Trump has threatened to impose tariffs of up to 25% on Canadian and Mexican imports starting February 1. This announcement led to an active market sell-off, as traders began reevaluating the potential impact of new restrictions on inflation. European stocks also took a hit, with notable declines in automakers and mining companies.

Meanwhile, Chinese stocks rose due to the absence of announcements targeting China. However, analysts caution against placing too much emphasis on Trump's first day as president. Market optimism remains limited: Trump's focus today is on Canada and Mexico, but tomorrow it could shift to Europe or China.

The lack of a comprehensive plan for trade restrictions underscores the risk of heightened volatility in equity markets. The Canadian dollar and Mexican peso both fell by 1.4% following Trump's tariff threats.

The yield on 10-year Treasury notes fell by 9 basis points to 4.54% as cash trading resumed after the U.S. holiday. The perceived reduction in immediate tariff risks has dampened expectations for faster inflation.

Investors remain cautious, awaiting further executive orders from the White House. Trump has pledged to swiftly implement his "America First" agenda. After his November election victory, fears of widespread tariffs exacerbated concerns over global trade tensions. These fears initially led to declines in everything from the Australian dollar to European stocks while the U.S. dollar surged, as the Federal Reserve adopted a more cautious stance on monetary easing.

Reports suggest that, while avoiding immediate tariffs on Chinese goods, Trump has directed his administration to address unfair trade practices globally. This includes investigating whether Beijing has adhered to the trade agreement signed during Trump's first term.

Traders are also keeping an eye on the fourth-quarter earnings season. On Tuesday, major U.S. companies including 3M Co., Netflix Inc., and United Airlines Holdings Inc. are scheduled to report earnings. Additionally, comments from the World Economic Forum in Davos could influence market sentiment.

In commodities, oil prices fell as traders digested Trump's pledges and executive orders, including plans to boost domestic production. Iron ore prices rose, while Bitcoin declined for the fourth consecutive day, trading below $102,000.

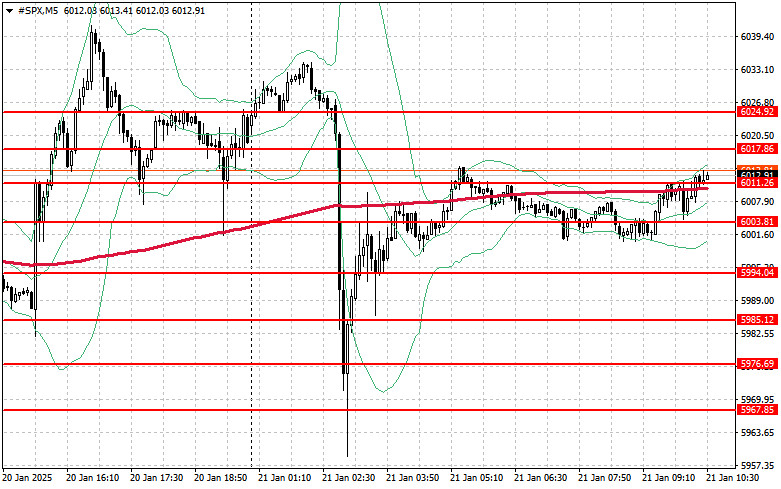

Demand remains subdued for the S&P 500. Buyers' main target today is to defend the $6,000 level. Successfully holding this support will help maintain the upward trend and could pave the way for a rally to $6,017. Another key target for bulls is $6,024, which would strengthen their position.

If risk appetite declines further, buyers will need to defend $6,000. A breach of this level could push the index down to $5,994, opening the door to a further decline toward $5,985.

TAUTAN CEPAT