Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

Does Iran want war? Judging by the symbolic attack on American bases in Qatar, Tehran does not appear eager to enter into an armed conflict with Washington — which it would lose anyway. The fact that no U.S. military personnel were harmed, combined with Donald Trump's statement about a ceasefire in the Middle East and dovish comments from FOMC officials, propelled the S&P 500 upward.

The main catalyst for the broad index rally was the plunge in oil prices. Historically, sharp spikes in oil prices have often led to recessions in the U.S. economy and crashes in the American stock market. This time, such a scenario was avoided — giving S&P 500 buyers a boost of confidence.

The best the Brent bulls could do was push the price of North Sea crude to $80 per barrel. At the onset of the war in Ukraine, prices soared above $120. Back then, investors were shocked and feared that one of the world's top oil producers would be pushed out of the market. Moreover, demand exceeded supply at the time.

Now, the situation is reversed: supply exceeds demand. The Middle East is in a constant state of turmoil, and the markets are used to it. If the U.S. and Israel had not limited their attacks to Iran's nuclear infrastructure and instead targeted economic facilities, Tehran would have shut down the Strait of Hormuz. Ultimately, the end of the conflict — which will likely be dubbed the Twelve-Day War — triggered a wave of S&P 500 buying.

Morgan Stanley claims that most geopolitical sell-offs in the broad stock index are short-lived and modest. According to the bank's research, previous episodes led to a decline in the S&P 500, but over one, three, and twelve months, the index rose by an average of 2%, 3%, and 9%, respectively.

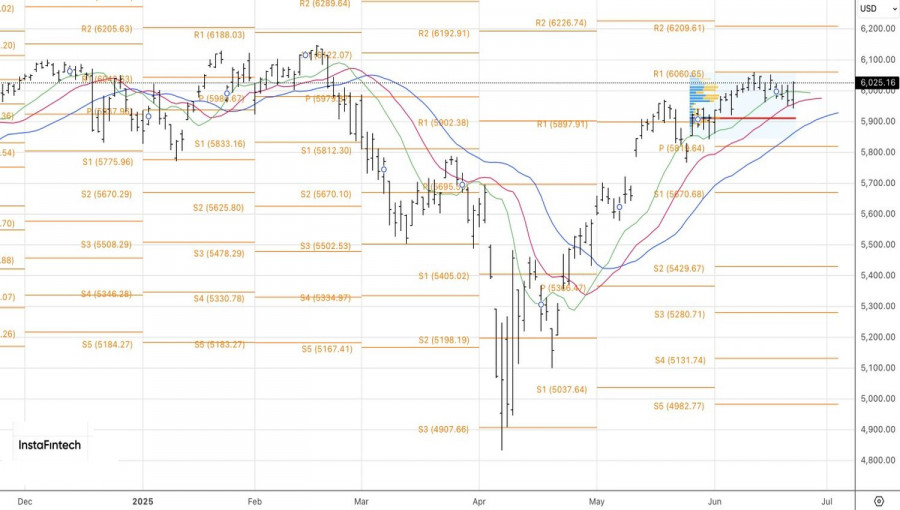

It appears traders once again seized the opportunity to buy the dip in the U.S. stock market. Retail investors still dominate the action. Institutional investors have reduced their bullish positions on the S&P 500. Now, the index no longer appears overbought. Combined with reduced demand for downside hedging, this points to limited correction potential.

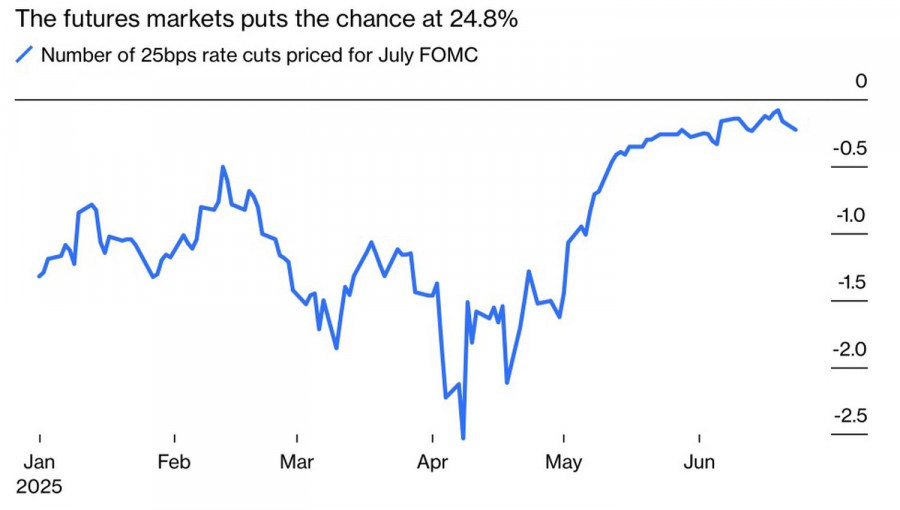

Dovish comments from FOMC officials are also fueling the S&P 500 rally. Following Christopher Waller, Michelle Bowman has also advocated for a federal funds rate cut in July. Notably, she was the only one to vote against the Fed's aggressive monetary expansion in September. It's also interesting that Donald Trump appointed both officials.

Technically, on the daily chart, there was a failed breakout of dynamic support represented by moving averages. In a strong bull market, this signals that the correction has run its course. A return to buying is recommended if the price breaks through 6051.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

ລິ້ງດ່ວນ