While China celebrates the Lunar New Year, major speculators, or so-called smart money, are not rushing to manipulate the gold market. The metal swings like a pendulum: it falls below the critical $5,000 per ounce mark, then returns above it. Hedge funds and asset managers are waiting for the crowd that will allow them to continue making money.

According to MUFG, in the short term, XAU/USD dynamics will depend on shifting market views about the fate of the federal funds rate. Over a medium-term investment horizon, gold will rise on central-bank bullion purchases, geopolitical risks, concerns about Fed independence, and investors' move away from the dollar and US Treasuries.

In this respect, the statement by Chicago Fed president Austan Goolsbee that several Fed rate cuts could occur in 2026 if inflation continues to move convincingly toward target supports the precious metal. By contrast, remarks by FOMC governor Michael Barr about a single rate increase in the more distant future restrain bulls in XAU/USD.

Dynamics of Indian gold and silver imports

MUFG's position looks reasonable but dated. The drivers cited in the forecast moved gold prices in 2022–2025. However, in 2026, speculative demand came into play. The asset was bought simply because it was rising. At present, the so-called crowd premium is priced in. Indeed, Asia created genuine frenzied demand for bars, coins, and ETF products. India, for example, imported nearly a record $12 billion of gold and $2 billion of silver in January. Only October was larger. Then, the figures were $14.7 billion and $2.7 billion, respectively.

Lunar New Year celebrations in China will run through 23 February. Until then, liquidity in the precious metals market will remain thin. Theoretically, that could help large players trigger big price swings. But if they do not, they are almost certainly waiting for the crowd to return. In January, hedge funds and asset managers were quietly selling gold while everyone else was buying it. The subsequent price collapse allowed smart money to fill its pockets.

In my view, the gold market is more manipulable at current levels. The bubble has burst, but not all the air has gone out of it. As a result, the metal's reaction to moves in the US dollar is far from ideal. Not to mention its response to Treasury yields, instruments to which XAU/USD was highly responsive in the past.

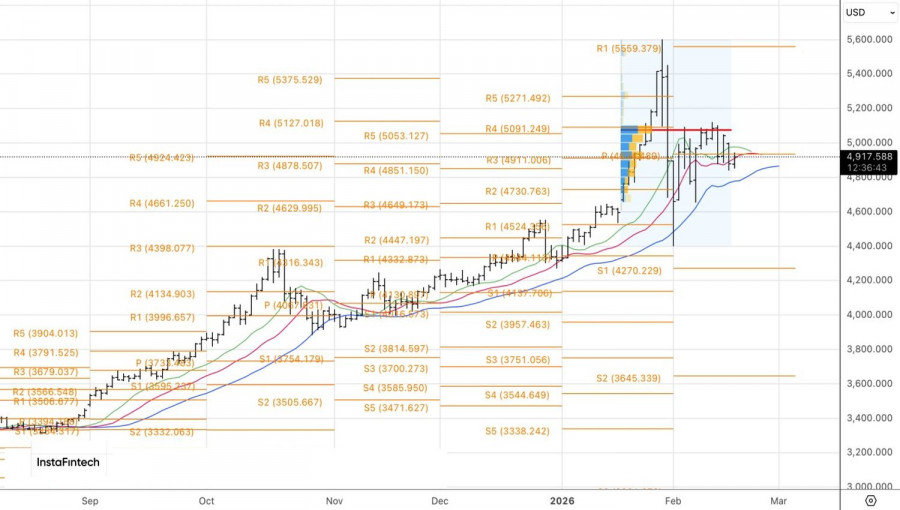

Technically, a 1-2-3 reversal pattern is forming on the daily chart of gold. Key resistance is near a fair value of $5,080 per ounce. While the metal trades below that level, it makes sense to focus on selling. A renewed build-out of short positions would be justified by a break of the local low at $4,845.