Among the upcoming U.S. economic reports next week, there is quite a lot on the calendar, but nothing particularly stands out. On Tuesday, data on new housing starts and building permits will be released. On Wednesday, we will see the FOMC minutes. On Thursday, the Philadelphia Fed Business Activity Index and new home sales are due. On Friday, Jerome Powell will deliver a speech. From this entire list, I believe only the Federal Reserve Chair's speech deserves highlighting.

Let me remind you that about half of the FOMC members now support the early resumption of the monetary policy easing cycle. However, many officials still do not believe that more than one or two rounds of rate cuts are needed in 2025. For the first time in a long while, the FOMC is divided into "doves" and "hawks." The doves, in turn, split into those who support rate cuts due to pressure from Donald Trump and those who genuinely believe easing is necessary. The fact remains, however, that the number of doves has increased significantly lately, so policy easing should indeed be expected. Easing monetary policy provides another reason for the U.S. dollar to continue its decline against the euro, the pound, and other currencies.

This is why Powell's speech is significant. Recently, Powell himself has remained on the hawkish side, but under pressure from U.S. labor market data, he may also voice support for a more dovish policy stance. If we hear dovish rhetoric on Friday (and most likely, that is precisely what will happen), demand for the dollar will again weaken.

Let me also remind you that the wave structure of both instruments suggests the continuation of an upward trend segment, meaning further dollar weakness. Resolution of the geopolitical conflict in Ukraine may also negatively affect the U.S. currency's position. In general, whichever way you look at it, the U.S. dollar remains unpromising. Based on this, I expect demand for the dollar to continue declining.

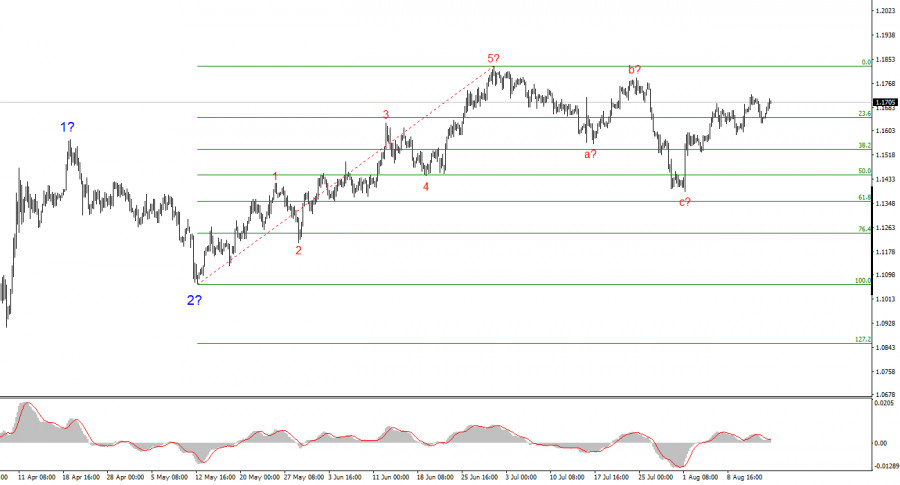

Based on the analysis of EUR/USD, I conclude that the instrument continues forming an upward segment of the trend. The wave structure still entirely depends on the news background connected with Trump's decisions and U.S. foreign policy. The targets for this trend segment may extend as far as the 25th figure. Therefore, I continue to consider buying with targets around 1.1875, which corresponds to 161.8% Fibonacci, and above. I assume that the construction of wave 4 has been completed. Accordingly, now is a good time to buy.

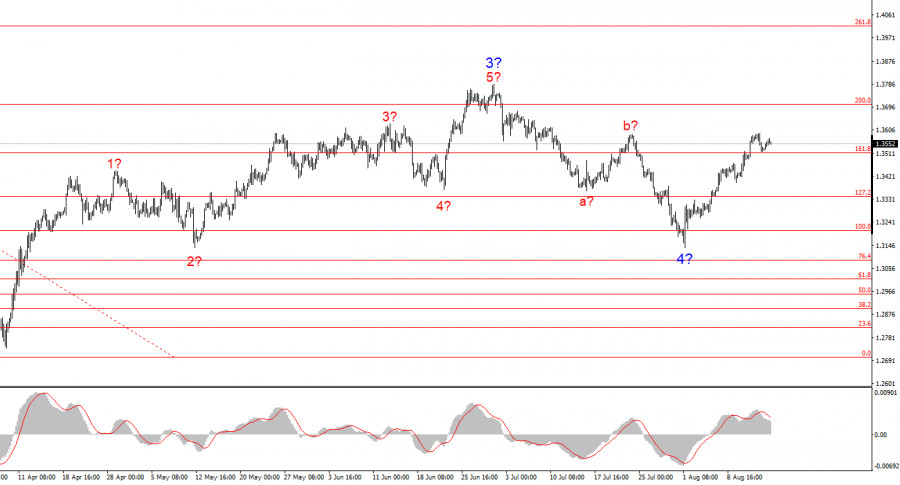

The wave structure of GBP/USD remains unchanged. We are dealing with an upward, impulsive trend segment. Under Trump, the markets may still face a large number of shocks and reversals, which could significantly affect the wave structure, but at present, the working scenario remains intact. The targets of the upward trend segment are now located near 1.4017. At the moment, I assume that the formation of downward wave 4 has been completed. Therefore, I recommend buying with a target of 1.4017.

TAUTAN CEPAT