The test of 1.2439 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I did not sell GBP/USD at that moment.

Later, after a failed bullish attempt, a second test of 1.2430 took place. This time, it coincided with the MACD indicator starting to move downward from the zero mark, confirming a valid sell entry. At the time of writing, GBP/USD has already declined by more than 15 points from the entry point.

Given the current economic environment, the British pound remains under pressure. Despite positive credit data, market participants have chosen to remain cautious, considering the uncertainty surrounding potential monetary policy changes in both the UK and globally.

Recent reports indicate a notable increase in loan demand, which should have supported the pound. However, without strong institutional investor participation, GBP/USD failed to hold above 1.2460. Instead, after a short-term spike, the pair came under renewed pressure, returning to levels consistent with a sideways trend.

The economic slowdown in the U.S. could have far-reaching consequences for global markets, potentially weighing on the dollar later today. The sustainability of the U.S. dollar is now in question, as high interest rates combined with slowing economic growth are not ideal conditions for a strong bullish trend. The Fed's reluctance to cut rates may be an attempt to cool the economy, but this stance is unlikely to sit well with President Donald Trump.

Ultimately, only weak U.S. GDP data today could provide meaningful support for the pound.

For today's trading, I will focus on executing Scenario #1 and Scenario #2 as primary strategies.

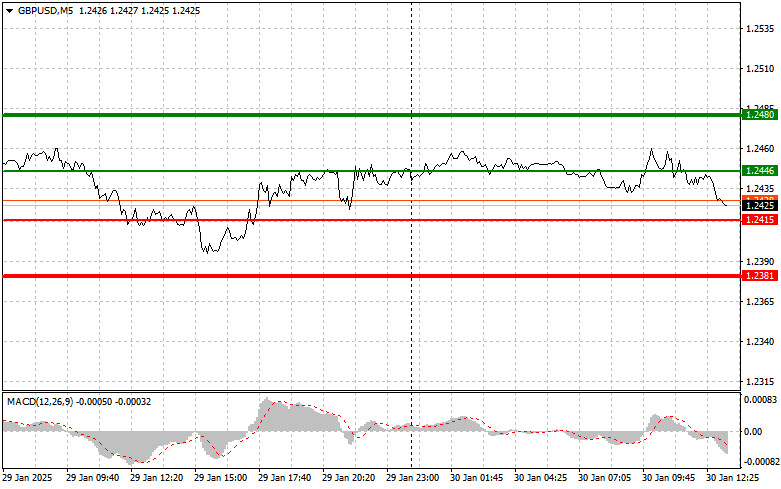

Scenario #1: I plan to buy the pound (GBP/USD) today if the price reaches 1.2446 (green line on the chart), with a target of 1.2480 (thicker green line). At 1.2480, I plan to exit the long position and enter a short trade, expecting a 30-35 point downward correction. Bullish momentum for the pound is only expected if U.S. GDP data is weak.

Important: Before entering a buy trade, ensure that the MACD indicator is above the zero level and just starting to rise.

Scenario #2: I also plan to buy GBP/USD today if the price tests 1.2415 twice in a row, while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and trigger a bullish reversal. Expected upside targets: 1.2446 and 1.2480.

Sell Signal

Scenario #1: I plan to sell GBP/USD after the price breaks below 1.2415 (red line on the chart), which could lead to a sharp decline. The main target for sellers will be 1.2381, where I plan to exit shorts and immediately buy for a 20-25 point rebound. Sellers are likely to become active if U.S. data is strong.

Important: Before entering a sell trade, ensure that the MACD indicator is below the zero level and just starting to decline.

Scenario #2: I also plan to sell GBP/USD today if the price tests 1.2446 twice in a row, while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and trigger a bearish market reversal. Expected downside targets: 1.2415 and 1.2381.

For beginner Forex traders, it is crucial to make careful entry decisions. Before the release of key economic reports, it is generally better to stay out of the market to avoid sharp price fluctuations. If you choose to trade during high-impact news events, always use stop-loss orders to minimize potential losses. Trading without stop-loss protection can quickly deplete your account, especially if you lack proper risk management or trade large volumes.

Key to Successful Trading: