There are very few macroeconomic reports scheduled for Thursday, and none of them are significant. Essentially, we can only note the reports on US imports and exports, as well as jobless claims. All these reports are secondary. Volatile movements were expected based on yesterday's FOMC meeting, but the results turned out to be "bland," as anticipated. Therefore, the market has likely already priced in this event, and today it will move based on technical factors and new statements from Donald Trump, which have been plentiful in the new year.

On the penultimate trading day of the week, both currency pairs will trade based on technical factors. The euro can be traded today in the range of 1.1970-1.1988, and the British pound in the range of 1.3814-1.3833. Of course, the dollar will not fall every day. There will be pauses, corrections, and pullbacks. But a correction already took place yesterday, and the dollar's decline may well continue today.

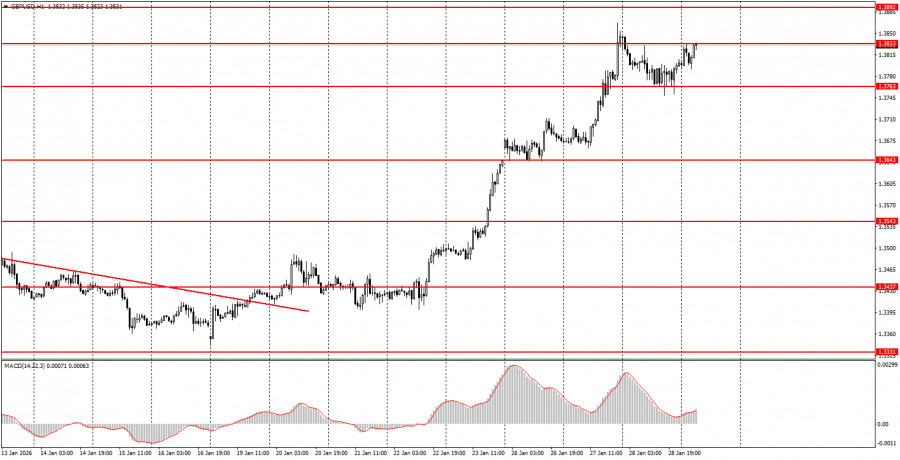

Support and resistance price levels — levels that serve as targets when opening buys or sells. Take Profit can be placed near them.

Red lines — channels or trendlines that reflect the current tendency and show which direction is preferable to trade now.

MACD indicator (14,22,3) — histogram and signal line — an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can strongly affect a currency pair's movement. Therefore, during their release, trading should be done with maximum caution, or positions should be closed, to avoid a sharp price reversal against the preceding move.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and effective money management are the keys to long-term trading success.