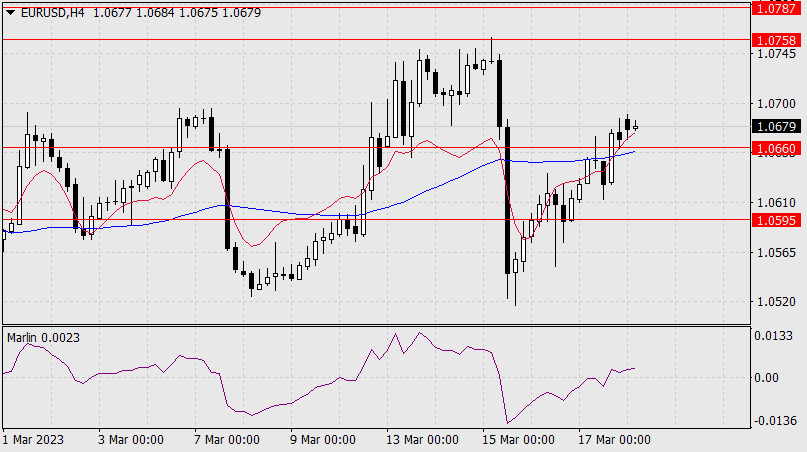

The single European currency was able to overcome the resistance level of 1.0660. It can stay at this level until the Federal Reserve meeting on Wednesday. The level is favorable - the support itself, and the euro approaching the balance indicator line will strengthen the neutral mood. The signal line of the Marlin oscillator is close to the local high on March 14 (turquoise line), here we can also expect the oscillator to get weaker and lose its main function.

We will not receive any macro data that can push up the euro until Wednesday; the eurozone trade balance for January will be released today - the forecast is 12.5bn euro against -8.8bn in December. Tomorrow, the ZEW eurozone economic sentiment indicator for March might go down from 29.7 to 23.2 points. No significant data on the US, and we don't expect to receive fresh news on the banking crisis in the near future.

Nevertheless, purely technical factors strengthen the bulls' positions. There's the fact that the price is taking its time before it settles above 1.0660, the consolidation of the oscillator in the positive area, and even the convergence of the price with Marlin creating the potential for a breakthrough into the target range of 1.0758/87. Consolidating below 1.0660, that is, the opening and closing of the daily candle under the level, will remove these growing sentiments.

On the four-hour chart, the price has consolidated above the balance and MACD indicator lines, the Marlin oscillator in the positive area. Everything is rising, but we are waiting for developments. During the consolidation period, one or more false movements can be created.

QUICK LINKS