JPMorgan zvýšila své hodnocení společnosti The Wendy’s (NASDAQ:WEN) z „Neutral“ na „Overweight“ na základě pozitivnějšího dlouhodobého pohledu na peněžní toky, alokaci kapitálu a růstový potenciál tohoto řetězce rychlého občerstvení.

Zároveň stanovila nový cílový kurz pro prosinec 2026 na 15 dolarů (snížený z předchozích 17 dolarů).

„Díváme se na příběh této akcie znovu, tentokrát s ohledem na stabilizaci provozních výsledků a výnosy z volného cash flow ve výši středních až vyšších jednociferných procent,“ uvedli analytici JPMorgan vedení Rahulem Krotthapallim.

Upgrade následuje po výrazném snížení rizika v krátkodobém výhledu pro srovnatelné prodeje a vyšší důvěře v rozvoj zejména na mezinárodních trzích.

Banka očekává, že Wendy’s vygeneruje v letech 2025 až 2028 přibližně 605 milionů dolarů volného cash flow a že akcionáři by mohli získat až 700 milionů dolarů formou dividend a zpětných odkupů akcií.

Firma také ocenila zaměření Wendy’s na odpovědnost franšízantů a expanzi s nízkou kapitálovou náročností, což by mělo vést k „odolnější bázi aktiv“.

„Wendy’s sice není největším hráčem, ale po 50 letech existence si udržela jasnou identitu v rámci národní scény QSR (Quick Service Restaurant),“ doplnili analytici.

JPMorgan také analyzovala scénář, kdy by Wendy’s snížila počet nových provozoven financovaných modelem Build-to-Suit (BTS) o 185 jednotek. Tím by mohla v roce 2028 zvýšit volný cash flow o dalších 55 milionů dolarů a zvýšit výnosnost až na 9,3 %.

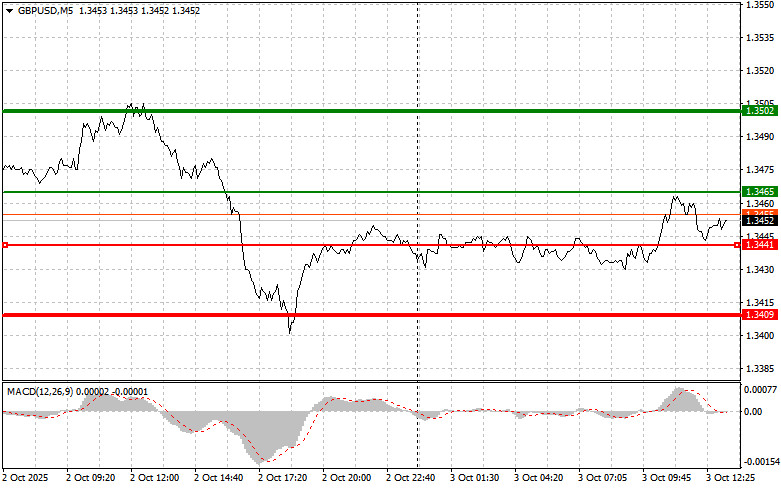

The test of 1.3446 coincided with the moment when the MACD indicator had just started moving upward from the zero mark. This confirmed the correct entry point for buying the pound and resulted in a 20-point rise.

Weaker growth in the U.K. services sector in September negatively affected the British pound. The Services PMI, published today, came in below analysts' expectations, raising concerns about a slowdown in economic growth. The decline in service-sector activity, which is a key part of the U.K. economy, points to weakening domestic demand and consumer spending. This could push the Bank of England toward a more dovish stance on future monetary policy, putting further pressure on the pound.

During the U.S. session, focus will shift to FOMC member John Williams' speech and the ISM Services PMI. Weak U.S. data would support the pound by undermining the dollar. The market is closely monitoring Williams' comments for hints about the Fed's monetary policy path. His statements shape investor expectations on the pace of rate cuts and inflation prospects, which directly affect the dollar's attractiveness. A more dovish tone could pressure the U.S. currency. At the same time, the ISM Services PMI release will serve as an important indicator of the U.S. economy's health. Since the services sector is a major driver of growth, a reading below expectations may signal a slowdown, which would also weigh on the dollar.

For intraday strategy, I will rely mainly on Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today at 1.3465 (green line on the chart), targeting growth toward 1.3502 (thicker green line on the chart). At 1.3502, I will exit buy trades and open sales in the opposite direction (expecting a 30–35-point move back from the level). A strong rally in the pound is possible after weak U.S. data.Important: Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of 1.3441 while the MACD is in the oversold zone. This will limit downward potential and lead to a reversal upward. Growth toward 1.3465 and 1.3502 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after a breakout below 1.3441 (red line on the chart), which should trigger a quick decline. The key target for sellers will be 1.3409, where I will exit sales and immediately open buy trades in the opposite direction (expecting a 20–25-point rebound). The pound could drop sharply in the second half of the day if U.S. data are strong.Important: Before selling, make sure the MACD indicator is below the zero mark and just beginning to fall from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3465 while the MACD is in the overbought zone. This will limit upward potential and trigger a reversal downward. A decline toward 1.3441 and 1.3409 can be expected.

Chart Guide

Important: Beginner Forex traders must be very cautious when deciding on entries. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp swings. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without them, you can quickly lose your deposit, especially if you skip money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, like the one outlined above. Spontaneous decisions based only on the current market situation are a losing strategy for intraday traders.