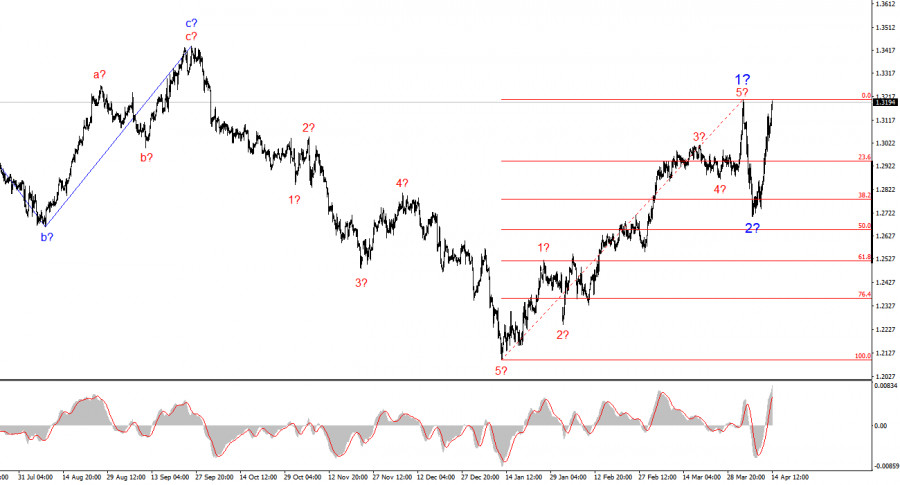

The wave structure of the GBP/USD pair has also transitioned into a bullish, impulsive formation—thanks to Donald Trump. The wave pattern looks almost identical to that of EUR/USD. Up until February 28, we were observing a convincing corrective structure that raised no alarms. However, demand for the U.S. currency then began to fall rapidly. This ultimately led to the formation of a bullish five-wave structure. Therefore, we can expect the construction of three corrective waves in the near future, followed by wave 3 of a new global upward trend segment. Wave 2 may also take the form of a single wave, in which case it may already be complete.

Taking into account the fact that recent news from the UK had no effect on the pound's sharp rise, one can conclude that Donald Trump alone is steering currency rates. If (theoretically) Trump were to change his stance on trade policy, the trend could also reverse—this time to a downward one. Hence, over the coming months—or even years—it will be essential to monitor every move coming out of the White House.

The GBP/USD pair gained another 100 basis points on Monday and is now near the peak of the presumed wave 1. At present, the wave structure appears to have completed wave 2 and is transitioning into a complex and extended wave 3. However, in my opinion, the dollar will continue to weaken for as long as Trump ramps up pressure on all of America's trading partners. How long this will continue, I do not know. Over the weekend, I had assumed the trade war escalation had taken a pause, as Trump himself had granted a "pardon" to all countries except China and did not raise the already astronomical tariffs against Beijing. But come Monday, the U.S. president announced new tariffs on all imported semiconductors, as well as on all electronics. Tariffs on imports of steel, aluminum, and cars also remain in force. So personally, I see no relief, no "pardon," no de-escalation, not even a reduction in tensions.

But—if Trump unexpectedly begins to retreat from his protectionist stance (which cannot be ruled out), demand for the U.S. dollar may stop falling daily. In that case, the euro and pound will need very strong fundamental drivers to continue building the third wave of the uptrend that began three months ago. Without Trump's help and given the current state of the British and EU economies, that will be extremely difficult. And both economies could suffer significantly from Trump's tariffs. Right now, the market is only selling the dollar as a reaction to Trump's policies. But in the future, it will also turn its attention to the condition of the European and British economies.

The wave structure of the GBP/USD pair has transformed. We are now dealing with a bullish, impulsive segment of the trend. Unfortunately, under Donald Trump, markets may experience countless shocks and reversals that do not conform to wave structures or any form of technical analysis. Therefore, at this time, we should expect a corrective wave set, the size of which will also depend on Trump. After that, we can expect the formation of bullish wave 3—but only if Trump does not completely reverse his trade policy stance, which currently shows no signs of happening.

On the higher wave scale, the wave pattern has also shifted into a bullish formation. We can now assume an upward segment of the trend is developing. The nearest targets are 1.2782 and 1.2650.

Core Principles of My Analysis: