Yesterday, equity indices closed sharply lower. The S&P 500 fell by 0.84%, while the Nasdaq 100 dropped by 1.43%. The Dow Jones Industrial Average lost 0.34%.

Shares of software developers fell from India to Japan, following losses in their US peers, amid concerns that AI breakthroughs would undermine traditional business models. Investors worried whether current AI architectures could, over time, automate a significant share of tasks previously performed exclusively by humans, from coding to data analysis. The initial hype has faded, and major breakthroughs have yet to appear. The sell?off hit not only industry giants but also small startups, underscoring the systemic nature of the fears.

India's IT leader Tata Consultancy Services Ltd. fell by about 6%, while Infosys Ltd. slid by more than 8%. Australian cloud?accounting vendor Xero Ltd. plunged by over 15%, and Japan's Nomura Research Institute Ltd. dropped by 8%.

Elsewhere, oil prices rose after the US Navy shot down an Iranian drone headed toward an aircraft carrier in the Arabian Sea. The yen weakened as traders positioned ahead of Japan's snap elections this weekend. Gold climbed back above $5,000/oz on dip buying.

As noted above, the weakness in US software stocks spilled over into alternative asset firms such as Blue Owl Capital Inc., amid speculation that AI?driven change could produce significant losses. Wall Street has long been sceptical of parts of the software industry, but sentiment deteriorated further on concerns about AI's potential impact. Increasingly, investors are betting that the long era of tech leadership led by the Magnificent Seven is giving way to broader market participation.

In the oil market, prices rose for a second day amid renewed geopolitical tensions after the US downed an Iranian drone in the Arabian Sea. Brent crude climbed to roughly $68 per barrel after a 1.6% gain on Tuesday.

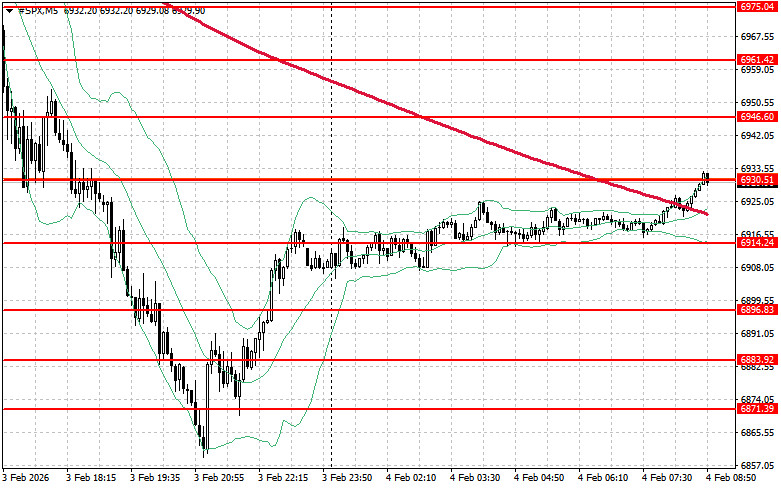

As for the technical outlook for the S&P 500, the immediate task for buyers today is to overcome the nearest resistance level of $6,930. Breaking above that level would signal upside and open the path to $6,946. An additional priority for bulls is to secure control above $6,961, which would strengthen buyers' positions. In case of a downside move amid waning risk appetite, buyers must assert themselves around $6,914. A break below that level could quickly push the instrument back to $6,896 and open the way to $6,883.