Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

The euro held its ground despite real trade threats from the United States, while the pound continued to decline against the US dollar following weak fundamental data related to the country's core economic indicators.

At the end of last week, Donald Trump announced the imposition of 30% tariffs—rather than the previously planned 10%—on EU countries, which put pressure on the European currency. As expected, this decision triggered a wave of criticism from European leaders and experts, who fear serious consequences for global trade and economic growth. In particular, Germany called Trump's actions an "unjustified and aggressive step," emphasizing that the European Union is ready to take retaliatory measures to protect its interests. Similar statements were made by other EU countries as well, highlighting rising tensions in transatlantic relations. Economists also voiced concerns about the potential impact of the new tariffs on consumer prices and inflation in Europe. A rise in the cost of imported goods could lead to a decline in consumer purchasing power and a slowdown in economic growth.

Weak data on changes in the UK's GDP and industrial production last Friday triggered a sharp drop in the British pound. Traders, alarmed by signs of slowing economic growth, continued actively selling the British currency, leading to a sharp weakening against both the US dollar and the euro. The published figures were significantly worse than expected, intensifying concerns about the outlook for the British economy.

Today, apart from the Eurogroup meeting, there are no other data scheduled. This meeting will likely focus on discussing retaliatory measures against the US and further trade relations. This is the key moment that will shape the short-term outlook for the European currency. The Eurogroup meeting is not just a formal gathering of finance ministers; it is a platform for formulating a unified position on key economic issues—in this case, a response to the US's trade aggression. Markets will be watching closely for signals coming out of Brussels. Any mention of concrete retaliatory actions—such as reciprocal tariffs or an appeal to the WTO—could exert considerable pressure on the dollar and, in turn, support the euro.

No statistical data is expected from the UK today, which implies continued pressure on the British pound in the context of an emerging bearish trend.

If the data matches economists' expectations, it's best to act using a Mean Reversion strategy. If the data significantly exceeds or falls short of expectations, a Momentum strategy is more appropriate.

Buying on a breakout above 1.1690 may lead to a rise toward 1.1715 and 1.1747.

Selling on a breakout below 1.1666 may lead to a decline toward 1.1624 and 1.1590.

Buying on a breakout above 1.3480 may lead to a rise toward 1.3510 and 1.3540.

Selling on a breakout below 1.3450 may lead to a decline toward 1.3411 and 1.3375.

Buying on a breakout above 147.52 may lead to a rise toward 147.84 and 148.20.

Selling on a breakout below 147.18 may lead to a decline toward 146.78 and 146.49.

Will look for selling opportunities after a failed breakout above 1.1704 followed by a return below this level.

Will look for buying opportunities after a failed breakout below 1.1664 followed by a return to this level.

Will look for selling opportunities after a failed breakout above 1.3517 followed by a return below this level.

Will look for buying opportunities after a failed breakout below 1.3455 followed by a return to this level.

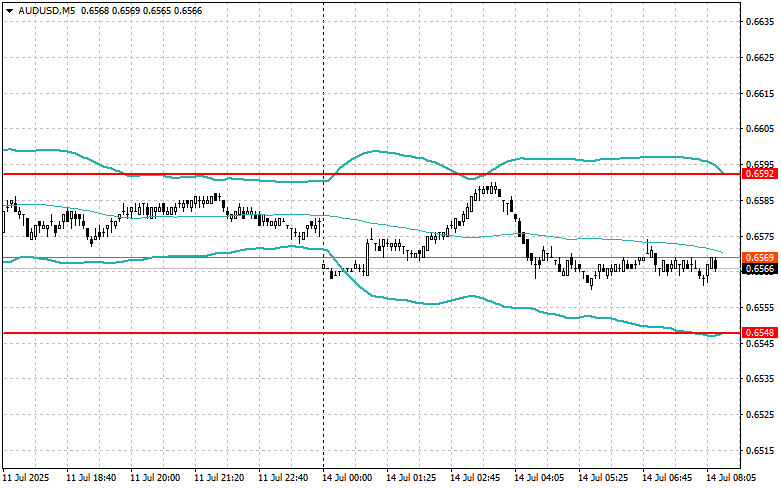

Will look for selling opportunities after a failed breakout above 0.6592 followed by a return below this level.

Will look for buying opportunities after a failed breakout below 0.6548 followed by a return to this level.

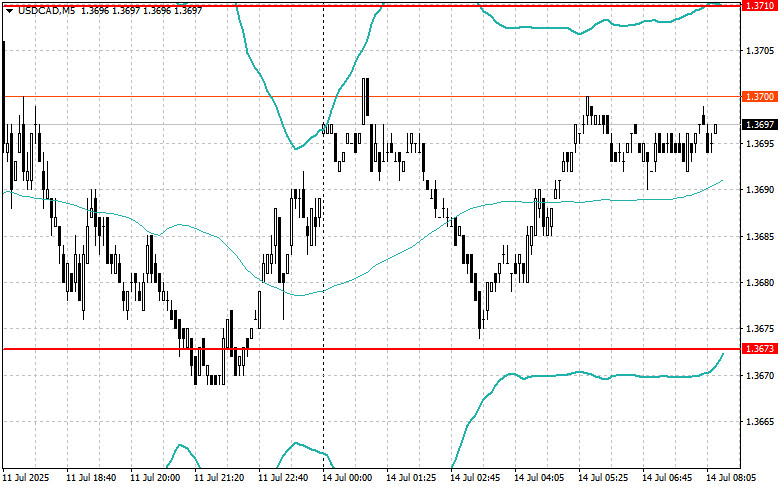

Will look for selling opportunities after a failed breakout above 1.3710 followed by a return below this level.

Will look for buying opportunities after a failed breakout below 1.3673 followed by a return to this level.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.