The EUR/USD currency pair traded lower again on Wednesday, for no apparent reason. While the British pound fell sharply that morning due to a weaker-than-expected UK inflation report (which significantly increased the likelihood of a Bank of England rate cut later this year), this report had no direct relevance to the euro.

Indeed, GBP could have pulled EUR down with it, as the two currencies are moderately correlated. But this explanation feels more like an excuse—and lately, the market appears to be full of such "excuses." Let us explain what we mean.

Many are now questioning why the U.S. dollar has been strengthening over recent weeks. We've been saying for three weeks that the market is trading in a flat range on the daily chart and that recent moves often lack logic. Yet most analysts remain eager to offer fundamental explanations for the dollar's rally. The most widespread theory right now? Easing tensions between the U.S. and China, following U.S. President Donald Trump's more conciliatory remarks.

Recall that Trump first threatened to raise tariffs on China by "only" 100% starting on November 1. He then stated repeatedly that he "believes in a successful and fair deal with Beijing." Of course, by "successful," Trump primarily means beneficial for the U.S., not necessarily for China.

However, China is far from passive and has recently started pushing back. As of December 1, the country plans to implement new export regulations on rare earth metals. While details remain unclear, the reaction from Washington suggests that these restrictions will be real and impactful—not just for the U.S., but for all high-tech economies reliant on Chinese sourcing.

So, while the media narrative portrays improving relations, the facts indicate the opposite: trade tensions are escalating. Tariffs have not been removed, Chinese export restrictions are going into effect, and the highly anticipated November meeting between Trump and Xi still lacks confirmation.

Nevertheless, most analysts continue spinning the dollar's rise as justified by "deal hopes," ignoring clear indicators of continued global tension. When Trump introduced new tariffs, the dollar barely reacted. But now, following vague rhetoric about potential negotiations, the USD is rallying for the fourth consecutive day. All other broader macro factors—almost universally negative for the greenback—are being brushed aside.

Our opinion remains unchanged: the flat trend on the daily chart explains much of the irrational movement.

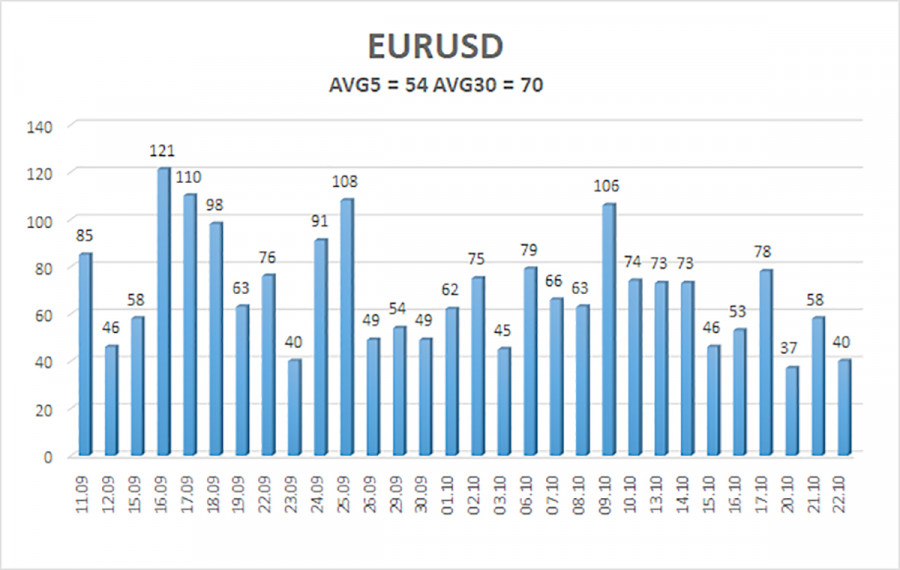

At the time of writing, the average EUR/USD volatility over the last five trading days stands at 54 pips, which is considered "average." We expect the pair to fluctuate between 1.1559 and 1.1667 on Thursday. The upper linear regression channel remains upward, confirming a bullish long-term trend. The CCI indicator recently entered oversold territory, which could signal the potential start of a new upward leg.

The EUR/USD pair is attempting to resume an uptrend on the 4-hour chart, while the bullish trend remains intact across higher time frames. The U.S. dollar continues to be driven predominantly by President Trump's policies, and nothing suggests that this influence will diminish anytime soon. Although the dollar has strengthened recently, the local factors appear ambiguous at best. The continued flat trend on the daily time frame remains the dominant force shaping price action.

Linear Regression Channels: used to determine current trend direction. If both channels point the same way, the trend is strong.

Moving Average (20.0, smoothed): sets short-term momentum and helps identify direction for trading decisions.

Murray Levels: serve as potential targets for movement and corrections.

Volatility Levels (red lines): projected price channel for the upcoming 24 hours based on recent volatility metrics.

CCI Indicator: readings below -250 or above +250 suggest that a trend reversal may be near (oversold or overbought conditions).