On the hourly chart, the GBP/USD pair continued to trade sideways on Monday. The sideways movement began last week when a series of important reports were released in the U.S., and active trading could have been expected from market participants. However, most of the reports were deemed insignificant under current conditions, and traders continue to closely monitor Donald Trump's speeches, hoping for a de-escalation in the U.S.–China conflict. In the absence of news, traders prefer not to act, fearing false positions ahead of Trump's next appearance.

The wave situation has recently been simple and clear. The last completed upward wave broke the high of the previous wave, and the new downward wave did not break the previous low. Thus, the "bullish" trend remains intact. A reversal will only be possible after a confident close below 1.3234, accompanied by a relevant informational backdrop from the White House that would signal a reduction in global tensions stemming from the trade war. Otherwise, the dollar's strengthening will come to an end.

Monday's news flow was rather weak, but as mentioned, traders are more interested in the U.S.–China topic. There's plenty of information about it, and most of it is contradictory. Donald Trump initially raised tariffs on China to 145%, to which China responded with 125% tariffs. Then, the U.S. President began speaking about negotiations with China and the possibility of reducing tariffs over time. However, last week, Trump stated that China deserved these tariffs because they are "just retribution." According to Trump, prices in the U.S. will not rise, a view not shared by many analysts. Still, with 145% tariffs, most of the goods flow to the U.S. will halt, so inflation may indeed rise only slightly (due to other tariffs). But this is a rather optimistic scenario.

Trump also claimed that Beijing would agree to the tariffs and pay them itself, although in reality, it will be American consumers who foot the bill. Chinese producers, after paying the tariffs, will simply raise prices on their goods. Trump failed to answer a reporter's question as to why China would definitely accept the tariffs.

On the 4-hour chart, the pair rebounded from the 100.0% Fibonacci level at 1.3435, turned in favor of the U.S. currency, and began a downward movement toward the 76.4% corrective level at 1.3118. There are no emerging divergences on any indicator today. The ascending trend channel still indicates a "bullish" trend. The news background remains contradictory, preventing expectations of strong dollar growth.

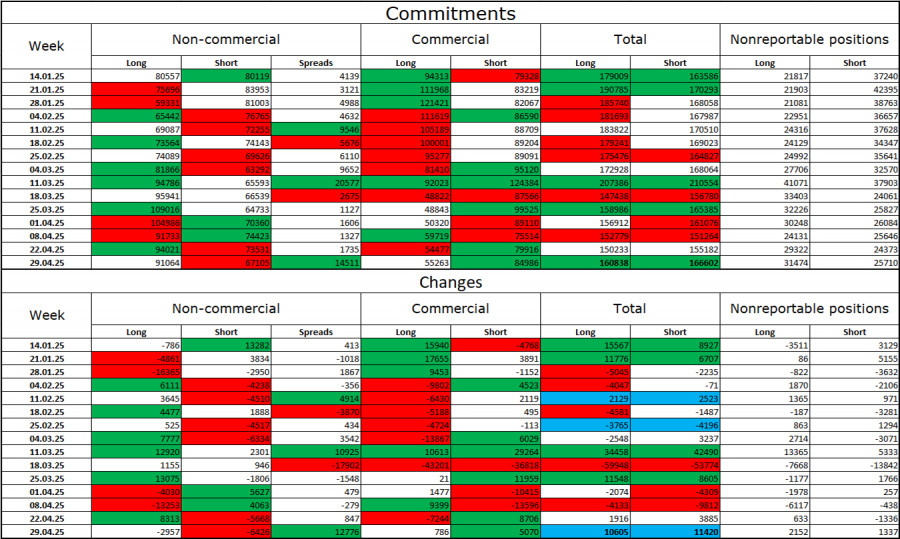

Commitments of Traders (COT) Report:

Sentiment among the "Non-commercial" trader category became more "bullish" during the last reporting week. The number of long positions held by speculators fell by 2,957, while the number of short positions dropped by 6,426. Bears have lost their market advantage. The gap between long and short positions is now 24,000 in favor of the bulls: 91,000 vs. 67,000.

In my view, the pound still has downward potential, but recent developments could push the market to reverse in the long term. Over the past three months, long positions have increased from 80,000 to 91,000, while short positions have decreased from 80,000 to 67,000. More importantly, over the past 14 weeks, long positions have grown from 59,000 to 91,000, and shorts have dropped from 81,000 to 67,000.

News Calendar for the U.S. and U.K.:

United Kingdom – Services PMI (08:30 UTC)

Tuesday's economic calendar contains only one relatively unimportant event. The news background is not expected to influence trader sentiment today.

GBP/USD Forecast and Trader Recommendations:

Today, selling the pair is possible upon a rebound from the 1.3344 level on the hourly chart, with a target of 1.3205. Buying is possible upon a rebound from the 1.3205 level with a target of 1.3344.

The Fibonacci grids are constructed from 1.3205–1.2695 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

QUICK LINKS