Londýn – Ceny ropy na začátku nového týdne prudce klesají. Skupina OPEC+ se chystá urychlit zvyšování těžby, což vyvolává obavy z výrazného převisu nabídky na trhu. Vývoj poptávky po ropě ale kvůli americkým clům zůstává nejistý.

The EUR/USD exchange rate barely changed on Thursday, and over the course of the current week it has risen by only 35 basis points.

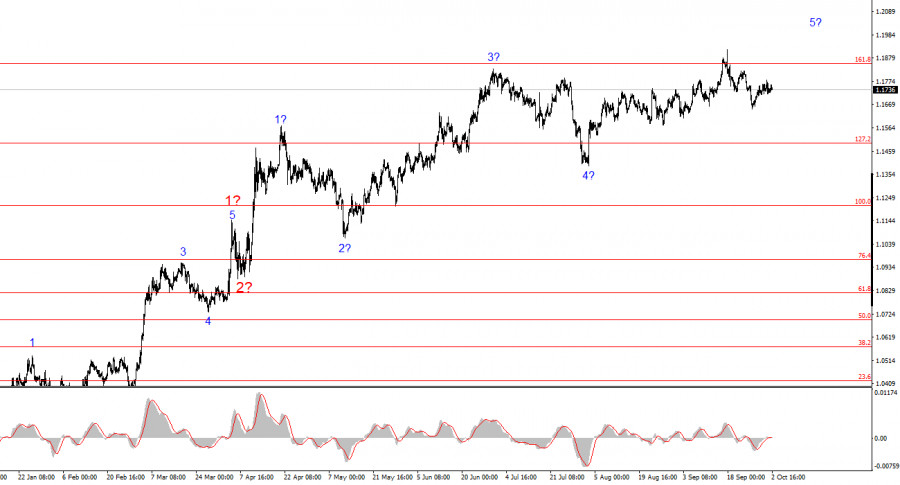

The wave pattern on the 4-hour chart for EUR/USD has remained unchanged for several months, but in recent days it has started to look increasingly complex. It is still too early to conclude that the upward segment of the trend has ended, but further complication of the wave pattern is quite possible in the near future.

The construction of the upward segment of the trend continues, and the news background continues to mostly work against the dollar. The trade war launched by Donald Trump goes on. His confrontation with the Fed also continues. Market expectations of a dovish Fed stance are growing. The market has given a very low assessment of the first six to seven months of Trump's presidency, even though GDP growth in the second quarter was almost 4%.

At present, it can be assumed that the construction of impulse wave 5 is ongoing, with potential targets reaching as high as the 1.25 level. Within this wave, the structure is rather complex and ambiguous, but its larger-scale outline raises no particular questions. Three upward waves are currently visible, which suggests that the pair is in wave 4 of 5, which has taken on a three-wave form and may already be complete. A stronger decline would require adjustments to the current wave count.

On Thursday, the EUR/USD exchange rate barely changed, and over the course of the week it has risen by only 35 basis points. Thus, the U.S. dollar has lost just 35 points during what was a "black" week for it. Does this not seem strange—and what does it mean?

To recap briefly: the market has no shortage of reasons to keep selling the U.S. dollar. The current wave pattern points to it, and so does the news background. I can easily explain the dollar's decline when the news flow is neutral, but explaining the absence of a decline when the background is negative is much more difficult. In other words, this week the market had every reason to continue buying EUR/USD, but instead of strong, steady growth, we are seeing sideways movement in a very narrow range.

Why has the market suddenly stopped selling the dollar, when for the past eight months it has done little else? In my view, this is only a temporary pause caused by an extremely high level of uncertainty. Donald Trump has chosen not to stop at controversial laws, unusual decisions, and the trade war—he has added yet another problem to the U.S. economy, which he insists will "be great again" very soon. The market simply no longer knows how to react to Trump's latest surprises, so it may now have paused to reassess the situation in the U.S. I see no other explanation.

Based on the EUR/USD analysis, I conclude that the pair continues to build an upward trend segment. The wave pattern still depends entirely on the news background related to Trump's decisions and the domestic and foreign policies of the new White House administration. Targets for the current segment may extend as far as the 1.25 level. A corrective wave 4 is currently in progress and may already be complete. The upward wave structure remains intact. Therefore, in the near future I consider only long positions. By year-end, I expect the euro to rise toward 1.2245, which corresponds to the 200.0% Fibonacci level.

On a smaller scale, the entire upward segment of the trend is visible. The wave pattern is not the most standard, as the corrective waves are of different sizes. For example, the larger wave 2 is smaller in size than the inner wave 2 of 3. However, this does happen. I would emphasize that it is best to identify clear, legible structures on the charts rather than trying to label every single wave. The current upward structure leaves little room for doubt.

Key principles of my analysis: