It should also be recalled that the trade agreement between the US and the EU, reached last year, is now literally hanging by a thread. The European Union is in a difficult position. European politicians understand the destructive consequences of NATO's collapse, as well as the consequences of a renewed trade war with the US. In recent years, the European economy has been growing very slowly, and industry has been losing ground to China in competition. If one NATO member attacks another, Europe will have to urgently think about its own security. A new defense alliance would be required, with multibillion-dollar costs the European economy simply cannot afford under current circumstances.

Europe is dependent on the US, but seeks to show everyone that this is not the case. This explains all the attempts by European officials to ease the situation and pursue peaceful negotiations. However, there is a concept called the "boiling point." Sooner or later, Brussels will understand that after Greenland, there will be other demands and ultimatums. Trump has two indisputable levers of pressure on Europe: NATO and the American market. He is using them to the fullest. The question is how long Europe will continue to acquiesce to Trump's trump cards and refrain from playing its own.

It should also be added that Trump wants, by annexing Greenland to the US, to create a new air defense system called the "Golden Dome." The logic is understandable. If air defense systems are deployed in Greenland, then potential missiles flying toward the US will, for the most part, be intercepted over the uninhabited island rather than over America's heavily populated eastern coast. However, experts believe that the "Golden Dome" system actually has nothing to do with the Danish island. To begin with, the US has had access to Greenland since 1951. In the event of a massive missile attack, air defense systems on the island could be easily bypassed. The "Golden Dome" project implies that most interceptors of enemy missiles would be located in space, in Earth orbit. In the end, Trump's true intent may be much simpler.

Greenland is a vast landmass with its own subsoil, natural resources, and oil reserves. Even if no one plans to develop these permafrost regions in the next 20 years, no one knows how the world will change in the future. Politics is a strategic long-term game, and no one in this world has ever been harmed by having additional land.

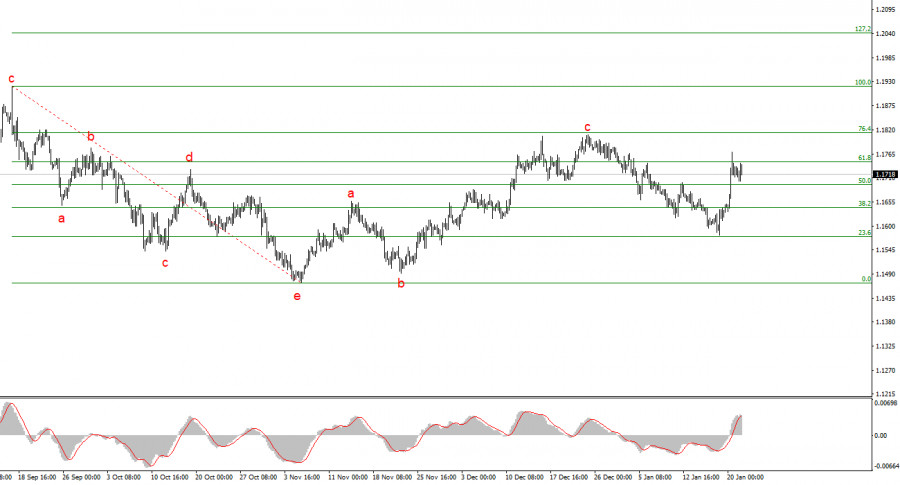

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. Donald Trump's policies and the Federal Reserve's monetary policy remain significant factors in the long-term decline of the US currency. The targets of the current trend segment could extend as far as the 1.25 figure. However, to reach those targets, the market must complete the construction of the extended wave 4. Right now, we only see the market's desire to keep this wave going. Therefore, in the near term, a decline to the 1.15 figure can be expected.

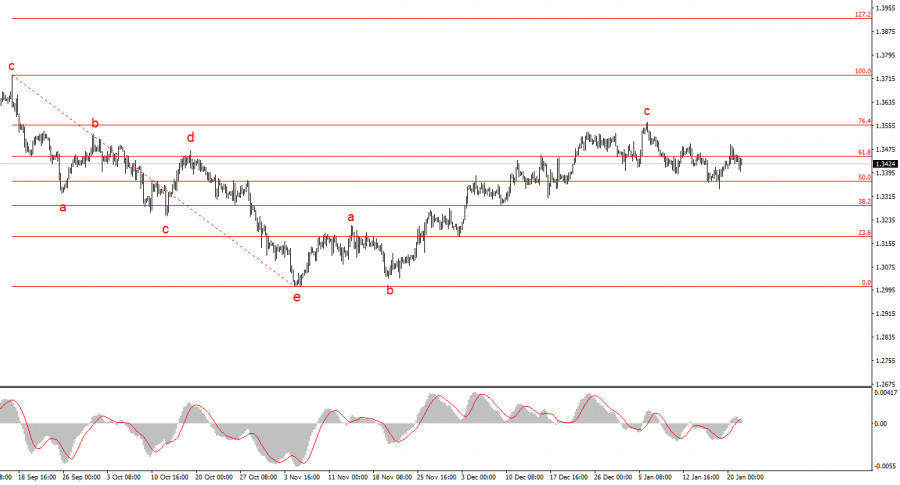

The wave picture of GBP/USD has changed. The downward corrective structure a-b-c-d-e in C of 4 appears complete, as does the entire wave 4. If this is indeed the case, I expect the main trend segment to resume its development, with initial targets around 1.38 and 1.40.

In the short term, I expected wave 3 or C to form, with targets around 1.3280 and 1.3360, which correspond to 76.4% and 61.8% of Fibonacci. These targets have been reached. Wave 3 or C has presumably completed its construction, so in the near term, a downward wave or a series of waves may form.