On Wednesday, the euro continued its strengthening against the British pound amid the overall weakness of the pound, driven by escalating political tensions within the UK Labour Party and speculation about Prime Minister Keir Starmer's leadership. These events have heightened market uncertainty ahead of the annual budget scheduled for the end of this month.

According to recent media reports, supporters of Starmer warned that any attempts to challenge his leadership would be considered "reckless," amid rumors of internal discord and declining public support. This uncertainty has arisen just days before the budget is announced on November 26, as investors grow increasingly concerned about potential tightening of tax policy and tax increases, which may negatively impact the economic growth outlook in the UK.

Speaking of macroeconomics, weak labor market data published on Tuesday reinforced expectations of a rate cut by the Bank of England at the December meeting. According to Deutsche Bank analysis, the probability of a one-day rate cut has risen from approximately 72% to 86%.

Regarding the euro, the figures from Germany showed that inflation in October remained stable. The harmonized consumer price index (HICP) increased by 0.3% month-on-month and by 2.3% year-on-year, fully aligning with analysts' expectations.

Meanwhile, strong statements from European Central Bank President Isabel Schnabel bolstered the euro, emphasizing that the economy still demonstrates "positive underlying dynamics," and that "inflation in the services sector remains unstable." She also highlighted that interest rates are "in a good place," but warned that inflationary risks are "slightly skewed to the upside," indicating the ECB's readiness to keep interest rates unchanged at the next meeting.

On Thursday, markets are awaiting the release of important economic reports, including preliminary GDP data, industrial production, and manufacturing output for the UK in the third quarter. The Eurozone will also publish industrial production data for September.

From a technical perspective, prices on Wednesday reached levels last seen in April 2023 and encountered resistance at 0.8830. The EUR/GBP pair found support at the nine-day EMA around 0.8795. However, the main support is at 0.8766; if prices drop below this level, bulls may start losing strength.

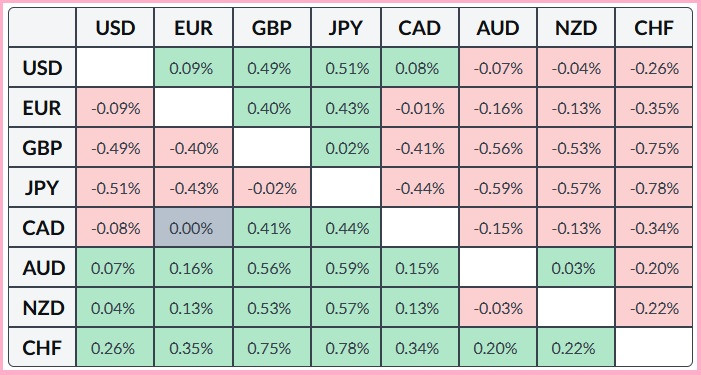

It's also worth noting that the oscillators on the daily chart are positive but close to the overbought zone, indicating a potential correction in the near future. Below is a table showing percentage changes in the British pound's exchange rate against major currencies. The pound showed the greatest strength against the Japanese yen.