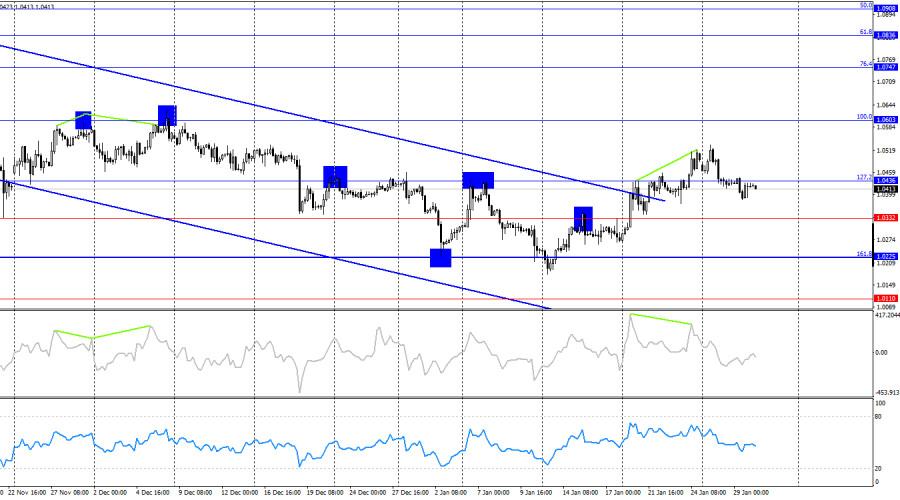

The wave structure remains relatively clear. The last completed upward wave broke through the previous high, while the current downward wave has yet to break the previous low. This indicates that the bullish trend is still intact, but recent waves have been small and weak. To invalidate the current bullish trend, the pair must fall below the 1.0338–1.0346 support zone.

Despite the potential for strong market reactions on Wednesday, Jerome Powell's speech failed to provide any meaningful direction. Traders received no clear signals from the Fed, as Powell's comments remained neutral and cautious. The focus now shifts to today's ECB meeting, where markets will be looking for more decisive remarks from Christine Lagarde. Unlike the Fed, which maintained its policy stance, the ECB is almost certain to cut rates, which could trigger a renewed sell-off in the euro. While the Fed's decision was neutral, the ECB's rate cut will be decisively dovish, and the more Lagarde signals further monetary easing, the greater the chances of a EUR/USD decline.

Additionally, macroeconomic data is unlikely to support the euro. German and Eurozone GDP reports are not expected to bring positive surprises, while the U.S. economy continues to show strong growth. Although bears missed their chance to push the pair lower yesterday, they will have several more opportunities today.

On the 4-hour chart, EUR/USD reversed in favor of the U.S. dollar after forming a bearish divergence on the CCI indicator, securing a move below the 127.2% Fibonacci level at 1.0436. This suggests that the pair could continue its decline toward 1.0332. However, the downtrend might be limited, as bulls previously managed to break above the downward trend channel. At the moment, no new divergences are forming on any indicator.

During the last reporting week, professional traders opened 4,905 long positions and 6,994 short positions, reinforcing bearish sentiment among non-commercial traders. Currently, there are 167,000 long positions and 230,000 short positions in the market.

For 18 consecutive weeks, large institutional players have been selling euros, confirming a strong and sustained bearish trend. Occasionally, bulls have taken control for brief periods, but these instances have been exceptions rather than the rule.

The main driver behind dollar weakness in recent months has been expectations of Fed rate cuts. However, this factor has already been priced in, meaning there is no longer a fundamental reason to sell the U.S. dollar. While new reasons may emerge over time, the dollar's strength remains the more probable scenario. Technical analysis also confirms the continuation of the long-term bearish trend, suggesting that EUR/USD is likely to decline further.

January 30 is packed with high-impact economic events, meaning market sentiment is likely to be highly volatile throughout the day.

Sell positions remain relevant, with targets at 1.0376 and 1.0346, as long as the pair holds below the upward trend channel on the hourly chart. Buying opportunities could emerge if EUR/USD breaks above 1.0437, with a potential target at 1.0507. However, if this happens, selling will no longer be a viable strategy.

Fibonacci levels are set at: