Trade Analysis and Recommendations for the British Pound

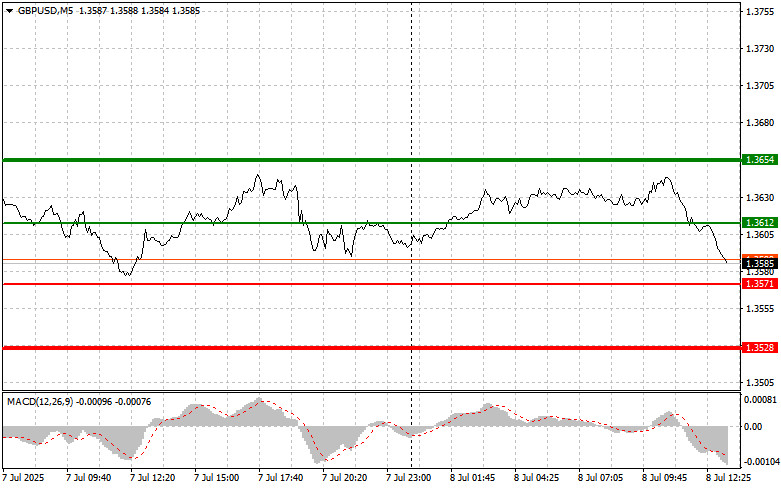

The price test at 1.3621 coincided with the MACD indicator just beginning to move downward from the zero line, which confirmed the validity of the sell entry point for the pound and resulted in a 30-point drop in the pair.

The lack of UK statistics affected the British pound, and once again, there was no interest in buying above 1.3640. We saw a similar situation yesterday, and now technical indicators suggest a possible correction toward the weekly low. Only fundamental factors could stop the pair's downward movement.

In the second half of the day, the NFIB Small Business Optimism Index and the volume of U.S. consumer credit will be the key economic releases. However, market participants should also monitor Trump's actions and trade policy. The unpredictability of his decisions on tariffs and international agreements can trigger sharp market movements, often overshadowing the influence of traditional macroeconomic indicators. At the same time, economic data should not be completely disregarded. Even when political factors dominate, indicators like consumer credit and small business optimism offer insights into the state of the economy and business sentiment. Careful analysis of this data can help identify potential growth points or signs of an economic slowdown.

As for the intraday strategy, I will mainly rely on the execution of Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound around the 1.3612 level (green line on the chart), with a target at 1.3654 (thicker green line on the chart). At 1.3654, I will close long positions and open short positions in the opposite direction (expecting a 30–35 point reversal). A strong rise in the pound is unlikely today.Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound if the price tests 1.3571 twice in a row while the MACD is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. The target would be a rise to the opposite levels of 1.3612 and 1.3654.

Sell Signal

Scenario #1: I plan to sell the pound after a break below 1.3571 (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers is 1.3528, where I will close short positions and open long ones in the opposite direction (expecting a 20–25 point reversal). Sellers will likely maintain pressure on the pair if U.S. data is strong.Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the pound today if the price tests 1.3612 twice in a row while the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.3571 and 1.3528 may be expected.

Chart Notes:

Important: Beginner Forex traders should be very cautious when entering the market. It is best to stay out of the market before key fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't follow money management principles and trade with large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on current market conditions is a losing strategy for intraday traders.