There are no macroeconomic reports scheduled for Thursday—again. The only data point worth mentioning is the secondary report on U.S. existing home sales. Interestingly, this report may elicit a reaction from traders simply due to the absence of any other relevant data or events. Volatility across both currency pairs remains near zero. The flat trend on the daily time frame persists. Irregular and illogical intraday price movements continue.

Very few fundamental events are scheduled for Thursday. The only item of note is a speech by European Central Bank Chief Economist Philip Lane. However, considering that ECB President Christine Lagarde has already delivered nearly ten speeches recently, the markets are well aware of the Bank's stance and expectations.

In contrast, current intrigue centers around the Federal Reserve. The next Fed meeting is just one week away, and the U.S. government shutdown continues. As a result, critical labor market and unemployment reports have not been released. However, the inflation report is still expected on Friday.

Public appearances by FOMC members have ceased due to the pre-meeting blackout period. Despite the market's anticipation of rate cuts in both October and December, there's a growing sense that surprises could be in store.

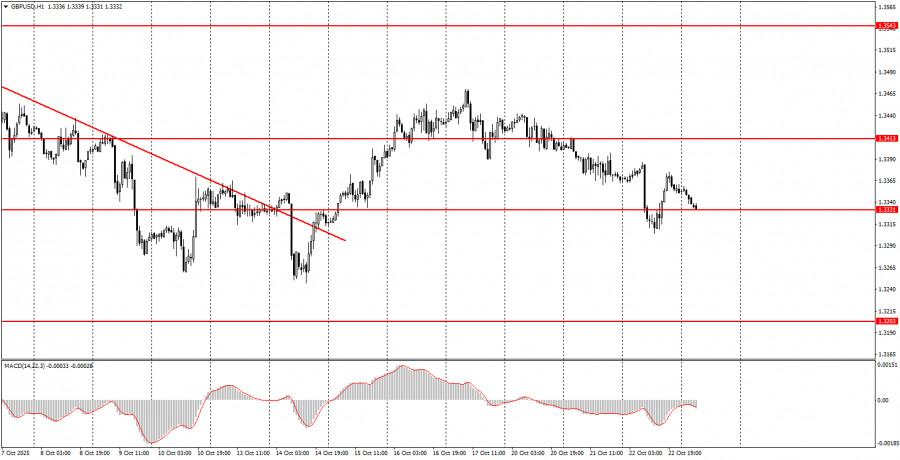

During the fourth trading day of the week, both currency pairs may remain in low-volatility flat ranges. For the euro, the 1.1571–1.1584 area remains a good zone for trading decisions in both directions (long or short positions). The British pound is hovering near the 1.3329–1.3331 zone, which may also serve as a reference point for trades. However, it's important to reiterate that market volatility remains low, and the macroeconomic background is virtually nonexistent. Movements continue to be irrational.

Important note: High-impact news events and economic releases (always listed in news calendars) can significantly impact the volatility of currency pairs. During such releases, trade carefully—or exit the market altogether—to avoid aggressive price reversals.

Beginner traders on the Forex market should remember: not every trade will be profitable. The key to long-term success lies in having a clear trading strategy and applying strict money management principles.