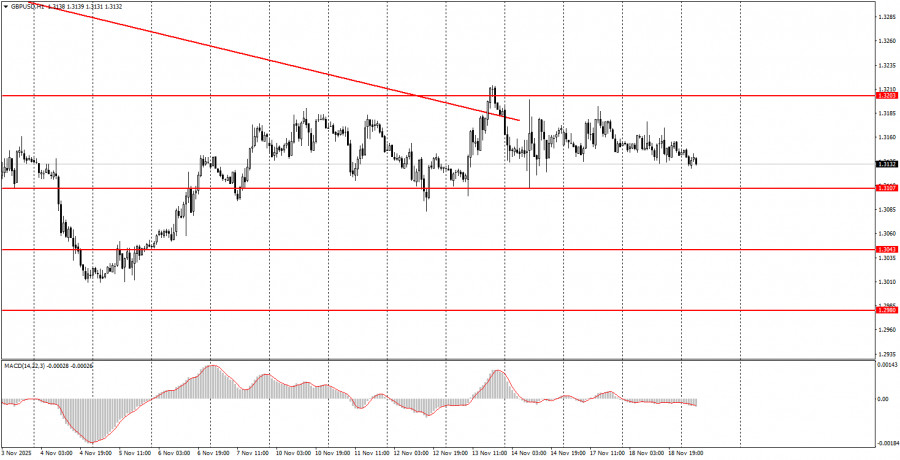

During the third trading day of the week, both currency pairs may continue to move sideways. The euro has a great trading area at 1.1571-1.1584. The British pound has two relevant trading areas: 1.3096-1.3107 and 1.3203-1.3211. The British pound may show some semblance of trending movement today, while the euro is unlikely to do so.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.

RYCHLÉ ODKAZY