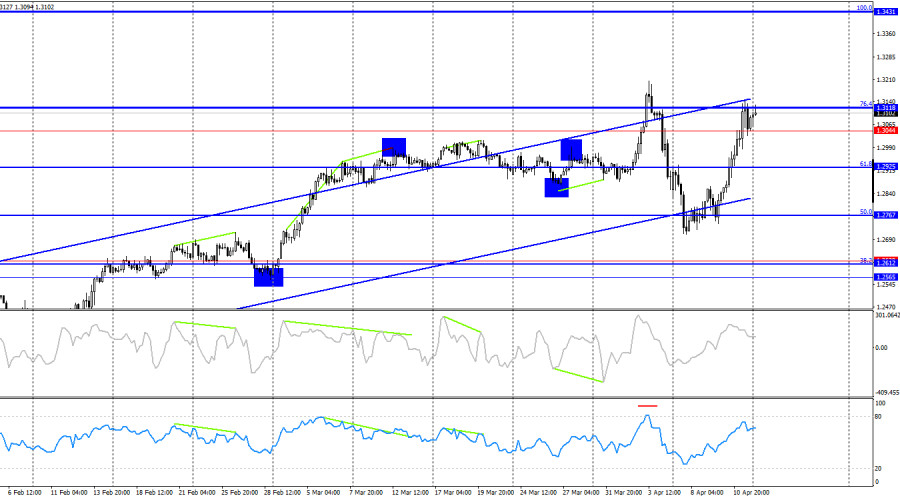

On the hourly chart, the GBP/USD pair continued its upward movement on Friday and today is on track to reach the 1.3151 level. A bounce from this level will favor the US dollar and a possible decline toward the 127.2% Fibonacci level at 1.3003. A firm break above 1.3151 will increase the likelihood of continued growth toward the next corrective level at 1.3249.

The last completed upward wave broke the previous high, while the new downward wave easily broke the last low. This could suggest that the trend is shifting to bearish. However, considering recent events, the strength of movements, and the frequency of trend changes, I wouldn't rush to such conclusions. In my view, market sentiment may shift multiple times. Everything depends on the progression of the trade war.

The news on Friday was still disastrous for the dollar, and even on Monday, we're seeing the same picture as before – the dollar remains under strong market pressure. None of Donald Trump's concessions had any positive effect on the US currency. Trump announced a 90-day pause, which could have supported the dollar. But traders understand this is not a true "amnesty" – tariffs are still in effect, and the US President merely removed the likelihood of further increases for the next three months. Where's the positive in that?

On Friday, Trump excluded phones, computers, and various electronic devices from the list of Chinese imports subject to tariffs. But what does that matter if just recently he raised overall tariffs to 145%? This time, the market didn't fall into a false sense of optimism. It now looks at events without rose-colored glasses.

On the 4-hour chart, the pair retains its bullish trend. In the near term, even a break below the ascending channel wouldn't convince me that the trend has reversed. The trade war continues to escalate, and in recent months this has only led to the dollar's decline. Either way, chart analysis cannot currently answer the question of what to expect next – it is the news backdrop that dictates market movements.

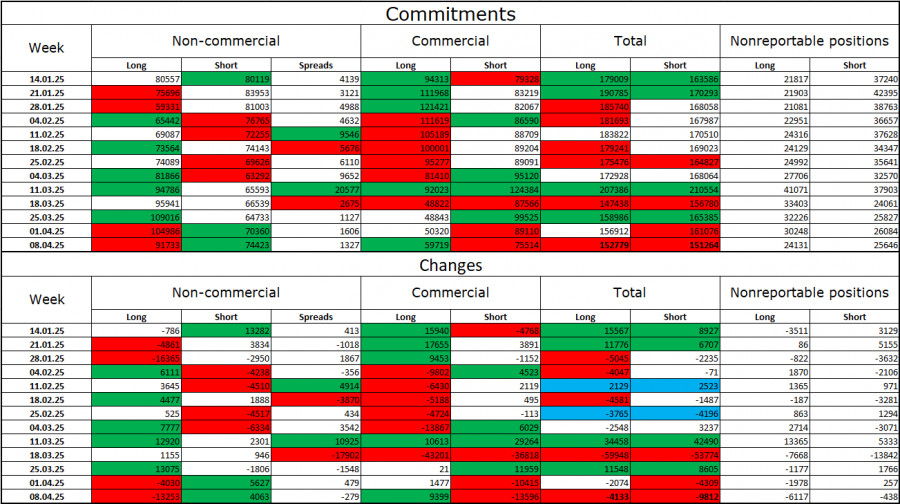

Commitments of Traders (COT) Report:

The sentiment among the "Non-commercial" trader category became less bullish last week. The number of long positions held by speculators decreased by 13,253, while the number of short positions rose by 4,067.

Bears have lost their edge in the market. The gap between long and short positions now stands at 18,000 in favor of bulls: 92,000 vs. 74,000.

In my view, the pound still faces downside risks, but recent developments may cause a longer-term market reversal. Over the past three months, long positions have increased from 80,000 to 92,000, while short positions have decreased from 80,000 to 74,000. More notably, over the last 10 weeks, longs rose from 59,000 to 92,000, and shorts fell from 81,000 to 74,000. Let me remind you – these are the "10 weeks of Trump's reign"...

News Calendar for the US and the UK:

Monday's economic calendar contains no significant entries. Thus, market sentiment today will continue to be driven by the overall news backdrop. Any updates on the trade war will have an impact, should they emerge.

GBP/USD Forecast and Trader Tips:

Selling the pair is possible today if it rebounds from 1.3151, with a target of 1.3003. Buying was possible after the pair closed above 1.2810 on the hourly chart, with targets of 1.2865 and 1.2931 – all of which have been reached. Positions could have been held above 1.3003 with a target of 1.3151 – which is also nearly achieved.

Fibonacci levels are drawn from 1.2809–1.2100 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.