In April, the US stock market took investors on its wildest roller coaster ride since the pandemic. The White House's "American Liberation Day" tariffs seemed to undermine the S&P 500's stability, pushing it into bear market territory. Yet, the longest 7-day rally since November helped the broad index recover nearly all of its losses by month's end.

A defining trait of today's market is its herd-like behavior. Correlation between individual stocks within the S&P 500 surged, with investors reacting to the same headlines—primarily from the White House—rather than to macroeconomic data. The latest confirmation came when the S&P 500 rallied in response to disappointing private-sector job numbers from ADP and weak GDP data.

S&P 500 Stock Correlation Trend

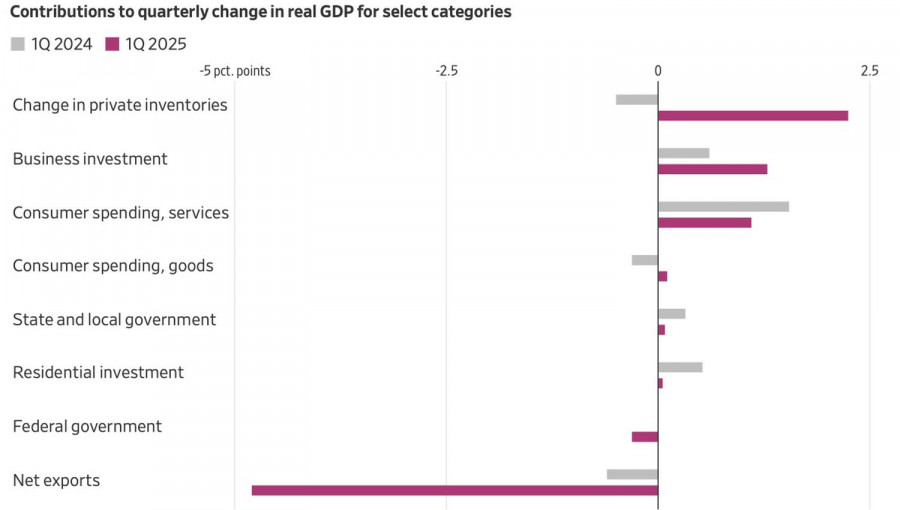

For the first time since 2022, the US economy contracted, shrinking by 0.3% in the first quarter. The downturn was driven by a 41% surge in imports amid tariff fears, which resulted in net exports shaving a record 4.8% of GDP. After an initial slump following the grim data, the S&P 500 rebounded and closed the session in the green.

Investors seem to believe that the negative impact from import activity is temporary. As inventory levels normalize, the reading will decline. The White House also stepped in to calm nerves. Council of Economic Advisers Chair Steven Miran has asserted that the US economy is stronger than the data suggests, noting that companies anticipating a recession typically hold back on investments.

Key drivers of US GDP performance

Donald Trump blamed Joe Biden for the economy's weakness, claiming that the Democrat handed it over in dire shape but tariffs and reshoring, he argued, would eventually turn things around.

Once again, investors bought the dip, encouraged by renewed confidence in Trump's so-called "put." Commerzbank believes that the worse US macroeconomic indicators get, the higher the likelihood that the White House will soften its stance and roll back a significant portion of the tariffs. In an environment of extreme bearish speculative positioning and lingering retail investor pessimism, hopes for a Republican backstop are helping lift the S&P 500.

In my view, Trump still cares deeply about the stock market. He does not want to see the S&P 500 fall too deep and appears to be trying to halt the slide with supportive rhetoric. Still, sooner or later, investors will refocus on the data, which, unfortunately, remains far from encouraging.

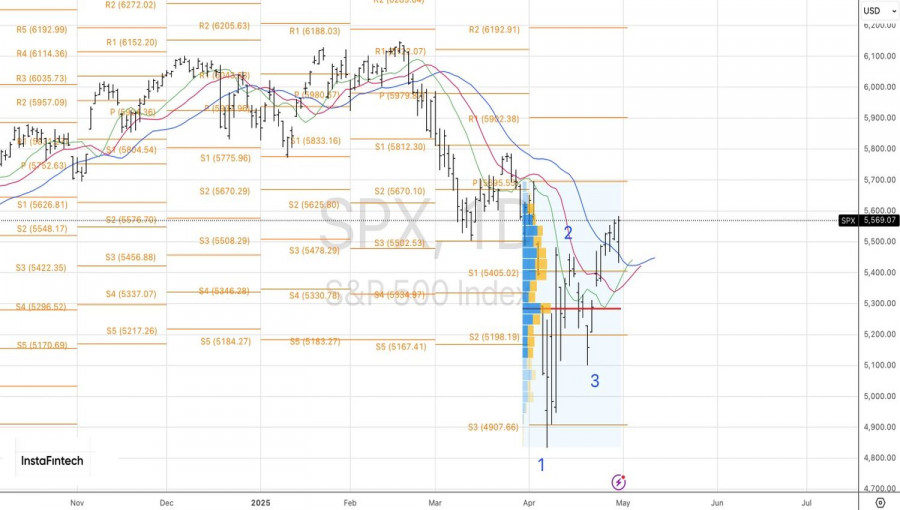

Technical Outlook:

On the daily chart, the S&P 500 continues to form a 1-2-3 reversal pattern. A breakout above the moving averages confirms bullish progress. However, for the rally to continue, bulls should clear resistance at 5,625 and 5,695. A successful breakout would allow for expanding long positions initiated from the 5,400 level or for bears to flip their stance.