On the hourly chart, the GBP/USD pair rebounded from the corrective level of 50.0% (1.2464) on Wednesday, but the downward process was short-lived. Bears retreated from the market again, and the British pound returned to the level of 1.2464. Holding the pair's rate above this level increases the likelihood of continued growth towards the next level at 1.2517. A new rebound from the level of 1.2464 will once again allow for some decline in the British pound.

The wave situation remains unchanged. The last completed downward wave broke the low of the previous wave, and the new upward wave has yet to come close to the last peak from April 9. Thus, the trend for the GBP/USD pair remains bearish, and there are no signs of its completion at the moment. The first sign of bulls transitioning to an offensive could be a breakthrough of the peak on April 9, but bulls need to cover a distance of about 280 points to reach the zone of 1.2705–1.2715. It is unlikely that we should expect a trend change to bullish in the coming days. A new downward wave, if weak and does not break the low from April 22, could also indicate a trend change.

On Wednesday, the information background was positive for the dollar, but traders considered it insufficiently positive to start buying the dollar again. Reports on durable goods orders turned out to be above expectations, but bears practically did not attack during the day. Today's GDP report for the US should be above the forecast of +2.5% q/q for bears to take the offensive. Despite the weakness of bears in recent days, the bearish trend persists. Market expectations for the interest rates of the Bank of England and the Fed in 2024 still indicate the hawkish sentiment of the latter. The FOMC may start tapering its QE only towards the end of the year, which could support the dollar for another 5–6 months.

On the 4-hour chart, the pair made a reversal in favor of the British pound and returned to the level of 1.2450. A rebound in quotes from this level will work in favor of the US dollar and the resumption of the decline towards the corrective level of 50.0%-1.2289. The downward trend channel still characterizes the current sentiment of traders as bearish. Holding the pair's rate above the level of 1.2450 will allow for further growth of the British pound towards the upper trend line of the trend channel.

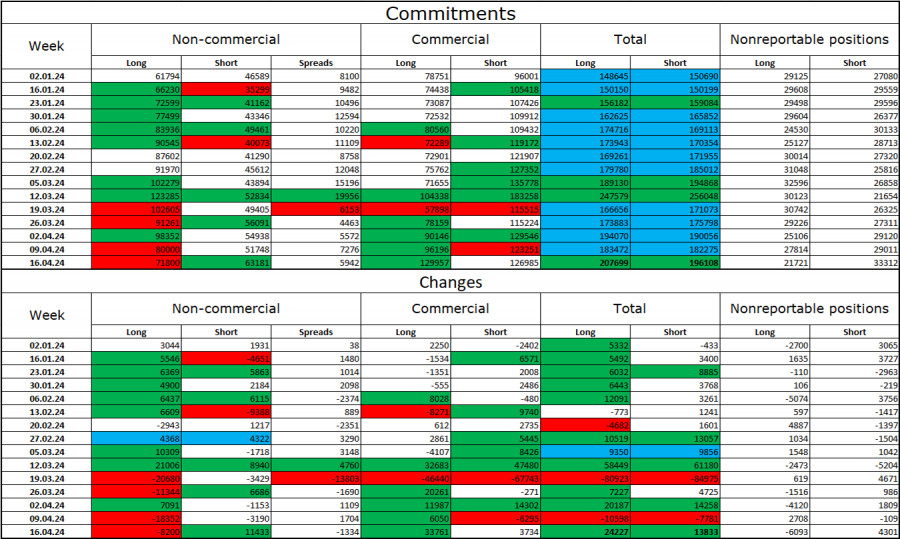

Commitments of Traders (COT) report:

The sentiment in the "non-commercial" trader category for the last reporting week became less bullish. The number of long contracts held by speculators decreased by 8200 units, while the number of short contracts increased by 11433 units. The overall sentiment of major players remains bullish but has been weakening in recent weeks. The gap between the number of long and short contracts is almost non-existent now: 72,000 versus 63,000.

There are prospects for the British pound to decline. Over the past 3 months, the number of long positions has increased from 62,000 to 72,000, while the number of short positions has increased from 47,000 to 63,000. This explains the relatively weak decline of the British pound. Over time, bulls will start to unload buy positions or increase sell positions, as all possible factors for buying the British pound have already been worked out. Bears have demonstrated their weakness and complete reluctance to transition to an offensive in recent months, but inflation reports in the US and UK could give them new strength.

News Calendar for the US and UK:

US - Change in GDP for the first quarter (12:30 UTC).

US - Number of initial jobless claims (12:30 UTC).

On Thursday, the economic events calendar contains only two entries in the US, one of which needs to be of more significance. The impact of the information background on market sentiment today may be of moderate strength.

Forecast for GBP/USD and trader advice:

Sales of the British pound are possible today on an hourly chart rebound from the level of 1.2464 with a target of 1.2363–1.2370. Purchases of the pair were possible on a rebound from the level of 1.2300 with a target of 1.2363 and on consolidation above the resistance zone of 1.2363–1.2370 with a target of 1.2464. All targets have been reached. New purchases are possible on a consolidation above the level of 1.2464 with a target of 1.2517.