Deutsche Bank (XETRA:DBKGn.DB / NYSE: DB) zveřejnila obsah projevů, které přednesou její předseda Alexander Wynaendts a generální ředitel Christian Sewing na výroční valné hromadě dne 22. května 2025.

Generální ředitel Sewing ujistil, že banka je na dobré cestě k dosažení svých finančních cílů pro rok 2025, včetně návratnosti hmotného kapitálu přesahující 10 % a poměru nákladů k výnosům pod 65 %. Slibné výsledky prvního čtvrtletí letošního roku, navzdory ekonomické nejistotě, která se objevila na začátku dubna, potvrzují, že banka je na správné cestě, uvedl Sewing.

Deutsche Bank rovněž oznámila žádost o další zpětný odkup akcií a aktualizovala svůj kapitálový cíl. Banka plánuje na letošní valné hromadě navrhnout dividendu ve výši 68 centů na akcii, což představuje 50% nárůst oproti předchozímu roku. V současné době probíhá program zpětného odkupu akcií v hodnotě 750 milionů eur, který by od roku 2022 zvýšil celkové rozdělení kapitálu akcionářům na 5,4 miliardy eur. Sewing uvedl, že banka požádala Evropskou centrální banku o další zpětný odkup akcií pro druhou polovinu roku, který je možný díky robustní kapitálové základně banky a silné organické tvorbě kapitálu.

Banka vykázala na konci prvního čtvrtletí poměr kmenového kapitálu Tier 1 (CET1) ve výši 13,8 %. Sewing uvedl, že poměr CET1 banky již delší dobu stabilně překračuje cílovou hodnotu kolem 13,0 % a banka si klade za cíl tuto úroveň udržet a poměr CET1 udržet v provozním rozmezí 13,5 až 14 %. Stávající politika rozdělování 50 % čistého zisku připadajícího akcionářům zůstává beze změny.

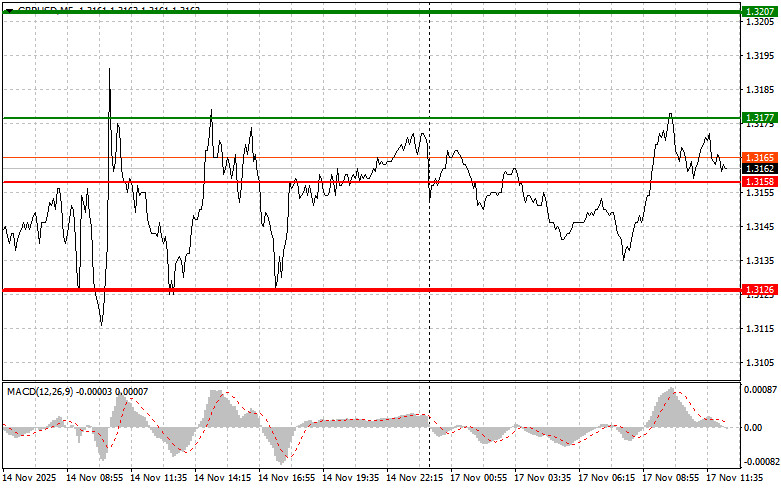

The test of the 1.3155 price level occurred when the MACD indicator had just started moving upward from the zero line, confirming a proper entry point for buying the pound. As a result, the pair rose by 25 points.

The lack of fresh data increased market uncertainty, as traders had no opportunity to assess the current state of the UK economy. Attention shifted to indirect indicators and global trends, which affected the volatility of GBP/USD. Given that the market continues to trade sideways, a break of any support or resistance level may serve as a signal for the start of a new directional movement.

Regarding data later in the day, the Empire Manufacturing Index is expected. It is traditionally considered an important indicator of industrial activity in the New York region, although its influence on overall market sentiment has somewhat weakened recently. Investors will watch for any deviations from forecasted values to assess potential impacts on overall U.S. economic growth.

Even more attention today will be focused on speeches from Federal Reserve officials. John Williams, Philip N. Jefferson, and Christopher Waller, as key figures in the Fed, may provide important clues regarding future monetary policy. Their comments on inflation, employment, and economic growth prospects will be closely analyzed for signals on the timing and scale of potential interest rate cuts.

For intraday strategy, I will mainly rely on Scenarios #1 and #2.

Buy Signal

Buy the pound today when the entry point reaches around 1.3177 (green line on the chart) with a target of rising to 1.3207 (thicker green line on the chart). Around 1.3207, I plan to exit long positions and open short positions in the opposite direction, expecting a move of 30–35 points from the level. Growth in the pound today is possible only if the Fed takes a dovish stance.Important! Before buying, make sure the MACD is above the zero line and just starting to rise.

I also plan to buy the pound if there are two consecutive tests of the 1.3158 level while MACD is in the oversold area. This will limit the pair's downward potential and trigger a reversal upward. Growth toward the opposing levels 1.3177 and 1.3207 can be expected.

Sell Signal

Sell the pound today after the 1.3158 level is broken (red line on the chart), which should trigger a rapid decline. The key target for sellers is 1.3126, where I plan to exit short positions and simultaneously open long positions in the opposite direction (expecting a 20–25 point rebound). Downward pressure on the pound will return if the Fed takes a hawkish stance.Important! Before selling, ensure the MACD is below zero and just starting to decline.

I also plan to sell the pound if there are two consecutive tests of 1.3177 while MACD is in the overbought area. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the opposing levels 1.3158 and 1.3126 can be expected.

What's on the Chart:

Important Notes for Beginner Forex Traders

Beginner traders must be very cautious when deciding entry points. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price fluctuations. If you trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if money management is ignored and large volumes are traded.

Remember: successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for intraday traders.