NEW YORK (Reuters) – Americký dolar v úterý posílil a zotavil se ze šestitýdenního minima vůči euru, i když investoři zůstávají znepokojeni možnými ekonomickými dopady obchodní války vedené administrativou prezidenta Donalda Trumpa.

„Došlo k výraznému výprodeji dolaru, který se dnes trochu vzpamatoval… Nemyslím si, že by se objevily nějaké nové informace, které by naznačovaly, že se dolar nějak významně obrátil,“ uvedl Marc Chandler, hlavní tržní stratég společnosti Bannockburn Global Forex LLC.

„Řekl bych, že oživení je stále poměrně omezené,“ dodal.

Dolar posílil vůči jenu o 0,7 % na 143,73. Euro oslabilo o 0,5 % na 1,1386 USD, poté co krátce dosáhlo šestitýdenního maxima 1,1454 USD. Dřívější údaje ukázaly, že inflace v eurozóně zpomalila pod cíl Evropské centrální banky ve výši 2 %, což podpořilo očekávání, že centrální banka tento týden sníží úrokové sazby.

The U.S. dollar has felt much better in recent weeks. Donald Trump has temporarily shelved the idea of seizing Greenland militarily while still not having struck Iran or announced new tariffs against any trading partners. The reason lies in a national-scale scandal surrounding Jeffrey Epstein. Trump is currently busy answering hundreds of questions related to his involvement in this case. As soon as Trump stopped bombarding the media with aggressive rhetoric, the dollar immediately experienced relief.

However, next week, the dollar will not have the luxury of relief. At least three significant indicators will be released, and the market may already be bracing for new sell-offs of the American currency. It is rare for three of the most crucial indicators under current conditions to come out in one week, made possible by the second "shutdown" in the U.S. at the beginning of February. Another rare occurrence is that all three reports could work against the American currency.

To start, the labor market and unemployment data were supposed to be released last Friday. After the ADP and JOLTS reports, currency market participants are skeptical that the U.S. labor market has stopped "cooling." Consequently, no strong Non-Farm Payroll numbers are expected. The unemployment rate will likely remain at 4.4% at best, but it could rise to 4.5%. There is a roughly 70-80% chance that at least one of these reports will come in below market expectations.

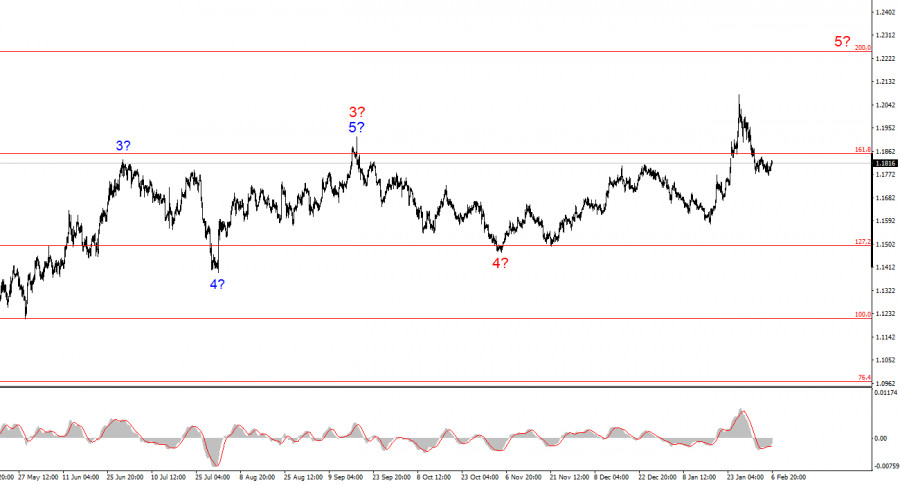

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend. Donald Trump's policies and the Federal Reserve's monetary policy remain significant factors affecting the long-term decline of the U.S. dollar. The targets for the current trend section could extend to the 25th figure. At this moment, I believe that global wave 5 has begun and is continuing, so I expect prices to rise in the first half of 2026. However, in the near term, I anticipate a downward wave (or series of waves), as the structure a-b-c-d-e appears complete. My readers can soon look for areas and levels for new purchases.

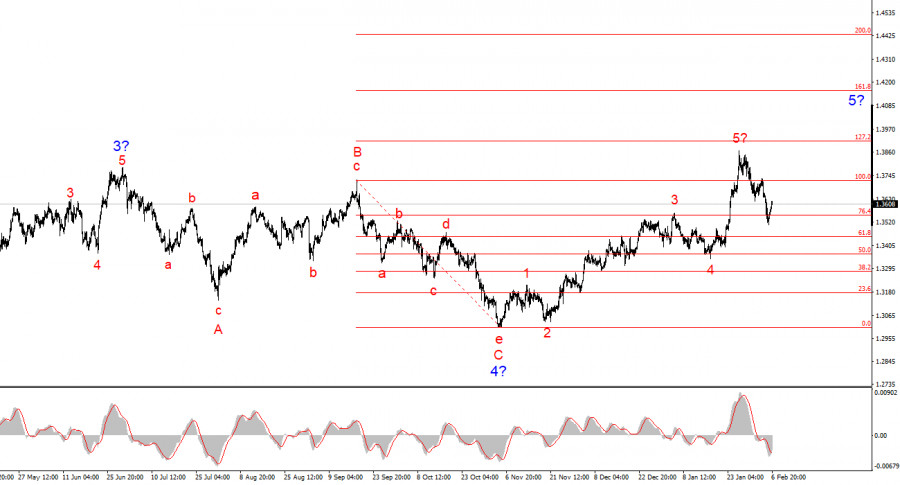

The wave pattern for GBP/USD appears quite clear. The five-wave upward structure has completed its formation, but global wave 5 may take on a much more extended appearance. I believe that a corrective set of waves may be formed in the near future, after which the upward trend will resume. Therefore, in the coming weeks, I suggest seeking opportunities for new purchases. In my opinion, under Trump, the British pound has a good chance of trading at $1.45-$1.50. Trump himself welcomes the decline in the dollar's exchange rate. All his actions have a dual effect: a weaker dollar and the resolution of internal, external, trade, and geopolitical issues.