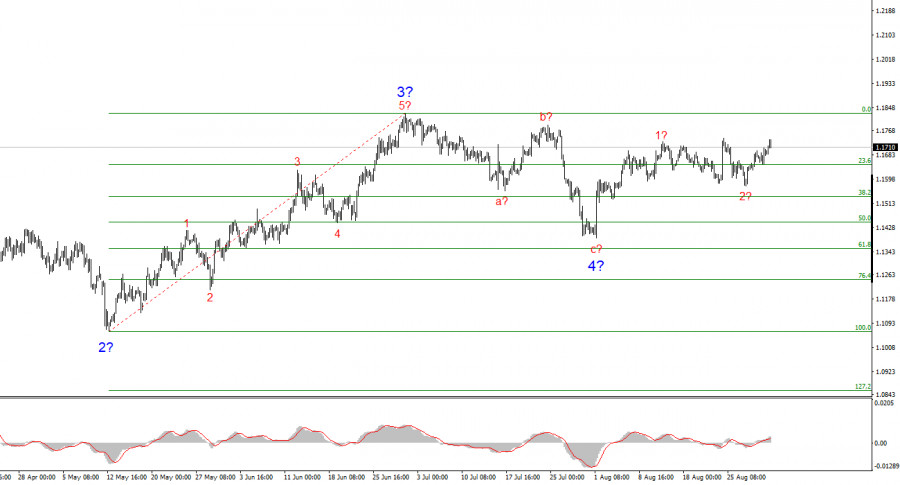

The wave pattern on the 4-hour chart for EUR/USD has remained unchanged for several months, which is very encouraging. Even when corrective waves are formed, the overall structure remains intact. This allows for accurate forecasts. It should be remembered that wave patterns do not always look like textbook examples. Right now, however, the pattern looks very clear.

The upward trend segment continues to develop, while the news background continues to support mostly not the dollar. The trade war initiated by Donald Trump continues. The confrontation with the Fed continues. Dovish expectations are growing. Trump's "one big law" will increase U.S. government debt by 3 trillion dollars, while the U.S. president keeps raising tariffs and introducing new ones. The market rates the results of Trump's first six months very low, despite the fact that economic growth in the second quarter reached 3%.

At this stage, it can be assumed that wave 4 is complete. If so, the construction of impulse wave 5 has begun, with targets extending as far as the 1.25 area. Of course, corrective wave 4 could still take a more extended five-wave form, but I proceed from the most likely scenario.

The EUR/USD rate rose slightly on Monday, but in recent weeks we have seen sideways movement that has not yet ended. I believe this week it will come to an end, and we will see continued development of the upward trend. As I wrote earlier in my reviews, the wave pattern is now so clear and straightforward that there is not even an alternative scenario. Nevertheless, such thinking may mislead traders. Caution is always necessary.

Today's news background was very weak. The final estimate of Germany's manufacturing PMI indicated growth to 49.8 points, and the Eurozone index rose to 50.7 points. These are decent figures and a positive trend that could have provided some support for buyers during Monday's trading. However, these reports were relatively weak, and much more important information awaits the market ahead. Tomorrow, the U.S. will release the ISM Manufacturing PMI. This report carries special significance.

Normally, PMI indexes do not provoke a strong market reaction, but ISM indexes can. Since the wave pattern indicates further growth of the euro, weak ISM data are needed. The same goes for other U.S. data this week. If the reports turn out strong, demand for the U.S. currency may increase, but this will only complicate the current wave structure. It should be remembered that the wave structure can become more complex and extended at any time, and the news background is one of the reasons for such complications.

Based on the EUR/USD analysis, I conclude that the instrument continues to form an upward trend segment. The wave pattern still depends entirely on the news background related to Trump's decisions and U.S. foreign policy. The targets for this upward trend segment may extend up to the 1.25 area. Accordingly, I continue to consider buying with targets near 1.1875, which corresponds to the 161.8% Fibonacci level, and higher. I assume that wave 4 has been completed. Therefore, this is still a good time to buy.

Basic principles of my analysis:

TAUTAN CEPAT