The euro, pound, and other risk assets continued to rise against the US dollar on Friday.

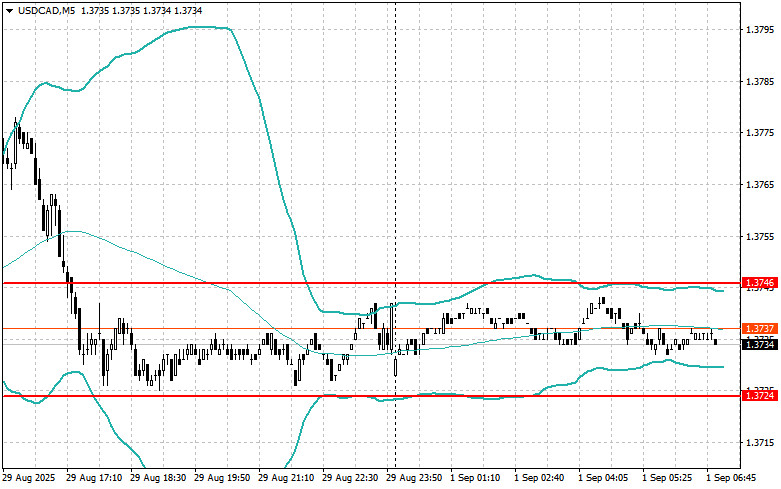

Given the fact that there was no significant rise in inflation in the US in July of this year, it suggests that the Federal Reserve may resort to its first interest rate cut of the year this month. Still, it's important to remember that inflation remains above the Fed's 2% target, and the central bank will closely monitor future economic data before making a final decision. The key factor will be the labor market dynamics and the further development of price pressures. On the other hand, if the Fed starts to cut rates too early, this could lead to a renewed acceleration of inflation and a weakening of the dollar. This would create additional risks for the US economy and the global financial system. Therefore, the Fed should act cautiously and prudently, taking all factors into account.

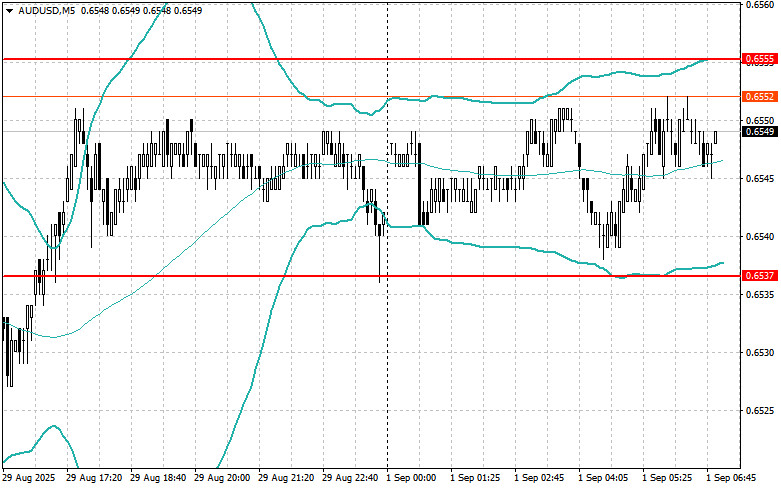

Today, two interesting economic indicators are expected to be released in the first half of the day. These are the Manufacturing PMI in the eurozone and the unemployment rate. As for the PMI, economists are forecasting a slight decrease compared to the previous month. This could indicate a slowdown in the manufacturing sector, triggered by geopolitical uncertainty and rising energy prices. However, if the indicator turns out above expectations, it could have a positive impact on investor sentiment and support the euro.

The unemployment rate, in turn, is an important indicator of labor market health. It is expected to remain stable, but any unexpected increase or decrease could substantially influence the European Central Bank's monetary policy decisions.

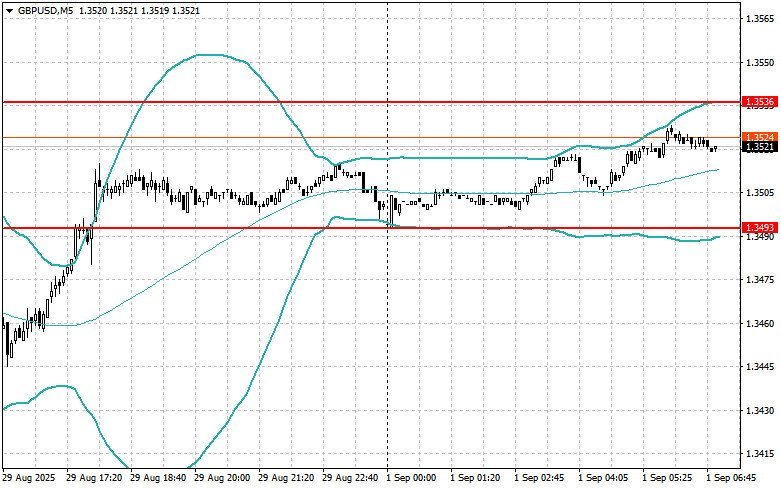

Additionally, the UK is expected to release several interesting data today. The manufacturing PMI is expected to attract attention and remain in contraction territory, indicating ongoing difficulties for the UK manufacturing sector. The number of approved mortgage applications will provide insight into consumer sentiment and activity in the housing market.

If the data aligns with economists' expectations, it's best to employ a Mean Reversion strategy. If the data comes in much higher or lower than expected, it's best to use a Momentum strategy.

QUICK LINKS