Tariffs on all imports from India to the US remain at 50%. Recently, Donald Trump announced a breakthrough in negotiations with New Delhi, announcing an "honest and fair trade agreement." It is worth recalling that Trump's main complaint against India has been its purchases of oil and gas from Russia. The US President aims to end the war in Ukraine and believes that all countries purchasing energy supplies from Moscow indirectly finance the continuation of the war. Undoubtedly, Trump's motivations extend beyond just peace efforts. Almost all trading partners from whom he demands cessation of oil and gas purchases from Russia are being encouraged to procure those from the US. Thus, Trump is trying to kill two birds with one stone: attempt to end yet another war in the world and increase American energy sales.

In my opinion, selling as much oil and gas as possible is far more important to Trump than achieving peace in Ukraine. However, the main point of this review isn't about this. The Prime Minister of India promised Trump that India would reduce its purchases of Russian oil, but did not promise a complete cessation. Moreover, this information is, to put it mildly, contradictory, and I even wonder where it originated from. Is it not from Donald Trump himself? We can only judge the state of the trade war between India and the US by statements from Washington, since officials in New Delhi are not prone to making promises. For instance, a few weeks ago, Prime Minister Modi stated that America would not succeed in imposing its own conditions, and India would continue to buy oil products where it is beneficial for them. Now, it appears that India has agreed to reduce oil imports from Russia?

An explanation for this inconsistency could be today's news that one of India's largest oil refining companies, Indian Oil Corp, announced a tender for purchasing Russian oil for early next year. The company stated that proposals in the tender must be backed by guarantees that there are no ties to companies subject to US sanctions. Therefore, India has not abandoned purchases of Russian oil but has merely suspended them temporarily. It is worth remembering that during the period of high US tariffs, many Chinese exporters easily found other markets for their products and continued to supply goods to the US via third countries, circumventing sanctions. I do not doubt that Moscow will find markets for its oil, and India can very well continue purchasing it via other countries under the guise of different oil grades.

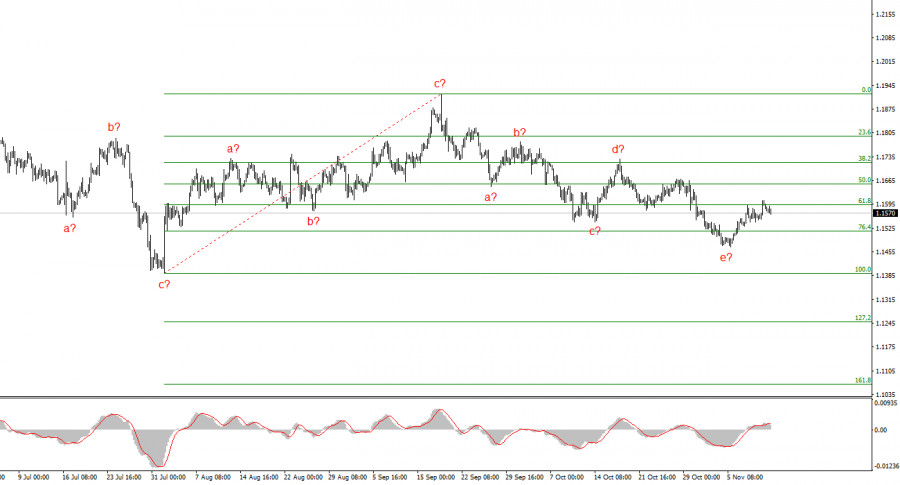

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. In recent months, the market has paused, but Donald Trump's policies and the Federal Reserve remain significant factors in the future depreciation of the American currency. The targets for the current trend segment may reach the 25 figure. Currently, the formation of corrective wave 4 is underway, taking on a very complex and elongated appearance. Its latest internal structure, a-b-c-d-e, is close to completion or may already be finished. Therefore, I am reconsidering long positions with targets in the 19 range.

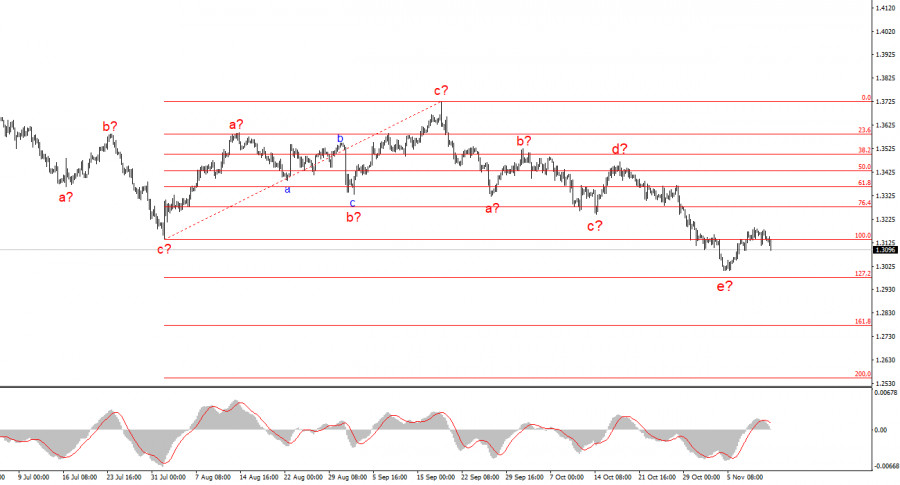

The wave structure of the GBP/USD instrument has shifted. We continue to deal with an upward, impulsive trend segment, but its internal wave structure is becoming more complex. Wave 4 has taken on a three-wave form, resulting in a very elongated structure. The downward correction structure a-b-c-d-e in c within 4 is presumed to be close to completion. I expect the main wave structure to resume development with initial targets around the 38 and 40 figures.