There are quite a few macroeconomic reports scheduled for Wednesday, but it's worth reminding novice traders that yesterday's calendar was also full of data—yet none of it had any impact on the dollar, euro, or pound. So a similar situation might occur today. For instance, what should we expect from the second estimate of eurozone inflation, when this reading already has almost no impact on the ECB? US construction and real estate data are unlikely to be more important than industrial production and retail sales, which the market ignored yesterday. Thus, the only data of real interest is the UK inflation report.

Among Wednesday's fundamental events, ECB President Christine Lagarde's speech stands out, but we won't dwell on it. She is speaking three times this week, and her first speech was not about monetary policy. The ECB meeting was held last week, so the market already has all the information it needs from the central bank. The biggest event of the day, week, and even the month is the Fed meeting. Even though everyone already expects the decision, there's plenty of room for surprises. For example, Powell might take an even more dovish stance, or the number of "doves" on the FOMC might increase. In general, surprises are possible, and the main risk is a new drop for the US dollar.

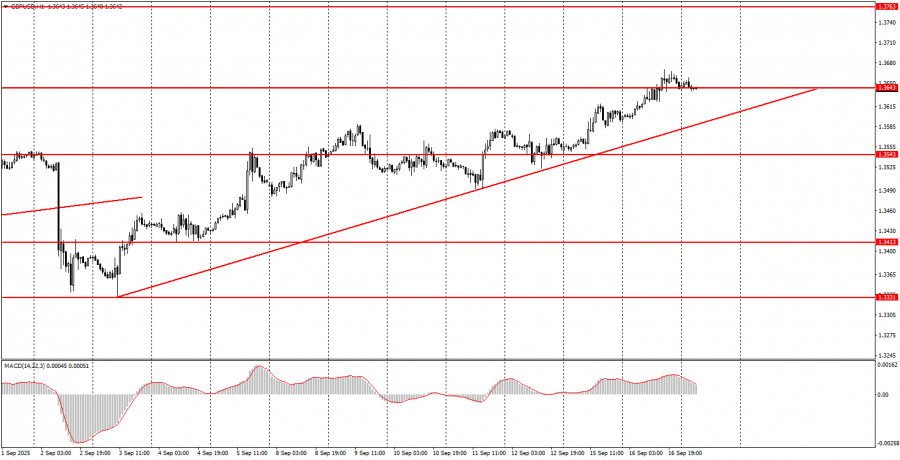

During the third trading day of the week, both currency pairs could continue their uptrends, but new buy signals are needed. The euro can be traded today from 1.1851, while the pound should be traded from the 1.3643–1.3652 area. Keep in mind that UK inflation may trigger a move in the pound, and the Fed meeting plus Powell's speech could drive both pairs.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

QUICK LINKS