Opening Long Positions on GBP/USD:

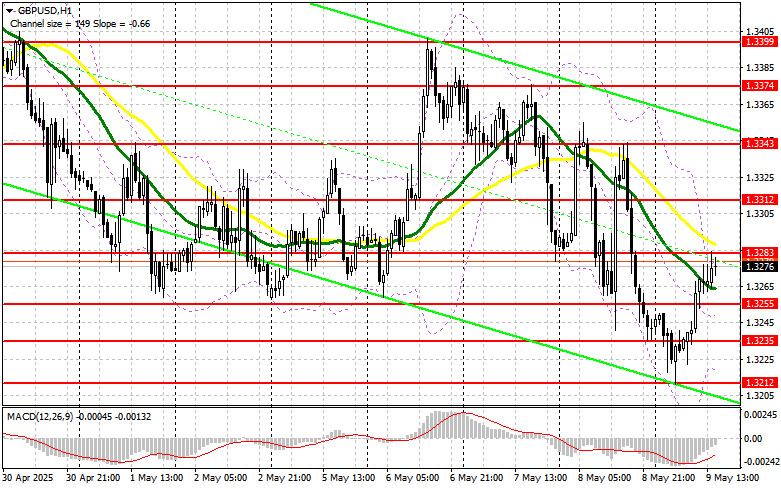

There are no major U.S. statistics expected during the American session, so attention will shift to speeches from FOMC members John Williams and Christopher Waller. A hawkish tone from them could renew pressure on the GBP/USD pair. If the pair declines, I prefer to act around the new support at 1.3255, formed in the first half of the day. A false breakout there would present a good entry point for long positions with the goal of recovery toward resistance at 1.3283, currently being tested. A breakout and retest from above would give another entry point for longs targeting a move to 1.3312, which could halt the bearish trend. The ultimate target would be the 1.3343 level, where I plan to take profit.

If GBP/USD declines and there's no bullish activity at 1.3255 in the second half of the day, pressure on the pound will resume. In that case, only a false breakout around 1.3235 would justify long positions. Otherwise, I'll look to buy GBP/USD on a rebound from the 1.3212 support level with a short-term correction target of 30–35 points.

Opening Short Positions on GBP/USD:

Sellers haven't been as active as expected. If GBP/USD climbs again after the U.S. policymakers' speeches—which is likely—I will only act if there's a false breakout near resistance at 1.3283, just as explained earlier. This would offer a selling opportunity targeting support at 1.3255. A breakout and retest from below would trigger stop-losses, opening the path toward 1.3235. The furthest target would be the 1.3212 level, where I'll fix profits.

If demand for the pound persists later in the day—and it seems to be heading that way—and bears fail to show resistance at 1.3283 (where the moving averages are also located in their favor), then selling should be postponed until resistance at 1.3312 is tested. I will only open short positions there after a failed breakout. If the market doesn't turn lower from there either, I'll look for short entries around 1.3343, expecting a 30–35 point intraday correction.

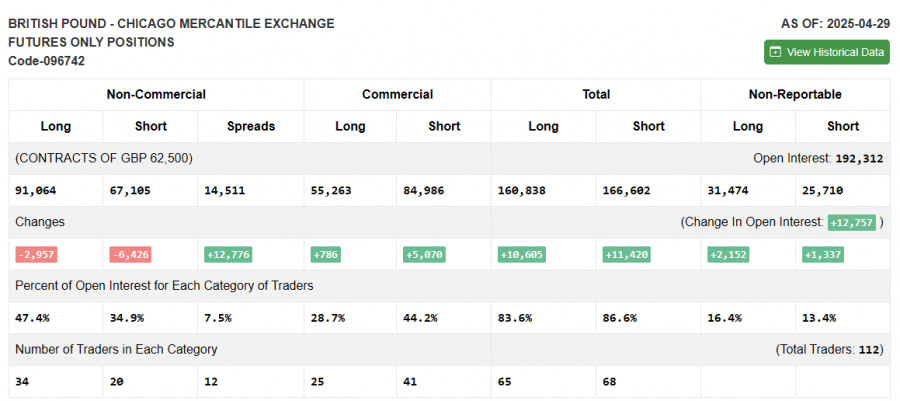

COT (Commitments of Traders) Report – April 29:

The report showed a decline in both long and short positions. Since the Bank of England currently has no plans for further rate cuts—similar to the Federal Reserve—traders are likely to focus on fresh fundamental data that could clarify the state of the UK economy and the impact of Trump's new tariffs. Long non-commercial positions fell by 2,957 to 91,064, while short positions dropped by 6,426 to 67,105. As a result, the net long position increased by 12,776.

Indicator Signals:

Moving Averages: Trading is taking place below both the 30- and 50-period moving averages, indicating a possible continuation of pound weakness.

Note: The moving average periods and prices are based on the H1 hourly chart and differ from classic daily moving averages on the D1 chart.

Bollinger Bands: If the pair declines, the lower band of the indicator near 1.3215 will act as support.

Indicator Descriptions: