The test of the 1.1541 level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the euro.

Strong U.S. consumer confidence data supported the U.S. dollar. The Conference Board Consumer Confidence Index for July came in better than economists had expected. This positive surprise suggests that American consumers, despite inflationary pressures and Donald Trump's policies, remain optimistic and willing to spend. Such confidence is a key factor in sustaining economic growth, as consumer spending accounts for a significant portion of U.S. GDP. The forex market reacted immediately. The EUR/USD pair came under pressure as the dollar's strengthening reduced the euro's appeal. Investors, reassessing their positions in light of favorable economic data, began actively selling the euro, leading to further declines in the pair. Overall, the consumer confidence report added another argument in favor of the U.S. dollar. However, the sustainability of this trend will depend on future economic data and decisions by the Federal Reserve regarding the path of interest rates.

Today, very weak data is expected on Germany's retail sales, German GDP, and Eurozone GDP. This triple blow to the region's economic fundamentals will undoubtedly create additional pressure on the euro. Weak German retail sales — from an economy often seen as the engine of Europe — would be a troubling sign of slowing consumer demand. This factor will, in turn, negatively affect the overall economic outlook for Germany and the euro area. A decline in retail sales may indicate falling consumer confidence caused by inflationary pressure, high energy prices, and general economic uncertainty. Equally important is the GDP figure for Germany. Expectations of weak results are reinforced by negative trends in the manufacturing sector and worsening business sentiment. A contraction in German GDP would significantly impact the economic performance of the entire Eurozone, as Germany is its largest economy.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

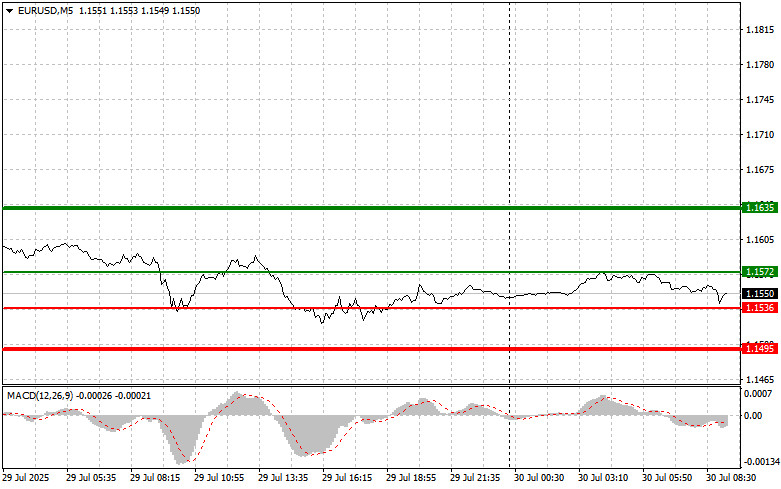

Scenario #1: Today I plan to buy the euro upon reaching the 1.1572 level (green line on the chart), targeting a rise to 1.1635. At 1.1635, I plan to exit the market and sell the euro in the opposite direction, aiming for a 30–35 pip move from the entry point. Buying the euro is advisable only if the data turns out strong.

Important! Before buying, ensure the MACD indicator is above the zero line and is just starting to rise from it.

Scenario #2: I also plan to buy the euro today if the 1.1536 level is tested twice in a row while the MACD indicator is in the oversold area. This would limit the pair's downside potential and trigger a market reversal upward. A rise to the opposing levels of 1.1572 and 1.1635 can be expected.

Scenario #1: I plan to sell the euro after it reaches the 1.1536 level (red line on the chart). The target will be 1.1495, where I plan to exit and open a buy position in the opposite direction, expecting a 20–25 pip reversal from the level. Selling pressure on the pair could return at any moment today.

Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario #2: I also plan to sell the euro today if the 1.1572 level is tested twice in a row while the MACD is in the overbought zone. This would limit the pair's upside potential and lead to a downward reversal. A decline to the opposing levels of 1.1536 and 1.1495 can be expected.