Trade Review and Tips for Trading the British Pound

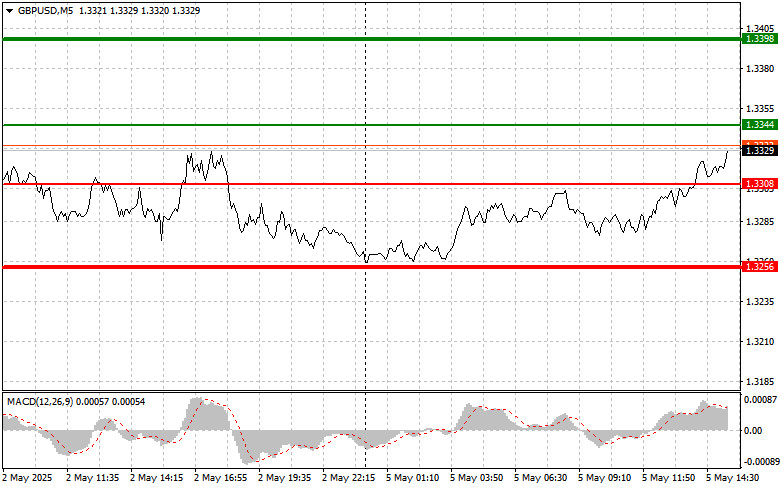

The test of the 1.3322 price level during the first half of the day occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the pound.

Traders' attention is now focused on the services PMI data. Investors closely monitor these indicators as they provide valuable insight into the condition and outlook of key economic sectors. The services PMI reflects purchasing managers' opinions in the services sector regarding current and future business conditions. The composite PMI, meanwhile, combines data from both the manufacturing and services sectors, offering a broader picture of overall economic activity. The ISM services index is also an important barometer, tracking changes in production, new orders, employment, and prices. If any of these indicators fall below the 50-point mark, it would signal a contraction in economic activity in the relevant sector, which could trigger a sharp decline in the U.S. dollar.

As for the intraday strategy, I will mostly rely on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3344 (green line on the chart), targeting a rise to the 1.3398 level (thicker green line on the chart). At the 1.3398 area, I will exit long positions and open short positions in the opposite direction, aiming for a 30–35 point retracement. Pound strength today should only be expected after weak data. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.3308 price level, with the MACD indicator in the oversold zone. This would limit the pair's downward potential and lead to a market reversal upward. A rise toward the opposite levels of 1.3344 and 1.3398 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after a breakdown of the 1.3308 level (red line on the chart), which would lead to a quick decline of the pair. The key target for sellers will be 1.3256, where I will exit the short positions and immediately open long positions in the opposite direction, expecting a 20–25 point rebound from the level. Sellers are likely to act in case of strong statistics. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to fall from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.3344 price level, with the MACD indicator in the overbought zone. This would limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.3308 and 1.3256 can be expected.

What's on the chart:

Important: Beginner traders in the Forex market must be extremely cautious when making market entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can very quickly lose your entire deposit, especially if you don't use money management and trade in large volumes.

And remember: for successful trading, you must have a clear trading plan like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.